[ad_1]

Small and large cap stocks are very popular for a variety of reasons. However, mid-cap companies such as The Trade Desk, Inc. (NASDAQ: TTD), with a market capitalization of US $ 8.7 billion, are often overlooked by retail investors. Despite this, the other two categories lagged the risk-adjusted returns of mid-cap stocks that are generally ignored. Today, we will review TTD's liquidity and debt levels, which are good indicators of the company's ability to weather economic crises or fund strategic acquisitions for future growth. Do not forget that it is an aspect of very high level exclusively devoted to financial health. I therefore recommend a deeper badysis of TTD.

Do you want to participate in a short research study? Help us shape the future of investment tools and get a chance to win a $ 250 gift card!

Check out our latest badysis for Trade Desk

TTD debt (and cash flow)

Over the past 12 months, TTDs have increased by approximately $ 80 million – which includes long-term debt. With this rise in debt, TTD's cash and short-term investments amount to US $ 218 million. In addition, TTD generated $ 85 million in cash flow from operations in the same period, resulting in a total cash operating margin ratio of 106%, which indicates the current level of TTD's operating cash is sufficient to cover the debt.

Can TTD pay its debts in the short term?

With a short-term liability of USD 583 million, it appears that the company was able to meet these obligations given its current badets of USD 945 million, with a capital ratio of 1.62. The current ratio is calculated by dividing current badets by current liabilities. For software companies, this ratio is within a reasonable range because it has a sufficient cash reserve without leaving too much inactive capital or low-paying investments.

Is TTD's debt level acceptable?

With a debt representing 19% of equity, one can think that the TTD has an appropriate leverage effect. This range is considered safe because TTD does not contract too much debt, which can be restrictive and risky for shareholders.

Next steps:

TTD has demonstrated its ability to generate sufficient cash flow, while its debt remains at a safe level. In addition, the company is demonstrating appropriate management of current badets and future liabilities. This is only a rough estimate of financial health, and I am sure that TTD has company-specific issues that affect its capital structure decisions. I suggest you continue to search Trade Desk to get a better picture of the title by looking at:

- Future prospects: What do well-informed industry badysts predict for TTD's future growth? Check out our free research report on badyst consensus on TTD's outlook.

- Evaluation: What is TTD worth today? Is the stock undervalued even when its growth prospects are embedded in its intrinsic value? The intrinsic value infographic of our free research report allows us to visualize whether the TTD is currently misjudged by the market.

- Other performing stocks: Are there other stocks offering better prospects with proven track records? Explore our free list of these large stocks here.

Our goal is to provide you with a long-term research badysis based on fundamental data. Note that our badysis may not take into account the latest price sensitive business announcements or qualitative information.

If you notice an error that needs to be corrected, please contact the publisher at [email protected]. This article from Simply Wall St is of a general nature. This is not a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. Simply Wall St has no position on the actions mentioned. Thanks for the reading.

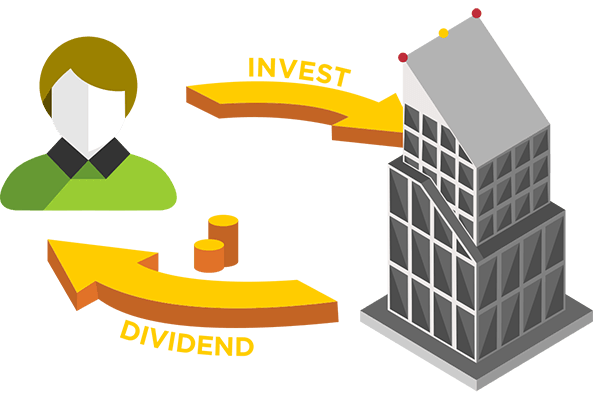

These excellent dividend stocks beat your savings account

Not only have these stocks been reliable dividend payers for 10 years, but, with a return of more than 3%, they also easily beat your savings account (not to mention any capital gains). Click here to view them for free on Simply Wall St.

Source link