[ad_1]

Southeast Asian startups' ecosystem to receive mbadive cash injection after launch of Jungle Ventures TechCrunch came to learn for the first time nearly $ 175 million for its new fund.

The leaders of the Singapore-based company expect the new fund, which is Jungle's third to date, to reach a final closing of $ 220 million in the coming months, TechCrunch told an informed source of the fund and his projects. When it reached this figure, the fund would become the largest for start-up investments in Southeast Asia.

Jungle Ventures declined to comment.

A document filed with the SEC in December suggested that the company planned to raise up to $ 200 million from the fund. Its last fund was $ 100 million and closed in November 2016. The founding partners Anurag Srivastava and Amit Anand started the fund in 2012 by creating a (much more modest) 10-year fund. millions of dollars.

Digging a little further, our source revealed that the new Jungle Fund includes LPs awaiting return, an affiliate of the World Bank, IFC and Cisco Investments – both of which invested in Jungle's SeedPlus Fund, which had an initial value of $ 18 million, and Singapore's sovereign wealth fund, Temasek. The German financier DEG is a new funder, although we know that Jungle has spent a lot of time raising funds in the US market, hence the filing with the SEC. Beyond Europe and the United States, the company is also said to have released records in Asia – as might be expected – and in the Middle East.

Jungle focuses on Series A and B contracts in Southeast Asia, with occasional investments in India or the rest of the world where it sees global potential. Engineer.ai, who raised $ 29.5 million last November on a Jungle and Lakestar-led tour, is one such example, with the participation of SoftBank's DeepCore Artificial Intelligence Unit.

Founding partners of Jungle Ventures (from left to right): Anurag Srivastava and Amit Anand

The fund's currency is Southeast Asia and its previous investments include the Deskera cloud platform (the most recent amount of $ 60 million), the Reddoorz economic hotel network (collected 11 million dollars last year), the fintech start – up Kredivo (raised $ 30 million last year) and Pomelo, the digital fashion brand, raised more than $ 30 million dollars. investors like JD.com.

In India, he notably supported the Moglix b2b sales platform and the Livspace interior design start-up. Previous releases include Travelmob to HomeAway, Zipdial to Twitter, eBus to IMD and Voyagin to Rakuten.

We understand that the new fund has already completed five transactions. Jungle usually processes half a dozen investments a year at least three times a year.

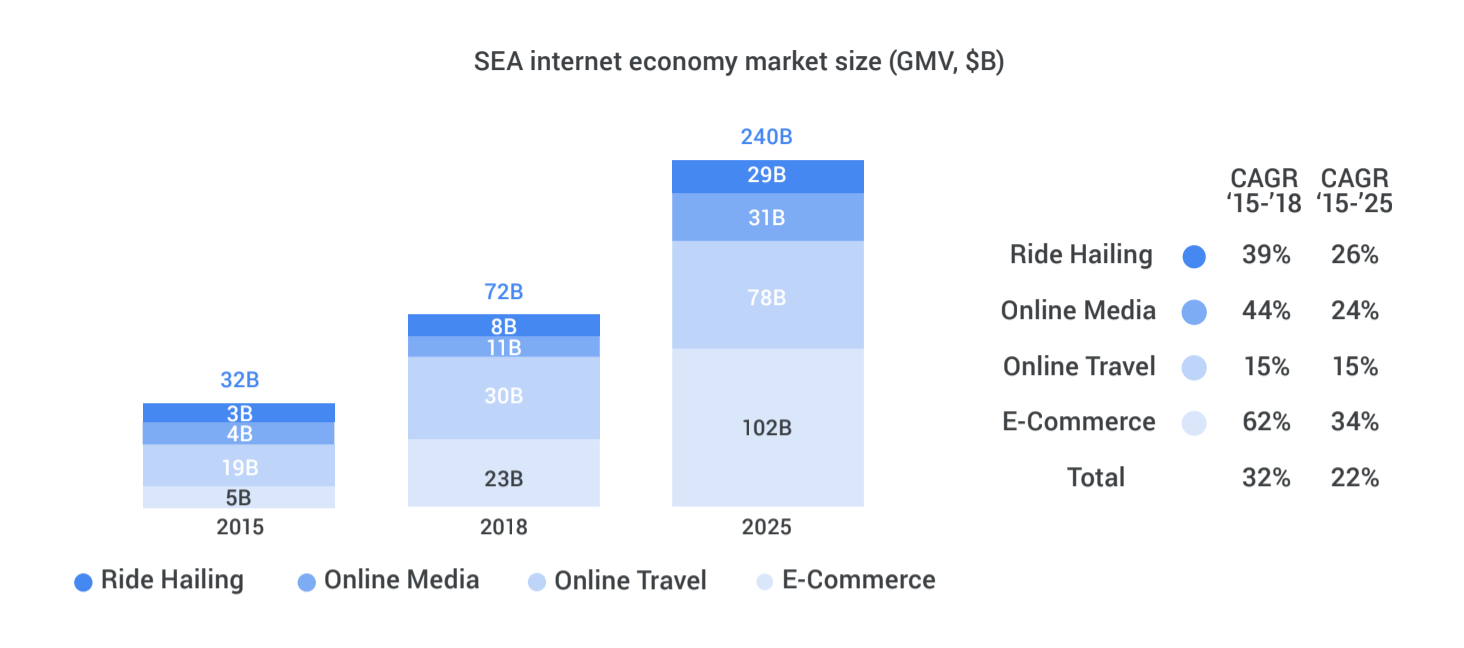

The fund's leaders are optimistic in Southeast Asia, which is expected to experience strong economic growth through increased access to the Internet and digital spending. A highly cited Google and Temasek report released last year predicts that the region's "digital economy" will triple to $ 240 billion by 2025.

A report published in 2018 by Temasek and Google predicts a significant growth of the digital economy in Southeast Asia

Other leading venture capital funds in Southeast Asia include Vertex Ventures ($ 210 million fund), Golden Gate Ventures – $ 100 million and a $ 200 million growth fund – Openspace Ventures ($ 135 million) and EV $ 150 million growth fund.

There is also B Capital of Facebook The co-founder Eduardo Saverin, who recently spent $ 400 million on the first closing of his second fund, does not invest exclusively in Southeast Asia, and Sequoia, which has a fund of $ 695 million for India and Southeast Asia. Other global names that you may see signing contracts in the area include Burda, which has a local presence and starts with Series B, TPG Global and KKR.

Update 04/29 19:50 PST: The original version of this article has been updated to correct the fact that Jungle invests in a dozen companies a year and not a month.

Source link