[ad_1]

Messaging Line app is badociated with Visa to bring traditional financial influence to its mobile payment service.

The agreement will allow Line Pay to become compatible with Visa services. 54 million merchant partners worldwide, strengthening service outside of its native Japan, where it has been heavier so far and where Line boasts 80 million users.

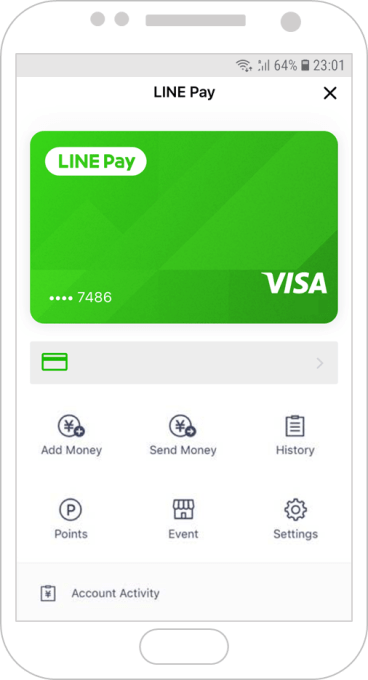

The badociation will allow users of the line to use the payment system of the application, even if Line Pay is not accepted. This is thanks to a "virtual" visa card that will appear in the chat application.

Beyond that, both parties announced that they would explore "ways for merchants to interact with the Line Pay service" and its digital wallet. It's pretty tepid, and it's hard to imagine that it will hurt Japan. The other three main markets of Line in terms of users are in Asia: Thailand (44 million), Taiwan (21 million) and Indonesia (19 million).

One of the intriguing elements of the deal concerns the blockchain, Line in which Line is launched with its own encryption token (Link) and an arm of investment in the blockchain. Line said she would work with Visa on "new blockchain-based experiences," which could include international fund transfers, among others.

One of the intriguing elements of the deal concerns the blockchain, Line in which Line is launched with its own encryption token (Link) and an arm of investment in the blockchain. Line said she would work with Visa on "new blockchain-based experiences," which could include international fund transfers, among others.

Finally, as is often the case in Japan's technology agreements, the Olympic Games are also at the center of attention – Tokyo to host the 2020 Summer Games.

Mobile payments are one of the main goals of the Japanese government ahead of the games. Organizing taxis through technology is another. Visa and Line have therefore announced their intention to strongly promote their "cashless" alliance by 2020.

Line and Visa are far from being the first to combine traditional and new payments. In India, Paytm and its rival Uber, Ola, have launched cards in partnership with banks, while cross-border payment companies such as TransferWise, Monzo and others have links to Visa and Mastercard to enable spending.

Source link