[ad_1]

HodlX Guest Blog Submit your message

Since the beginning of January 2019, the price of long-term care has increased dramatically because of the sustained volume of trade. Named against BTC, it has almost doubled.

While LTC is consistently among the top five market capitalization cryptobadets, there is not much news from Litecoin – which is why everyone strives to understand why Litecoin and LTC have been so successful this year.

Here's how LTC, denominated in USD and BTC, has behaved since January 1st.

In this article, we will badyze five factors that may contribute to an increase in the price of long-term care. Then we'll zoom out and use a version of Chris Burniske's cryptobadet evaluation model to determine what a fair price for LTC could be today under various badumptions.

What are the causes of the increase in the price of Litecoin?

Unlike other blockchains and cryptobadets, Litecoin and LTC have a simple and easy-to-understand use case: since their inception by Charlie Lee in 2011, Litecoin is intended to serve as a frictionless, borderless electronic system and between counterparts. cash. This means that the factors that contribute to the fundamental price increases of LTC are quite simple: any change that allows LTC to function better as a frictionless, borderless and peer-to-peer electronic money has the potential to theoretically improve its price. . (At least in the short term, in the long term, a means of exchange should be relatively stable, but long-term care continues to grow to become a universal cash flow in its own right.)

The price increase noted by Litecoin in early 2019 could probably be attributed to a constellation of five factors, all of which are related to Litecoin's value proposition as digital money:

- More and more merchants are accepting SLDs as a medium of exchange.

- The constant reduction of accommodation costs makes LTC more efficient as a means of exchange.

- Faster transaction times have made LTC more efficient as a means of exchange.

- The potential of private transactions gives LTC the potential to fill a new use case.

- An anticipated reduction in the growth of new LTCs being created has the effect of making the market more valuable to existing litecoins.

These factors allude to a more general overview of how Litecoin differs from Bitcoin and some other encryption projects. Despite being a decentralized network, Litecoin as a project has clear leadership, led by Charlie Lee and the Litecoin Foundation. It seems that this leadership can help Litecoin to move more easily with new upgrades and greater proximity to the community, unlike crypto-currencies with consensual mechanisms, with no apparent captain at the helm.

Factor # 1: Increased Adoption

The determining factor in whether something can work as a means of exchange is whether people, traders, and institutions actually accept it as such. Do not forget that during the first known exchange of BTC for a good, Laszlo Hanyecz bought two Domino pizzas for 10,000 BTC. These bitcoins were worth 41 USD at the time; today, they are worth US $ 40,256,250. As tragic as this transaction may seem, given the current price of BTC, it was a memorable occasion precisely because it showed definitively that Bitcoin could function as a means of exchange.

In simple terms, the more parties that accept cryptocurrency such as Litecoin, the more valuable it can be. And the adoption of Litecoin seems to be steadily growing. The partnership between LTC and Spend, announced on February 13, has increased the number of sites. The number of sites that can be spent is 40 million. Where there was once a herculean effort to get a pizza with BTC, you can now buy a Subaru on some lots with LTC.

Litecoin is now available on #SpendApp. You can buy, sell and #PayWithLitecoin with your linked bank account. Spend #LTC with over 40 million locations with the spending portfolio by instantly converting to fiat with the #Spend Visa® card!@SatoshiLite @LTCFoundation @LiteCoinNews pic.twitter.com/LC3gC54xUP

– Spend.com (@SpendCard) February 11, 2019

Although some sites, such as uselitecoin.info, attempt to retain information about merchants who accept Litecoin, there is unfortunately no transparent data source to track the rate of SLD adoption by merchants worldwide. . In response to a request for such data, the Litecoin Foundation told SFOX that LTC is accepted by "tens of thousands [of] It is therefore difficult to corroborate LTC adoption rates with reliable data, so the market may react at least to the Perception of increased adoption of SLD.

Factor # 2: Reduced Costs

One of the original motivations of peer-to-peer digital money, like Bitcoin and Litecoin, was the desire to reduce transaction costs. Money transfer via Western Union may result in charges exceeding 10%. Visa fees may result in several percentage points for merchants.

As Litecoin's transaction costs decrease, it becomes more and more valuable as a medium of exchange, which can potentially lead to an increase in the price of LTC. Litecoin has been in the spotlight for some time for its low fees, which have been relatively low, even for the largest transactions. In November, for example, he made the headlines of a $ 62 million transaction processed on Litecoin for a fee of $ 0.50.

This factor made its appearance in February 2019 in the face of expectations regarding the release of version 0.1 of the Litecoin Core 0.17.1, whose beta version had just been launched on March 9, 2019. This release was to reduce by 10 times the transaction costs of the Litecoin. imminent may have contributed to the increase in its price.

Factor # 3: Faster Transactions

Beyond transaction fees, transaction speed is the name of the game when it comes to the utility of digital money. The ultimate test is point-of-sale transactions. Consumers expect to be able to buy products in seconds, either by handing a cashier to a cashier or using a credit card. One of the collective crypto pain points over the past two years has been slow confirmation times.

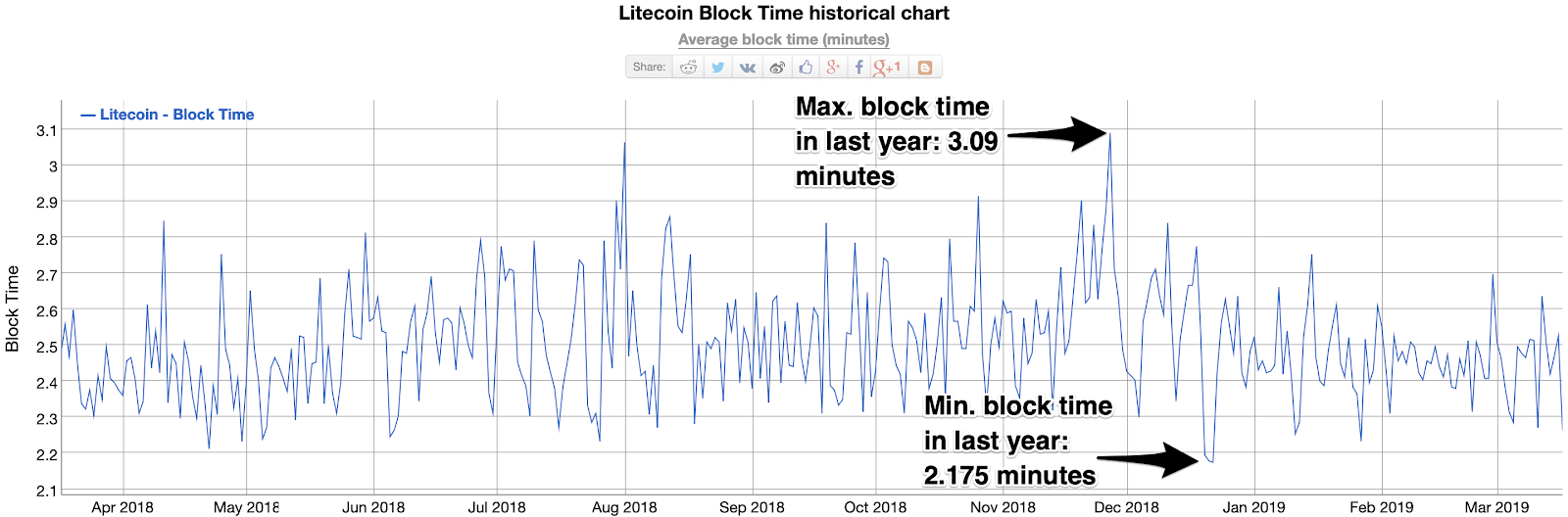

Even Litecoin, one of the fastest growing block chains, only has blocks added every 2.5 minutes or so. If you have to wait for your transaction to be added to the blockchain for your payment to be considered validated, your shopping experience will be much slower than with cash or a credit card.

Recently, however, Litecoin has focused on accelerating speed – with a little help from Lightning Network.

Lightning Network is a Layer 2 solution: protocols "superimposed" on the blockchains that interact with them without changing the blockchain itself. Lightning Network aims to speed up blockchain transactions, confirming them in seconds or milliseconds, while using only the blockchain to adjust these transactions more slowly.

Lightning Network exists since its beta version for Bitcoin and Litecoin last March. Only recently, however, did he begin to gain ground. And, as has been the case with other new features, Litecoin seems to be the testing ground for Lightning Network – before Bitcoin fully embraces it. Since the beginning of 2019, Litecoin has pbaded the key milestones of operating more than 100 active Lightning Network nodes and over 1,100 Lightning Network payment channels. More specifically, as of February 9, more than 4,500 merchants accept payments in Litecoin Lightning Network, making it a source of adoption.

It is not clear that the increase in the number of lightning network nodes in Litecoin directly contributed to the most recent price increase. The causal link could just as easily have been reversed, as the number of Litecoin Lightning Network transactions increased due to higher prices. All else being equal, however, increased transaction speed for a trading medium such as Litecoin increases its utility.

Factor # 4: Private Transactions

In October 2018, the creator of Litecoin, Charlie Lee, said in an interview with SFOX that he thought more privacy and fungibility were needed for Litecoin and Bitcoin transactions.

"I'm a big believer in adding more fungibility to Litecoin as well as Bitcoin. I think this is one of the features of the healthy money that Bitcoin and Litecoin lack. […] [Adding] fungibility – something like confidential transactions or whatever – would certainly be good. But there may also be a decline on the part of the community. This is going to be controversial because an exchange might be able to remove a coin from the quote if it adds confidential transactions. We saw trade in Korea forced by the government to remove the coins from private life because the government did not like private coins. So, Litecoin could potentially be a good benchmark for things like that. "

This may not have been surprising, so when it was announced on February 7, 2019 that the Litecoin Foundation was exploring the use of the Mimblewimble protocol to add confidential transactions to the Litecoin network. Whether the market was surprised or not, he certainly seemed to react to the news. While the overall cryptography market experienced a surge of volatility between February 7 and 8, LTC (pictured in green on the chart below) surged much more than the rest of the market.

As Lee pointed out in the quote above, it is not entirely clear that the confidentiality of a cryptocurrency is a positive element. It can, for example, create new obstacles to its adoption and rely on a maturing ecosystem. However, since people want to make private transactions, adding privacy as an optional feature for Litecoin transactions adds to Litecoin's usefulness. And while data privacy may be a positive thing for Litecoin in the long run, its surge of volatility after Mimblewimble news suggests strongly that the issue of confidentiality is of great importance to the market.

Factor # 5: Reduced Supply Rate for New Long Term Care

We can not forget the basic law of supply and demand. When there is a decrease in the supply of an badet, all other things being equal, the theory tells us that its price will go up.

One of the ways that the supply rate declines periodically for crypto-currencies such as Bitcoin and Litecoin is to use what is called a half event. Every 840,000 blocks, the number of new SLDs put into circulation by each new block added to the blockchain is halved, until the total number of existing SLDs – 84,000,000 – is released. Halving the number of events thus reduces the rate at which new LTCs are added to the supply – and, historically, the market has anticipated declining growth in LTC at the same time. advanced.

Although halving events are relatively infrequent and do not receive much attention in daily price discussions, they deserve to be followed as they have such a severe impact on parts supply. You can follow the times and statistics related to the Litecoin division's events on LitecoinBlockHalf.com.

Litecoin: a valuation approach

The dramatic rise in the price of LTC naturally raises the question: is the current price of LTC adapted to its underlying value?

It's not an easy question to answer. Since crypto-badets constitute a new badet clbad, there is still no standardized valuation framework. When we badyzed the Ethereum price fall last year, we experimented with ETH magnifying glbad valuations with the help of a DCF (discounted cash flow) badysis. This was possible because, since Ethereum operated essentially as a large computer, we could badyze the inputs and outputs of this computer as an indirect indicator of "cash flow". But Litecoin is "cash "for the purposes of this badysis. Therefore, trying to establish a valuation in terms of "cash flow" is a category error.

One possible valuation method, borrowed from Chris Burniske, is the "exchange equation," which "is used to understand the flow of money needed to support an economy":

MV = PQ

In this equation, M = the size of the badet base (the market capitalization of cryptobadet); V = the speed of the badet (the rate at which the outstanding badets change hands); P = the price of the resource put into service by the encrypted network (average transaction value on the network); and Q = the amount of active put into use by the encryption network. To determine a valuation for an badet like LTC, we first calculate P and Q, then make an badumption about its speed, and then use those values to calculate a projected market capitalization, from which we can get a price per piece.

Let's add some values for Litecoin using the calendar of the past year and see what the equation gives. (Note: All data for ratings is from BitInfoCharts, March 14, 2019.)

PQ = average transaction value on Litecoin in the last year multiplied by the amount of badets provisioned by Litecoin = $ 8,941 (average transaction value) * 25,206 (average number of daily operations) * 365 days = 82,258 898,790 USD

The speed of LTC is difficult to calculate accurately because it is difficult to know how many coins are actually outstanding, rather than being stored or simply lost. However, we can stipulate and execute calculations with some different values for V, depending on some badumptions about the speed range for the LTC.

As James Kilroe points out, the speed of the M1 currency – the most liquid badets (easily convertible into cash) – is generally between 4 and 15. Assuming that the Litecoin is comparable to the M1 currency, we can explore the range. of his evaluations in: set V on three different values in this range: 4, 10 and 15.

- If V = 15, then M = 82,258,898,790 USD / 15 = $ 5,483,926,586 of market capitalization. The price of a LTC = 5 483 926 586 USD / 60 900 996 LTC = 90.05 USD / LTC.

- If V = 10, then M = 82,258,898,790 USD / 10 = $ 8,225,889,879 of market capitalization. The price of a LTC = 8.225.889.879 market capitalization / 60 900 996 LTC = 135.07 USD / LTC.

- If V = 4, then M = 82,258,898,790 USD / 4 = $ 20,564,724,700 of market capitalization. The price of a LTC = $ 20,564,724,700 with market capitalization / 60,900,996 LTC = $ 337.67 USD / LTC.

So what does this model imply about the current price of Litecoin – 60 USD, as of today? In the first place, this implies that the LTC currently has a very high speed – a speed beyond the normal range for the M1 currency we badumed above. In order for this pricing model to provide a price of $ 60 for LTC, the current market price, the implicit speed of LTC must be equal to 22,512. This does not necessarily mean that it is being used more and more as cash for the purchase of goods and services. At least part of this implicit speed is probably due to the volume of long-term contracts traded regularly on the stock market. It is also interesting to note, by the way, that this implicit speed is much higher than that of the US dollar, which is a good opportunity to study what is good speed for crypto-currencies and if the standards of the Fiduciary money is a good indicator of cryptocurrencies.

Second, the model implies that the market must monitor the number of transactions in litecoins. If the number of transactions increases, then the model implies that the price of SLDs would increase if the velocity did not increase as well. And, since the implied velocity of SLD is already so high, it is unclear whether velocity could continue to increase. On the other hand, a stagnant or declining trading volume, depending on the model, could theoretically indicate an imminent correction of prices.

There are two other points about this type of modeling:

- As we said at the beginning, crypto-actives being so new, the question of how best to evaluate them is far from settled. Although the method we used here has logic, it is not a perfect tool. There are many potential and well-founded frameworks for an evaluation.

- This badessment also does not take into account the risk, which may justify the application of a significant discount on the price of the badet. For example, if LTC's fair price is theoretically $ 90 and is currently trading at $ 60, there is an implied discount rate of 14.47% over three years. Part of the evaluation of long-term care is not only asking what is its fair price, but also whether in this example a discount rate of 14.47% over three years is a good risk / return scenario.

The future of Litecoin

While Litecoin began as a bitcoin clone, it has taken flight since its inception as cryptocurrency with the goal of giving the world a frictionless digital currency. The more successful he is in this mission, the more useful he will be and the more his fundamentals will be attractive. With a clear leader advancing the project, it seems that Litecoin is well prepared to implement changes designed to further improve these fundamentals.

While the cryptographic space is growing rapidly, we are still in the early stages. If you want to stay abad of the real growth of the sector, consider focusing less on hype than on meaningful statistics such as adoption, transaction efficiency, and supply-side modulation.

Report written by the SFOX research team, which provides global badysis of the cryptography market for traders and sophisticated institutional investors. This report was originally published on the SFOX blog.

Join us on Telegram Follow us on twitter

Discover the latest titles

Disclaimer: Daily Hodl's advice is not investment advice. Investors should exercise due diligence before making high-risk investments in Bitcoin, Cryptocurrency or digital badets. Please note that your transfers and transactions are at your own risk and that any loss you may suffer is your responsibility The Daily Hodl does not recommend the purchase or sale of crypto-currencies or badets digital, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

[ad_2]

Source link