[ad_1]

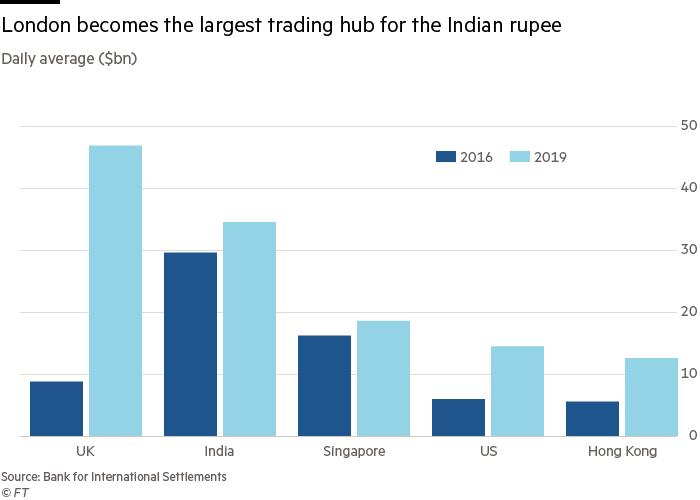

Indian traders in rupees have been suspecting for a while that volumes of the London currency have overtaken those of India. The latest triennial study on foreign exchange markets conducted by the Bank for International Settlements confirmed this impression, showing that while India handles about $ 35 billion in rupee transactions a day, London manages $ 47 billion .

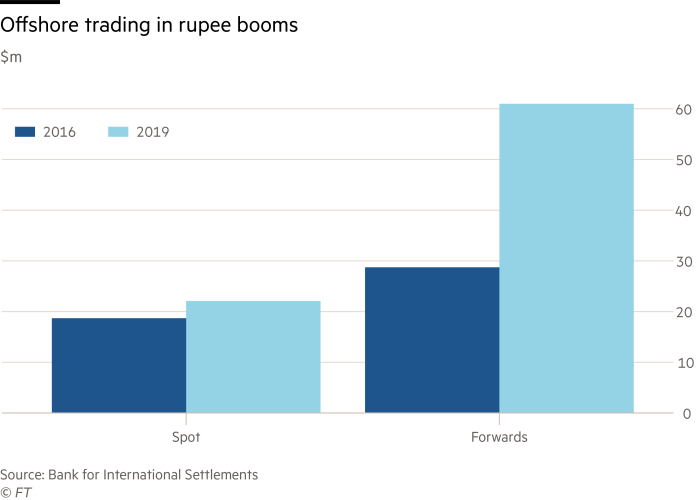

The Reserve Bank of India set up a task force in February to deal with the rise of activities abroad, responding to fears that the central bank would have lost control of the rupee exchange rate.

"Strong growth in offshore transaction volumes. . . have expressed concerns about the forces that determine the value of the rupee and the authorities' ability to ensure the stability of the currency, "said the RBI in July.

Although the Indian currency can not be delivered physically outside the domestic market, foreign investors can borrow against this currency by using undeliverable futures contracts, which gives them an idea of the exchange rate and the exchange rate. settle the difference between the agreed rate and the actual price. price in dollars.

The RBI working group found that London's location, straddling the time zones between Asia and the United States, gave it a considerable advantage. The BIS report said London had tightened its grip on the entire foreign exchange market over the last three years, bringing its market share from $ 6.6 billion a day to 43%, 6 percentage points higher than last survey.

"Given the fact that there are more dollars traded in London than in New York and more euros than in the EU, it makes sense that the rupee is trading here as well. "said Jon Vollemaere, managing director of the R5FX trading platform.

The FT is free to read today. You can share this article using the buttons at the top.

Source link