[ad_1]

Photography: Drew Hadley / Getty Images

The office industry has its detractors, who are not convinced that providing office space, comfortable sofas, coffee and (if they're lucky) craft beer to employees working in hot-selling a real business.

However, IWG (formerly Regus) exceeded expectations this morning by selling its Japanese operations to TKP Corp. for £ 320m under a new "master franchise agreement".

The agreement will allow IWG to sell 130 flexible work centers to TKP (Japan's largest provider of conference and banquet facilities). TKP also uses the Regus, Spaces and OpenOffice brands in Japan under a franchise agreement, the IWG working group providing sales and technology services.

The actions of the IWG working group have jumped 15%, traders welcoming this move towards greater franchise.

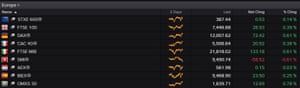

European banks' shares reach their highest level in six months

European banking stocks reached their highest level since early October, as transactions began.

The Stoxx 600 Europe Banks index has almost progressed, supported by the hope that the US-China trade war could ease, which could boost global growth.

In the markets, the Spanish and Italian stock exchanges have increased by more than 0.5%, but the shares in Frankfurt, Paris and London are more moderate.

European Stock Exchanges, April 12, 2019 Photo: Refinitiv

Update

Konstantinos Anthis, head of research at ADSS, believes that the optimism that US companies will publish decent results in the last quarter also boosts markets.

JP Morgan started the earnings season well on Friday, surpbading expectations with record earnings and earnings. If Goldman Sachs does the same today, the markets could be shaken higher.

But perhaps this optimism is exaggerated, given the concerns raised by the global economy?

Anthis warns:

The risk on sentiment is the key theme in the markets earlier this week after a solid close for most instruments on Friday. High beta currencies gained ground, equities rallied, Treasury yields rose, and gold declined. This is a typical risk for the environment and the question of whether investors are right to be so gay. Be that as it may, Easter price action is fast approaching and, with the US financial season in full swing, greater volatility should allow market participants to remain vigilant.

Improved risk sentiment is what appears to be the appetite of investors at this stage. The euro, the dollars in commodities, the greenback against the yen all rallied on Friday. At the same time, gold retreated while equities tended to target more gains aimed at new highs for the year. however, It is logical to mention here that the only significant catalyst for this increase is the fact that banks reported better profits for the first quarter, which seems too simplistic as a credible market driver. Should we be worried?

Reuters: the United States abandons their applications for subsidies to the industry

In another important movement, Reuters report that Washington has diluted one of its main demands during trade negotiations.

US negotiators apparently no longer insist that China limit subsidies to the industry as part of an agreement to remove tariffs on Chinese products.

Such a reversal could help both sides reach an agreement (but also fierce American officials who want to prevent Beijing from tipping the rules of the game).

Reuters says:

The issue of subsidies to industry is thorny because they are closely linked to the industrial policy of the Chinese government. Beijing provides grants and tax breaks to SOEs and sectors considered strategic for long-term development. Chinese President Xi Jinping has strengthened the role of the state in some branches of the economy.

In an effort to reach an agreement in the coming months, US negotiators have resigned themselves to getting less than they would like on reducing these subsidies and have focused on other areas where they consider that requests are more feasible, the sources said.

Vincent Lee

(@ Rover829)Reuters Exclusive by @alexalper @ChrisPrentice @michaelvmartina :#WE Tempered request to China to limit industrial subsidies to a trade deal after strong resistance from Beijing, according to two sources informed during talkshttps: //t.co/7dCSsasASr

Introduction: Mnuchin fueling optimism over trade talks with China

Treasury Secretary Steven Mnuchin at the International Monetary and Financial Committee Conference at the World Bank / IMF Spring Meetings in Washington, DC, Saturday, April 13, 2019. Photo: José Luis Magaña / AP

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

Investors begin the new week with a spring in their steps, hoping that Washington and Beijing are getting closer to a resolution of their trade war.

With the Brexit on the back burner, municipal investors are refocusing on US-Chinese trade negotiations … and welcome the optimistic comments of Secretary of the Treasury, Steven Mnuchin, this weekend.

Mnuchin told reporters in Washington: "We hope we are nearing the end of the final round of these issues," adding that further face-to-face talks could be imminent.

Perhaps significantly, Mnuchin also said that the United States was ready to face "repercussions" if it failed to meet its commitments in a possible trade deal with China. This could be a sign that the agreement being developed has teeth.

As Mnuchin says:

The United States is making certain commitments in this agreement and China is making certain commitments.

"I would expect the enforcement mechanism to work both ways, that we would expect to live up to our commitments, and if we do not do it, there should be some impact, and the same way in the other way.

We have already been there, of course. Optimism does not always translate into concrete actions. Both parties, however, wish to reach an agreement, especially after last Friday 's import and export data showed that US trade with China had fallen by more than 11% this year. year.

Mnuchin's Comments Raise Stocks in Asia, China Shanghai Composite Indiax up 0.6%.

From Japan Nikkei increased by 1.4%, reaching its highest level since last December.

European markets should record gains today as well:

Holger Zschaepitz

(@Schuldensuehner)Global stocks started unsurprisingly on the week's hike, thanks to the combination of better Chinese data and a heightened optimism about trade talks between the two countries and Wall St's Friday handover. The IMF and World Bank spring meetings are cautious but constructive. Unamortized 10-year bonds at 2.55%. Bitcoin at $ 5.2k. pic.twitter.com/xgvfSEDpXW

Sigma Squawk

(@SigmaSquawk)European investors are feeling risky this morning as Asian stocks pull together in the hope of a trade deal between the two countries.

US, Tres Sec Mnuchin, hopes US-China trade talks near "last round"

An agreement would go "well beyond" previous efforts to open Chinese markets to US companies https://t.co/VKAyQ5ODKO

Also coming today

Goldman Sachs publishes its latest financial results before the opening of Wall Street; Analysts predict that the turnover has decreased by 10% from one year to the next in the first quarter of 2019.

In addition, the latest report on the Empire's manufacturing will show how New York's plants are doing well this month and whether trade tensions are suffering.

L & # 39; s calendar

- BST midday (estimate): Goldman Sachs results for the first quarter of 2019

- 1:30 pm Paris time: publication of the New York Empire Manufacturing Index

Update

[ad_2]

Source link