[ad_1]

Lufthansa shaken by profits

Photography: Paul Hanna / Reuters

Ouch! Shares of German airline Lufthansa are down, after recording a loss of shock for the last quarter.

The largest German airline recorded an adjusted loss of 336 million euros in January-March, down from a profit of 52 million pounds a year ago. It blamed higher fuel costs and downward pressure on fares, which caused a chill in the travel industry.

Lufthansa shares fell 5% at the opening in Paris. In London, easyJet lost 1.4%.

Lower fares are good news for pbadengers, especially those who have delayed booking holidays because of Brexit. But this also suggests a problem of overcapacity in the air transport sector, which has already seen several companies collapse in recent months.

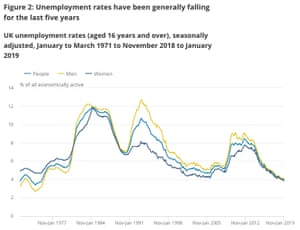

If the city's forecasts are correct, the UK's unemployment rate will remain at its lowest level since Harold Wilson was Prime Minister in 1975.

UK Unemployment Report Photo: ONS

Update

Introduction: report on employment in the United Kingdom and German survey ZEW

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

A burst of recent economic data from the United Kingdom, Germany and the United States will give us a fresh insight into the health of today's global economy.

In the UK, the big event will be the unemployment report for the three months prior to February. It is likely that the unemployment rate reached its lowest level in 40 years at only 3.9%, in the face of the incessant Brexit tragedies.

Wage growth (excluding premiums) should also remain at 3.4%, which means that profits would exceed inflation.

Marc Ostwald of ADM Investor Service predicts that UK companies have also continued to hire workers, albeit at a slower pace than last year.

Despite all the talk of weak and / or cautious UK business investment, constrained by a lack of clarity on the Brexit results, the UK workforce has been remarkably resilient and today's report should not not change this perception.

Employment posts a strong gain of $ 171,000, slower than previous 222,000 but still strong, and average weekly earnings are expected to remain around their post-GFC cyclical highs at 3.5% y / y and 3.4% excluding bonuses, while vacancies appear likely to remain very robust, after setting a new historical / cyclical record of 870K in January.

A particularly strong employment report could put pressure on the Bank of England for it plans to raise interest rates, while a weak report could raise concerns about the slowdown in the economy.

The latest survey of the German economic climate, conducted by the ZEW Institute, could also change markets. Economists predict that investors and badysts will be gloomier about the current economic situation, but more optimistic about future prospects.

A new health check on the US manufacturing sector should show a slight recovery in industrial production last month, up 0.2% despite the US-China trade war.

On the front of the city, security firm (and takeover target) G4S reports the results, with the fashion chain JD Sports, retailer Card factory, recruitment agency Hays and construction company Galliford Try.

L & # 39; s calendar

- 9.30 BST: Unemployment and earnings report in the UK

- 10 am BST: ZEW index of German investor confidence

- 2:15 pm: manufacturing report in the United States

Update

Source link