[ad_1]

ICOs are not dead. Not when one of the largest technology companies in the world ventures there.

Microsoft Azure, a cloud service created by Microsoft, recently added Stratis to the Products section. The platform, created by the British group Stratis, offers a Web application that allows projects offering initial coins to manage the distribution of tokens. It facilitates the secure and flexible payment process that participants use to purchase ICO tokens prior to the initial award. They pay with Bitcoin or Strat, the native Stratis token.

Find how @StratisPlatform sure #Azure can help you manage a successful initial parts offer: https://t.co/86efOPCmQ7 pic.twitter.com/8uQMXi8zQA

– Microsoft Azure (@Azure) February 19, 2019

According to Microsoft's description, Stratis has also integrated Changelly into its application. The complementary service allows ICO participants to effortlessly convert their currency or cryptographic currencies into Strat.

Friendly settlement

Microsoft's entry into the ICO space follows a year of slowdown in the cryptocurrency sector. During the cryptography boom at the end of 2017, ICO projects raised billions of dollars at the ideal stage. People started buying chips, thinking that they were going to become the next Bitcoin or Ethereum. Nevertheless, most ICO projects have not resulted in a practical business model. At the same time, many of them disappeared with the money of the investors.

Company: I have no product. I collect $ 40 million.#VC: Not interested

Company: But … it's an ICO.#VC: Do you think you can make room for me?– Adam Draper ? ? (@AdamDraper) June 29, 2017

Regulators around the world have taken drastic steps to limit fraudsters' access to potential investors. The US Securities and Exchange Commission (SEC), for example, launched its most serious crackdown on startups that were selling illegally. Its counterpart in South Korea, the Financial Services Commission (FSC), went so far as to ban international trade organizations.

Nevertheless, with Stratis, it seems that Microsoft takes seriously the scamming nature of the ICO.

The Onfido integrated platform – a risk management and fraud prevention software – protects contributors from the anti-money laundering checklists. The tool also checks documents that ICO participants submit as part of the customer's knowledge process.

At best, this method could allow new ICO projects to streamline their regulatory obligations. In the longer term, it could ensure accurate monitoring and report suspicious transactions to the relevant government bodies, making the OICs as safe as the SOPs in the eyes of supervisors.

What Microsoft means for the ICO industry

After 2017 bullish and early 2018, the ICO market has trended downward. Projects underperformed or did not progress beyond their levels of ideation; they lost value and prompted investors who bought their securities to "sell". Negativity eventually led to the erasure of a third of the value of the cryptography market. At the same time, projects that survived the crypto crash had to reduce their operating costs or reduce their workforce.

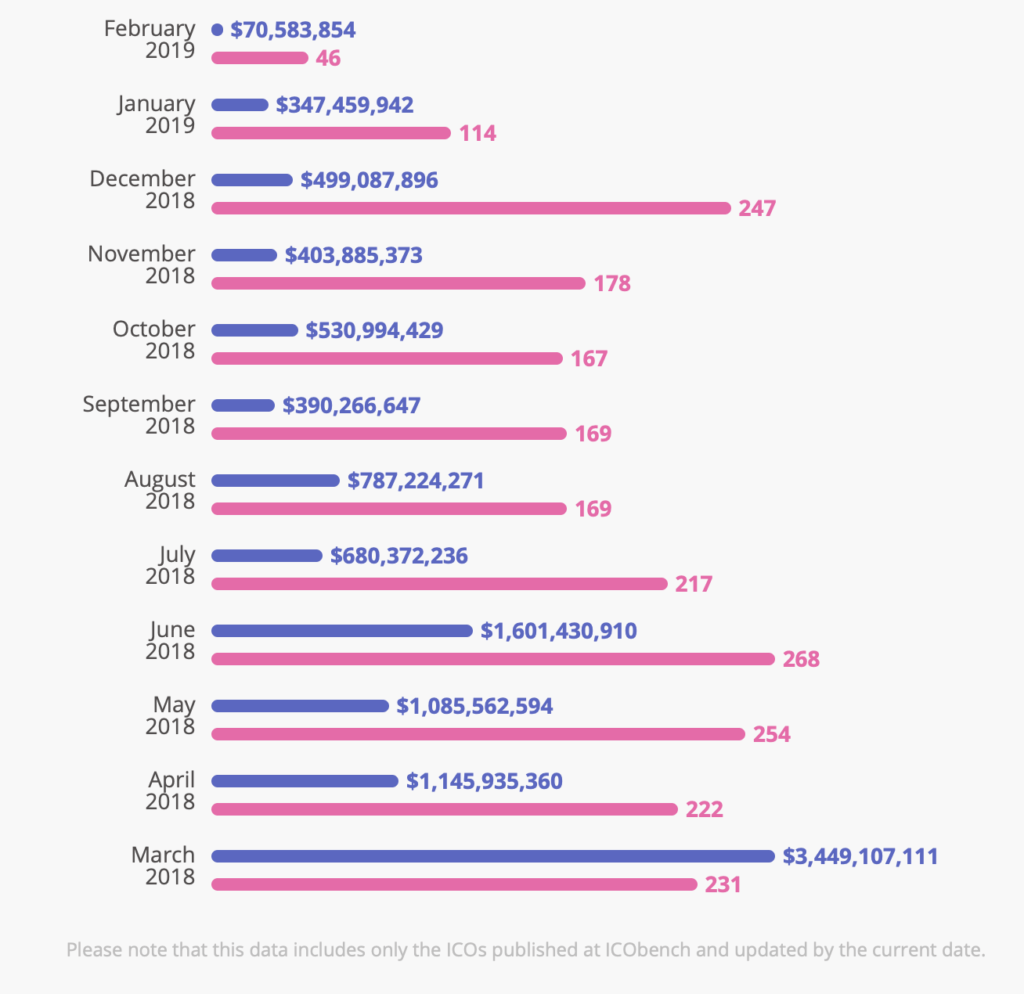

ICO performance in the last 12 months | Source: ICO Bench

Microsoft's entry into a supposedly dead space actually rejects this notion – if only the tech giant was right about its long-term potential.

One of the reasons ICOs are far from dying is the performance of a few projects in 2018. Even in a down year, the blockchain Block.One/EOS project managed to raise an impressive $ 4.1 billion of dollars. Telegram, one of the most renowned messaging applications, has also raised $ 1.7 billion to develop its Blockchain protocol. The list is extensive, with names such as Petro, Dragon Coin and Bankera leading the ILO's 2018 fundraising events.

2018 explained that it was not the ICO market that failed. Instead, investors became more intelligent in their investment decisions. They chose to place their money only in startups with practical business models and real chip utilities. Interestingly, 50% of OICs launched in 2018 did not have a minimum viable product – they all failed.

Conclusion

Finally, Microsoft Azure should seek to invest in a more professional ICO market. This means that all the usual ICO projects do not use the Stratis solution, given its user-friendly functionality for KYC. On the other hand, a more sophisticated market – thanks to the SEC – would guarantee the growth of the ICO market in the long term, but at a slow pace.

[ad_2]

Source link