[ad_1]

Discussion points on the price of technical crude oil:

- the A Thing: Crude oil remains bullish up from the December 24 trough and is now above support at $ 50 / bbl. The higher movements were impulsive while the counter-trend movements were not lively, showing that the bears lack conviction.

- The 3-month implied volatility has fallen sharply, showing that Bull's concerns have diminished and that bears are probably less credible at the moment. The current price increase in the WTI is the highest in three months.

- The fundamental picture confirms the upward trend of crude oil with OPEC, which reports that their production cuts exceed expectations and that the demand for IEA signaling is probably higher than expected despite the global slowdown.

- According to IG customer sentiment, the positioning of retail traders in crude oil has caused a renewed downward bias

You're lucky, DailyFX crude oil forecast for the first quarter of 2019 has just been released

Technical forecasts for USOIL: Neutral

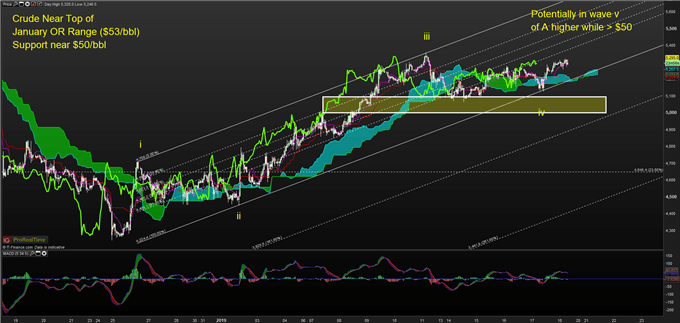

Graphic Source: Real Time Pro with IG Price Feed. Created by Tyler Yell, CMT

Trends can be broken down into impulsive or progressive movements, and corrective or consolidating. Trend movements since the end of December have been aggressive, while trend correction movements have been choppy and show that bears have retreated.

Looking at the WTI chart above, you can see that the price stays above 50 USD / bbl, and that the Ichimoku cloud is on an hourly chart. The chosen channel is helping to place support in the near future at around $ 54 / bbl, but the $ 50 / bbl will likely continue to be the market's top priority. With the price above the short-term cloud and the channel support line, traders will struggle to fight this rally, even if the rise does not lead us close to our September position.

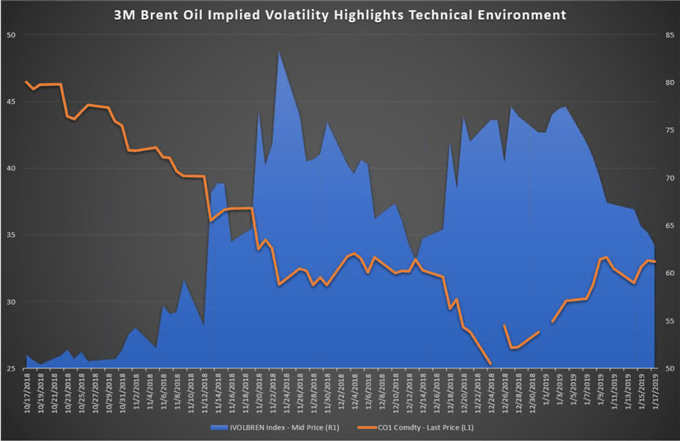

Why volatility is important now

Implied volatility is considered an excellent shortcut for measuring downward pressure on the markets. When future prospects become unclear and speculators begin to lose confidence in the context that supported the previous environment, implied volatility is a quick way to gauge the fear that currently prevails. The higher the implied volatility, the greater the perceived uncertainty or likely fear about the future.

At the beginning of the fourth quarter, fear increased when the 3-month implied volatility contract for Brent was examined. Implied volatility is a level derived from option pricing models to understand the increase in option prices, which increases in value as volatility increases, as volatility increases their chances of volatility. to be in the money.

When volatility decreases (as was the case for Brent in 2019 at the time of writing), this tends to show that storm clouds are getting smaller and bull fears are likely to be exaggerated. than the hopes of the bear. The implied 3-month volatility of Brent rose from 44.5 in early January to near the lows of January (34.2), a drop of -23%. A break under the December dip would go a long way toward restoring confidence in the bull business.

Data source: Bloomberg

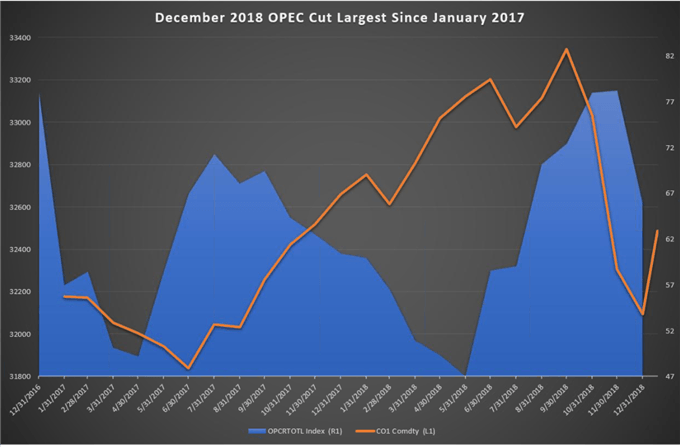

For traders who are wondering why the environment has changed, so that the volatility has decreased and that the WTI crude appears (temporarily) comfortable above 50 USD, I would like to highlight the fundamental chart positive thanks to OPEC and IEA. OPEC has shown the world how much they want to restore confidence in the world that they will fight a supply problem. Production of the deal for December was the largest drop by OPEC and strategic allies like Russia since January 2017.

Data source: OPEC, Bloomberg

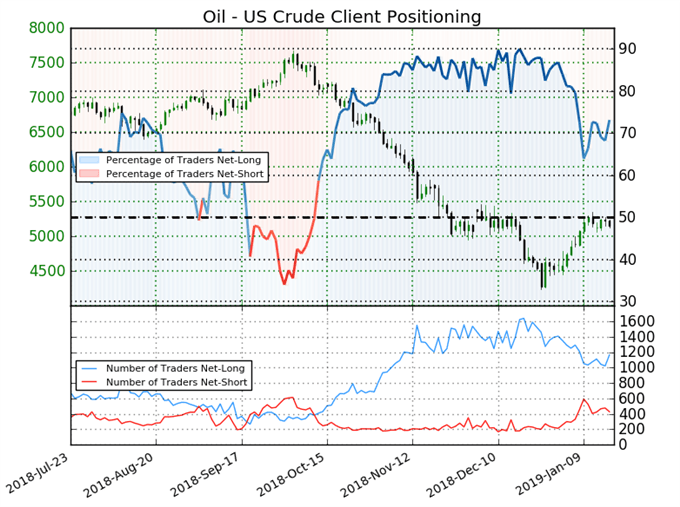

Reignites of the bearish sentiment bias, potentially limiting the rebound of crude

The data source: Feeling IG

Data from retailers indicate 73.1% of American crude oil traders are net-long with a long / short traders ratio of 2.72 to 1. In fact, traders have remained net since Oct. 11, when US crude-oil traded close to 7235.2; price has decreased by 28.8% since then.

Tnumber of gross traders have an increase of 3.9% over yesterday and 6.8% over last week, while the number of traders is 9.5% lower than yesterday and 15 , 4% compared to last week.

We generally have an opposite view of sentiment, and the fact that traders are net is long-term, suggesting that oil and US crude prices may continue to fall. Traders are even sharper than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger oil – US Crude –trade bias against the current (It's me who points out.)

— Written by Tyler Yell, CMT

Tyler Yell is a Certified Market Technician. Tyler provides technical badysis driven by fundamentals in key markets as well as educational resources. Learn more about Tyler's technical reports via its bio page.

Contact Tyler and shout out your sentence below by posting it in the comments box. Do not hesitate to also include your vision of the market.

New DailyFX podcast: Negotiating the decoded global market on iTunes

Speak on twitter markets @ForexYell

Other weekly technical forecasts:

Forecast in Australian Dollars: AUD / USD, AUD / CAD Get ready for the next major moves as the AUD / JPY could reverse

Sterling forecast: release your breath

Fairness Forecast: S & P 500 Upside Limited, DAX Brings Down the Surface

[ad_2]

Source link