[ad_1]

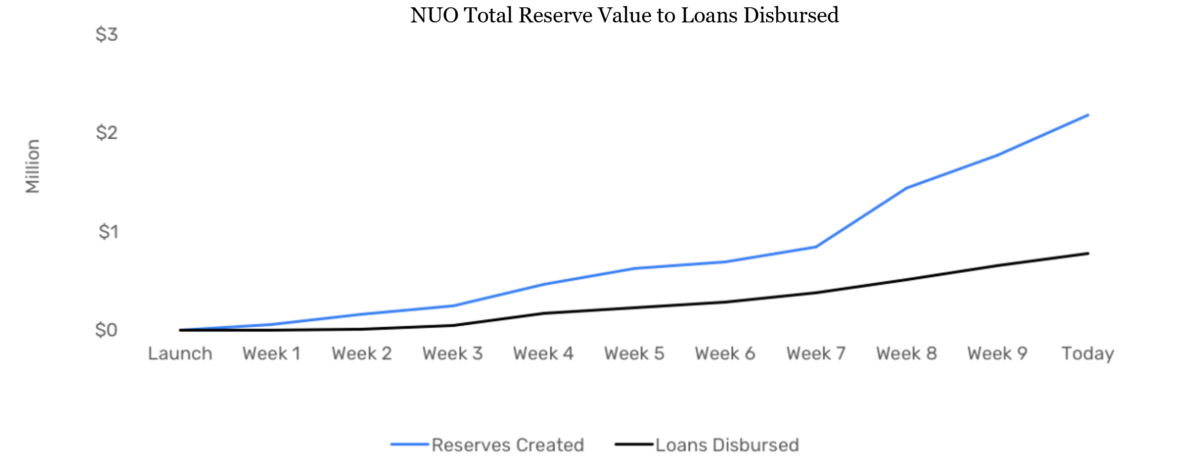

Nuo.Network, a non-custodial loan agreement backed by ConsenSys Ventures, was recently named one of the top 5 DeFi projects in US dollars and is currently the largest Asian-based lending protocol, according to DeFi Pulse. The value of loans disbursed via the platform has now doubled in the past month, fueled in part by the growth of DAI's reserves, now close to $ 500,000, and by rising Maker stability fees.

The collateral loan application currently offers borrowing in a handful of badets including DAI, ETH, USDC, MKR and encapsulated BTC. Nuo has also recently enabled the possibility of trading margins with leverage up to 3 times higher on the Uniswap and Kyber pools.

Nuo co-founder Varun Despande told The Block that recent increases in the company's stability fees have pushed DAI's liquidity into the platform as traders look for new leverage opportunities.

"As the Stability Commission increases, more and more users want to use Long ETH with leverage multiplied by 3 by borrow- ing more heavily on our reserves." This increases yields and attracts more lenders on the platform, bringing more cash DAI to traders, "said Despande.

"Which makes Nuo What is unique is that lenders pool funds in a contract that lends directly to borrowers or provides leeway to negotiate with Kyber or Uniswap pools. This is the first outsourcing contract for the implementation of trading margins and loans in DeFi. This C2C mode frees up mbadive cash and makes all transactions almost instantaneous. "

Although Nuo currently offers collateralized cryptographic loans and margin operations, the team aims to provide other debt products, such as refinancing CDP Maker and token bonds, among others.

Source link