[ad_1]

The FTSE 100 started the day with barely a whisper.

London's safe haven index is down 0.05%.

The other major European stock markets have fallen. In Germany, the Dax fell by 0.25% after relatively weak trade data. The Spanish Iberian bouquet fell by 0.2%, but the French Cac 40 remained unchanged.

Introduction: Oil prices hit record high this year

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

The beginning of the year 2019 was marked by fears of a long – awaited slowdown in the global economy, weighing on oil demand. However, supply constraints kept prices steady, with Brent crude futures trading above $ 70 a barrel earlier this week.

Futures prices rose 0.5% to a high of $ 70.78 on Monday morning, with traders predicting a drop in production in Libya, where fighting in the long-running civil war intensified, threatening the country's economy. UN-backed government in Tripoli.

Libyan instability coincided with relatively solid data on US employment on Friday, cuts in OPEC supply, the cartel of oil producing countries, and sanctions against Iran and Venezuela.

James McCormick, Global Head of Office Strategy at Natwest Marketssaid the Brent crude futures exceeded the 200-day moving average at the end of last week, signaling a bullish sentiment. He said:

The upside risks of crude oil prices […] are in progress.

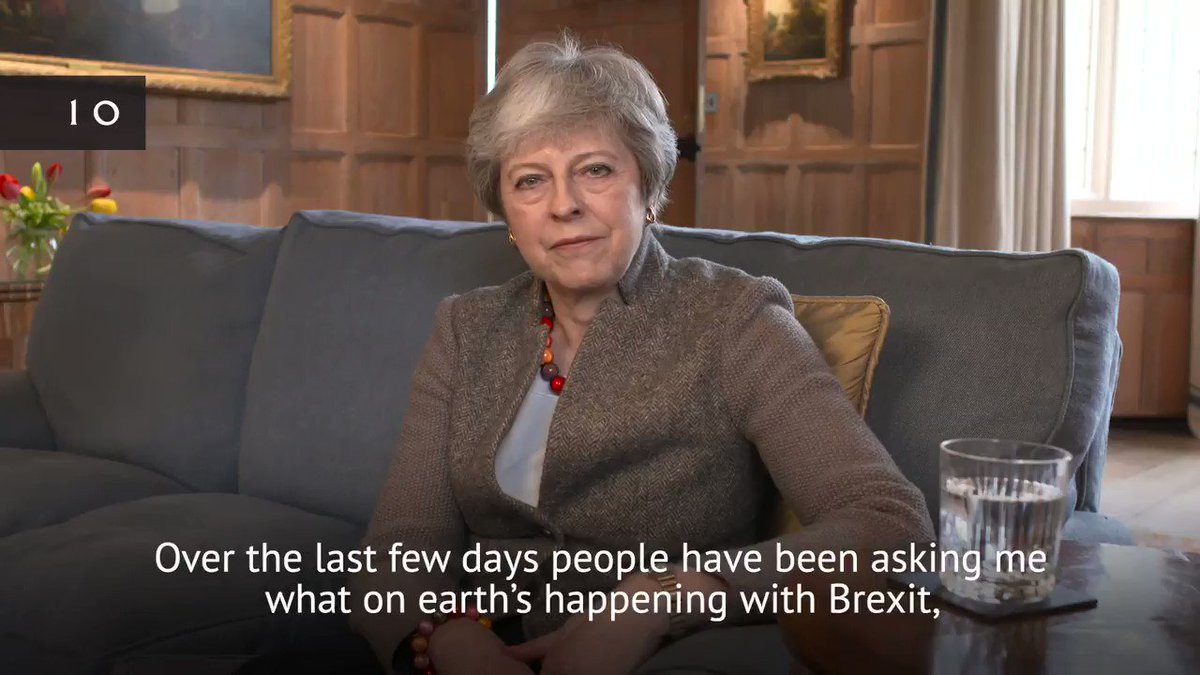

The sterling markets were relatively stable early in the session, but do not rely on this trend. The UK must leave the EU Friday at 11 pm unless something new happens – a fact that will undoubtedly lead to the week of information. Take a look at this shaky video of the Prime Minister to see how strange the current political situation is.

Theresa May

(@Theresa_may)Let me explain what is happening with Brexit.pic.twitter.com/gjGkvFk8fT

With just a hint of euphemism, Guy Stear and Klaus Baader, badysts at Societe Generale, I said:

This week will probably be overshadowed by Brexit events. The UK has asked for another brief extension, but the EU may prefer a longer deadline while setting strict conditions and demanding participation in the European Parliament elections.

L & # 39; s calendar

- 13.45 BST: speech by Andrea Enria, European Central Bank

- 15h (Paris time): US factory orders – February

[ad_2]

Source link