[ad_1]

OPay, an Africa-based mobile payments start-up founded by the Norwegian browser Opera, has raised $ 50 million in funding.

The main investors are Sequoia China, IDG Capital and Source Code Capital. Opera has also joined the tour in the payments business that he has created.

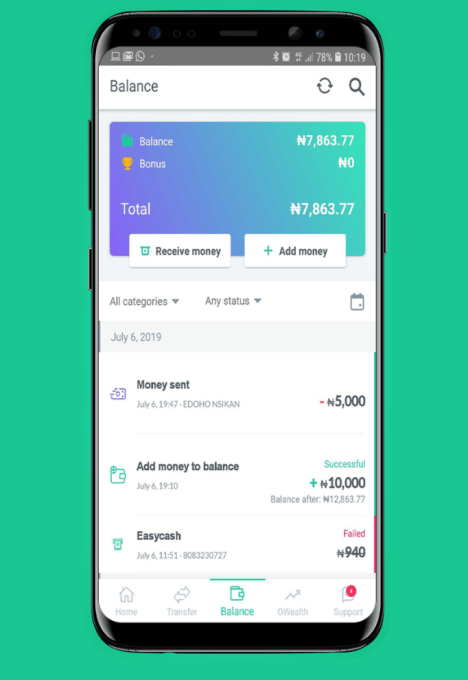

OPay will use this capital (which has not received a stage designation) primarily to develop its digital finance business in Nigeria, the most populous country and the largest economy in Africa.

OPay will also support Opera's expanding commercial network in Nigeria, which includes a motorcycle application "ORide" and "OFood".

Opera founded Opay in 2018 on the popularity of its Internet search engine. Opera's web browser ranks as the second largest user in Africa after Chrome in the last four years.

On the payments side, OPay in Nigeria reached 40,000 active agents and a trading volume of $ 5 million in 10 months.

On the payments side, OPay in Nigeria reached 40,000 active agents and a trading volume of $ 5 million in 10 months.

The $ 50 million investment in OPay is more than another major cycle in Africa. It is of considerable importance for the continent's technological ecosystem.

To begin, OPay is increasingly aligning China's influence on African technology – whose engagement with African startups has been weak compared to China's negotiation. infrastructure and amenities. The founder of OPay, Opera, was acquired in 2016 for $ 600 million by a consortium of Chinese investors, led by current CEO of Opera, Yahui Zhou.

Most of the investment in OPay's revival comes from Chinese funds and sources, including Source Code Capital, Sequoia China and GSR Ventures. There is not much statistical data on the value of Chinese venture capital investments in Africa, but a significant $ 50 million for a financial technology firm stands out.

OPay's venture capital transfer is also important compared to digital finance in Nigeria. Along with other trends, it could support Nigeria's slide, overtaking Kenya as the leader in digital payments in Africa. For years, Kenya has surpbaded Nigeria in terms of P2P digital payment volume and digital financial inclusion, largely thanks to the rapid adoption of mobile money products, such as Safaricom's M-Pesa.

This is partly because the Central Bank of Nigeria limits the ability of non-banks (including telecoms) to offer mobile payment services. The CBN eased many of these restrictions earlier this year. This opens the door for mobile operators such as MTN, which has the largest telephone network in Nigeria, to offer mobile money products. In addition to improvements in the regulation of financial technology, there has been a gradual increase in the volume of venture capital to Nigerian payment companies.

Paga, the country's leading digital payment company, raised $ 10 million in 2018 to expand its customer base to $ 13 million. OPay's US $ 50 million commitment to mobile money growth in Nigeria is expected to boost the adoption of digital finance among the country's 190 million people.

And, we must not forget that OPay's capital increase encourages Opera to become a multiservice Internet business platform in Africa.a. Part of the $ 50 million investment includes diversification of product and country offerings. "The geographical expansion of OPay and other services is a key part of our projects," TechCrunch, general manager of Opera, told E-mail.

This could place OPay and its suite of Opera-supported products on a competitive basis with other start-up, food delivery and payments businesses in the continent. It could also mean competition between Opera and Africa's largest multiservice Internet company, the e-commerce unicorn Jumia.

Source link