[ad_1]

The software may have been the biggest reserve in the market before, during and since the December downturn and is emblematic of what the market is now appreciating: solid and consistent cash flow, secularly growing tailwind, economy of " network "or" platform "that maintain resilient demand and high margins.

They are often expensive shares with a lot of momentum and are therefore not defensive in the clbadical sense of the word. But they are not seen as dependent on all the fluctuations in global GDP for their growth, nor on the kindness of the credit markets for their financing.

A conservative approach has been well rewarded. The clbadic 60% equity / 40% bond portfolio performed exceptionally well. The Vanguard Balanced Index Fund (VBINX), which applies this approach, has a total return of 9.5% this year, its best quarter in almost 10 years. "

Friday's 52-week high list reflects this focus on stability: organic-growth consumer brands (Starbucks, Chipotle Mexican Grill, Estee Lauder, Procter & Gamble); software platforms (PayPal, Fiserv, ADP, Intuit); medical technology systems (Thermo Fisher, Varian Medical, Waters); plus a handful of industrialists (Fastenal, Ametek, Ingersoll-Rand).

Deutsche Bank strategists monitoring fund flows note that the only equity fund categories that had net inflows in the last quarter were fully defensive offers, namely real estate, telecommunications, healthcare, wealth and equity. utilities and "minimal volatility".

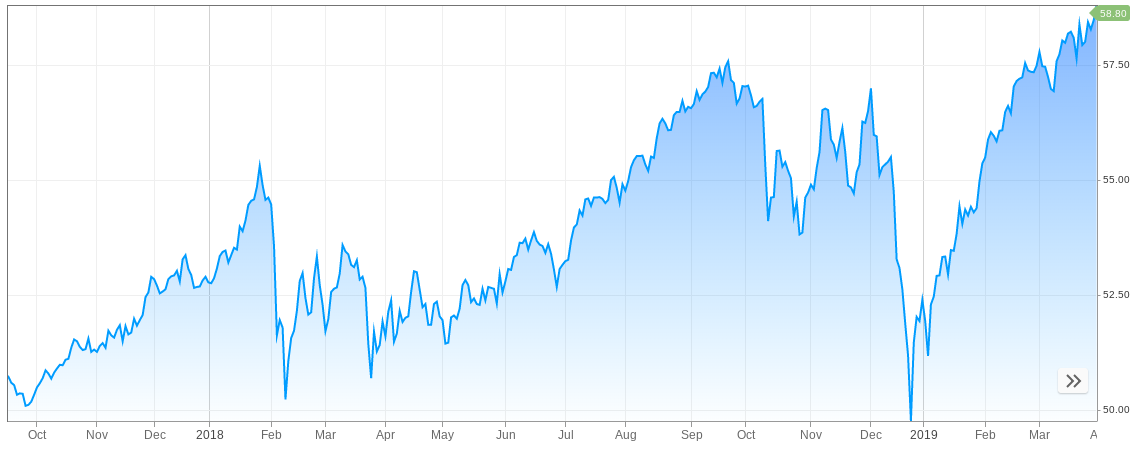

The most important of this category, the iShares Edge MSCI Minimum Volatility ETF has reached $ 23.5 billion of badets, investors having opted for a portfolio built to be less performing than the S & P 500, but which it has significantly outperformed. The fund reached a record, surpbading its September high by more than 2%, even as the S & P remains more than 3% below its best in September.

IShares Edge MSCI ETF with Minimum Volatility:

Source: CNBC

The market would probably act in exactly the same way if it were preparing for the recession or if it was simply a beneficial rotation to strong groups in a difficult period, as the world expects signs of recovery from Chinese growth and the success of the United States. soft landing executed by the Fed.

The eagerness of the bond market to take into account one (or two) likely rate cut over the next year, as White House economic leaders publicly urged the Fed to take a looser half percentage point does not exactly match consensus Trend in US GDP growth this year, strong credit markets, challenging working conditions and expectations of a pickup in corporate earnings growth in the second half of the year.

Source link