[ad_1]

The start-up Fintech, Revolut, announced this week changes to its business accounts. The good news is that if you are thinking about trying Revolut for your business needs, starting now is cheaper. But there are limits.

While Revolut Better known for its regular consumer accounts that allow you to receive, send and spend money around the world, the company offers corporate accounts launched two years ago.

The main advantage of Revolut for Business is that you can manage multiple currencies. If you work with customers or suppliers from other countries, you can exchange money and send it to your partners directly from the Revolut interface.

The company also allows you to issue prepaid business cards and track your expenses. Revolut for Business also has an API for automating payments and connecting to third-party services, such as Xero, Slack and Zapier.

None of this is changing today. Revolut mainly modifies the price structure.

Previously, you had to pay £ 25 per month to access the service with an additional limit of £ 100,000 per month. Large companies have had to pay more to raise this ceiling.

Now, Revolut is moving a bit closer to a software approach as a service. Instead of paying more to receive and keep more money, you pay more as your team grows and you use Revolut for Business more intensively.

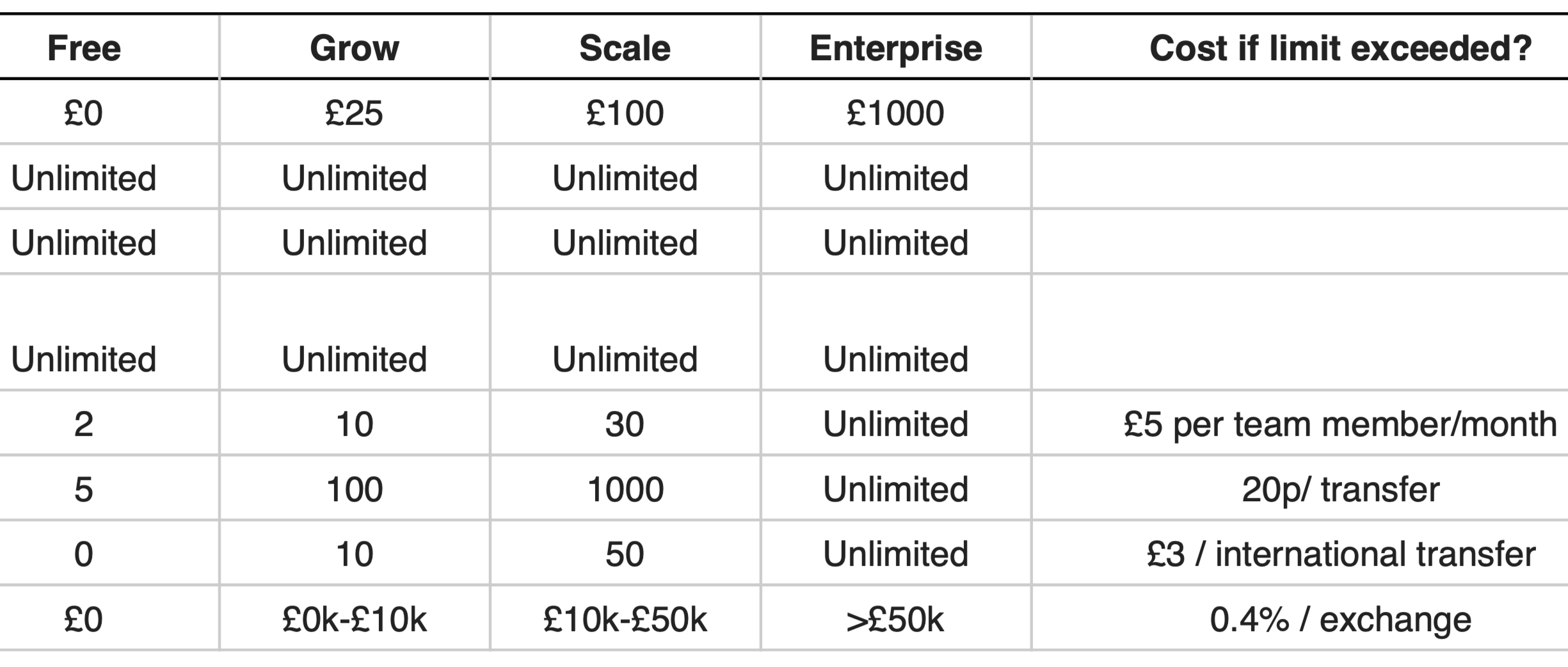

The basic plan is free with 2 members of the team, 5 free local transfers per month and 0.4% exchange fees. If you want to add more members of the team or initiate more transfers, you pay small fees.

If you previously paid $ 25, you can now add as much money as you want to your Revolut account, but there are certain limits for team members (10), local transfers (100 per month) and international transfers (10 per month, interbank exchange rate up to £ 10,000).

Again, exceeding the limits does not necessarily mean that you have to move to a new plan. You will pay £ 0.20 per additional local transfer, £ 3 per additional international transfer, etc.

Here is a complete overview of the new plans:

If you are a freelancer, there is now a free plan. You will pay 0.4% foreign exchange and £ 3 per international transfer, but there will be no additional limit.

Similarly, the old £ 7 scheme for freelancers has been replaced by a new plan that removes the limit for inbound transfers, but adds some limits to transfers.

This is good news if you are a small customer. But if you greatly exceed the transfer limit in one of the categories, you could pay more than before. With this change, the company wanted to make Revolut for Business more accessible, instead of letting small customers subsidize larger customers with high entry prices.

Existing customers can move to a new plan as of today. And Revolut plans to switch everyone on the new plans on October 1, 2019.

Source link