[ad_1]

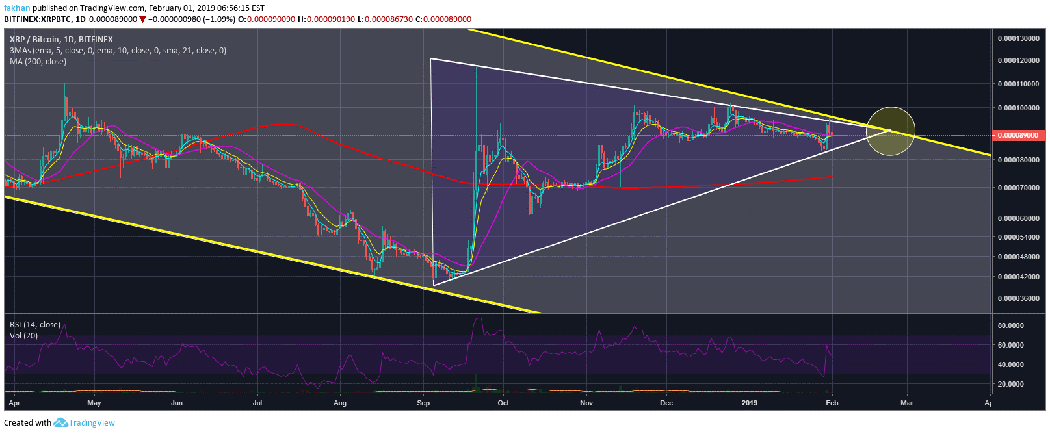

Ripple (XRP) is once again in a "do or die" situation in which it is necessary either to break up and exit the downtrend, or to fall lower to prepare for another correction against Bitcoin (BTC) . So far, XRP / BTC seems to be holding close to the 21-day EMA and has found support in the bullish pennant in which it traded. However, the price will soon run out of room for lateral movement and will then have to move up or down. The daily volume of transactions has also declined significantly, which means the price may fluctuate in the short term and traders will follow. In other words, market managers would have no problem setting an orientation at this stage.

Even if they are tempted to attract markets before the uptrend does occur, market makers are tempted to become aware of the implications of a strong downward trend. The majority of investors expect new sales at this stage. If market makers lower prices to try to trap some bears, they risk something more important in the long run, which is irreparable to market sentiment. The majority of investors may expect a selloff at this stage, but very few are willing to bet money on it. This is because basically they know that the bottom is either very tight, and that the price could go up anytime. However, if market managers manipulate the price just to trap bears in the short term, they may scare the horse in the long run, posing a greater threat to their interests.

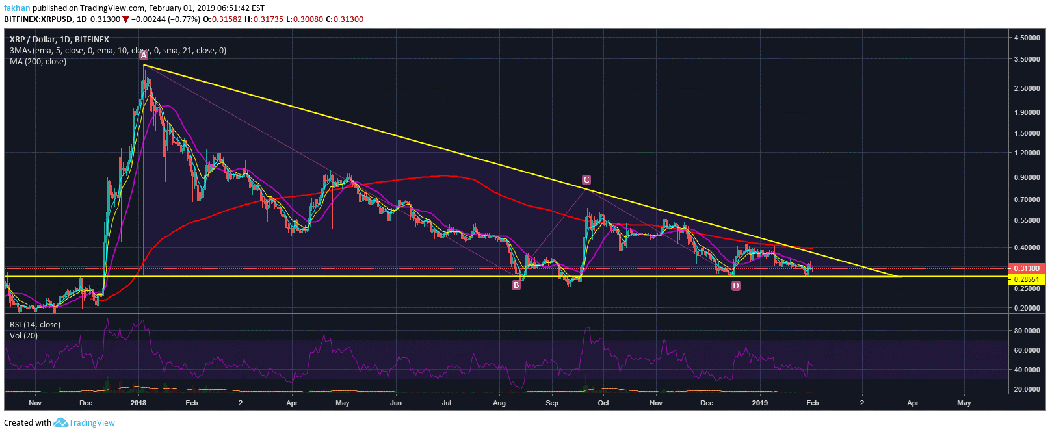

Ripple (XRP) has seen a surge in recent days, despite over-short-term conditions. It seems that Ripple's investors (XRP) have absolutely no regard for technical badysis and are more focused on accumulation, as we have seen in the bear market. While most crypto-currencies had extensive correction resulting in slow bleeding over a long period, Ripple (XRP) had a relatively shorter correction. In fact, the daily chart for XRP / USD shows that Ripple (XRP) reached a floor much earlier than the rest of the market in August 2018, then recovered most of its gains as the market continued to fall. .

The exuberance that followed SWIFT's partnership with R3 seems to have faded, as the XRP / USD has dropped significantly over the past 48 hours, wiping out most of its gains. However, the fundamentals of Ripple (XRP) have never been so good in its history. The price is very lucrative in terms of risk / return and, as the market recovers, the XRP / USD could once again become one of the biggest winners in this market. The price is still down more than 90% from its historical high, which means that good returns should be achieved as Ripple (XRP) is expected to hit a price below $ 5 in its next bullish cycle .

Source link