[ad_1]

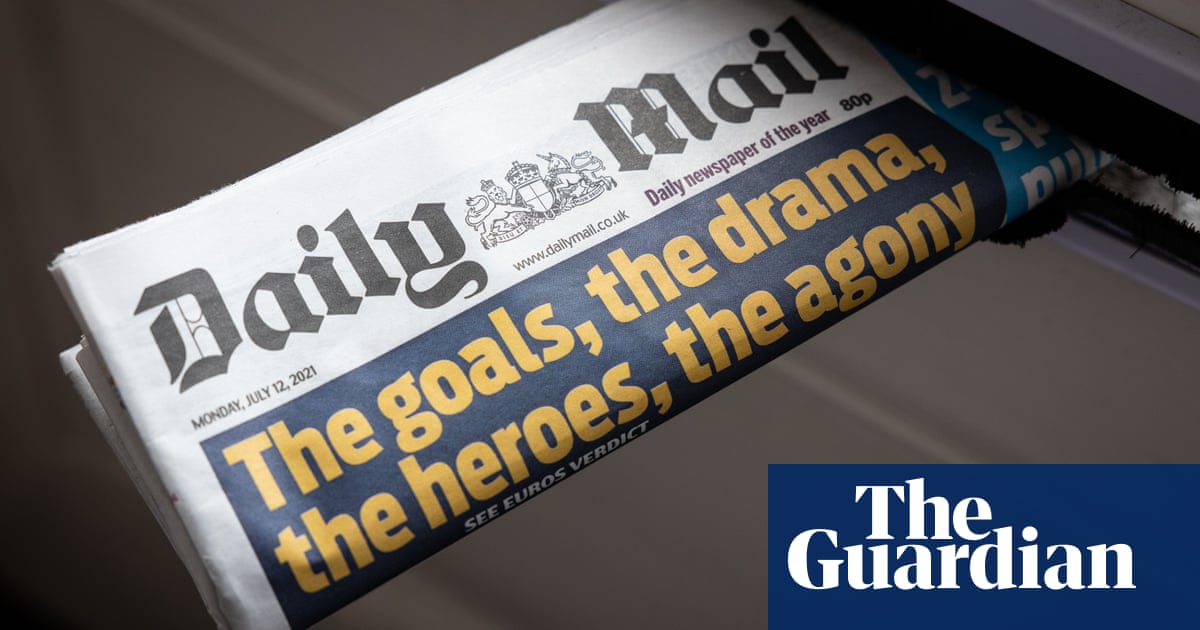

Lord Rothermere has agreed to extend until the end of September the deadline for making an £ 810million offer to privatize the parent company of the Daily Mail.

The Rothermere family, which controls a 30% stake in Daily Mail and General Trust, initially had until August 9 to make a so-called “put or close” (PUSU) offer for the company, which would end its 90 years of existence as a listed company on the London Stock Exchange.

Last month, Jersey-registered family-owned holding company Rothermere Continuation Ltd (RCL) announced that it was considering a takeover bid of 251p per share to buy DMGT, which also owns Metro and i newspapers among a wide range of ‘other assets.

However, the potential offer depends on meeting a number of preconditions, including the sale of the RMS insurance risk business and the sale of its stake in online auto retailer Cazoo, which was valued at around $ 8 billion (£ 5.7 billion), including $ 1 billion in cash on the balance sheet, after being hit by a specific purpose acquisition vehicle (Spac) in May.

Last week, DMGT fulfilled the first of those preconditions, selling RMS, which it has owned since 1998, to US risk and rating firm Moody’s Corporation for £ 1.4 billion.

“To allow more time for the preconditions to be met, DMGT and RCL requested, and the acquisition panel accepted, an extension of the initial PUSU deadline set in the reorganization announcement,” the two companies said. in a statement Monday. . “The revised deadline may be extended further with the agreement of the Takeover Panel. “

The next prerequisite involves DMGT selling its stake in Cazoo, which aims to be listed on the New York Stock Exchange this year, with its 16% stake worth around £ 970million.

The cash proceeds from the transactions will be distributed to DMGT shareholders through a special dividend. This could give the Rothermere family up to £ 700million, helping to fund DMGT’s potential takeover offer.

The Daily Mail publisher has revamped the business through targeted divestitures and acquisitions in recent years, having bought New Scientist magazine for £ 70million in March, as well as newspaper i for 49.6 million pounds two years ago.

The company has made £ 1.2bn from divestitures in recent years, including the sale of its stake in property portal Zoopla, education business Hinson’s and energy data company Genscape.

If DMGT is private, it will leave Reach – the parent company of national Mirror, Express and Star titles and regional publications such as the Manchester Evening News – as the only major UK news group remaining as a London Stock Exchange listed company. . .

Source link