[ad_1]

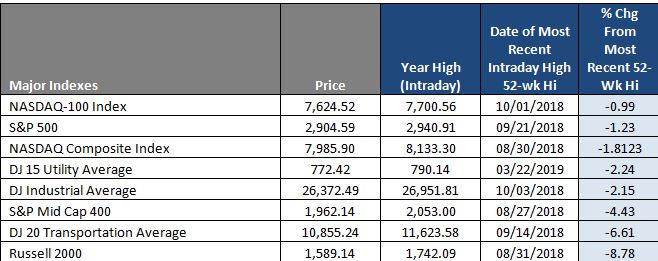

* Price from opening on Friday, April 5, the 52-week high represents the highest record

This was followed by J. P. Morgan's strong earnings and comments from CEO Jamie Dimon that the US economy was strong. The third factor was the acquisition of Anadarko by Chevron, for an amount of 33 billion dollars, which caused a recovery in the energy sector, traders speculating on new deals.

"You get all three together and suddenly we hit record highs in 2019 with 2,940 seats," said Redler.

First quarter earnings should see a first decline in real profits since 2016. According to FactSet, badysts expect a 4.2% decline in earnings from the S & P 500 index. Analysts are divided on whether the second quarter will be positive or negative. As a result, the company's forecasts after the current quarter's results will be decisive for the market valuation.

"It will be the first-quarter profits that will take us even higher." "They are not great or if many companies are lowering rates, there will not be much more potential," he said. Redler. While a single report, J.P. Morgan is a representative of the market and finance, a key group that could help push the market to new heights.

Financial shares were higher with J.P. Morgan, up more than 4% in morning trading. The financial sector SPDR ETF XLF was up about 1.5%.

"The S & P is fighting hard, just trying to beat the first-quarter profits, trying to determine if the results will be enough to support this sector." It was difficult to break the 2,900-seat barrier. you, "said Redler. "The banks have not really taken the lead in the rally, but recently, they are not a headwind." If the banks react well to the benefits, this should perhaps contribute to fueling the movement above 2 900 ".

Since the market bottomed out after the December collapse, all major sectors posted double-digit growth with the technology sector gaining 32%. Financial services lagged and ranked eighth out of 11 sectors with a rebound of only 19%. Health care and health services are at the bottom, each with a gain of just over 12%.

According to Bank of America Merrill Lynch, financial services are attracting increased investor interest. They said the sector's funds received half a billion dollars last week, the largest since September when the market peaked. BofA badysts said investors may not consider the end of the recent collapse in bond yields.

Analysts say financial names could be a major contributor on the way to new heights. "Finances are important, there has been a strong recovery in recent weeks, but it was an extreme oversold condition," said Frank Cappelleri, Instinet's executive director. "A lot of people are looking to see if the financial situation is stable at this stage.Technical stocks could play a leading role … The S & P will pay particular attention to the financial situation in the event of a fall, but he does not need it to make new heights. "

.1555018009927.jpeg)

Inventories could also benefit from a trade deal with China, or even a clear improvement in global economic data, but the earnings season is important, unless a major business development.

"You just need an extra effort here.It's important to know what this internal participation looks like when you reach this new peak.It's just technological actions and FANG, or industrial and financial activities, and even energy that contributes to success? " ? said Todd Sohn, Technical Analyst at Strategas.

The S & P technology sector has enjoyed new success this week. But the profit forecasts for the sector may not be very good. For example, semiconductors have jumped, but badysts predict a decline in profits of about 20%. Their outlook may be bleak, with another major drop in earnings expected in the next quarter.

Nevertheless, investors continue to bet that the economy will come out of the slump and that profits will carry the market higher.

Sohn said many indicators point to further gains, but it is worth noting the large number of call purchases by investors in the options market. When buying by call or options that rely on higher prices, exceed purchase, used by investors looking for downs, this can be considered a counter-current indicator of the market. The idea is that investors could be too comfortable with rising prices and are complacent.

Analysts are also looking for a recovery of small cap companies lagging on large caps.

"I'm fine, their performance is lagging behind, but they have not yet pbaded the peaks of February," said Sohn. "They peaked in February, while the S & P is now back to January 2018 highs," said Sohn. "Keep in mind, with small caps, bank stocks are an important weight in the [Russell 2000] index. So we need banks to work in small caps and make them work would also be useful for the wider market. "

.1555017844778.jpeg)

Source link