[ad_1]

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

Sony's motto, "Be Moved," is inspired by the emotional impact of technology and the power of smartphones, gaming devices, cameras and speakers.

Unfortunately, the only thing that's moving right now is the Sony share price, which falls after the electronics giant has become the latest tech company to warn that the situation is deteriorating.

Sony scared investors by reducing its sales outlook for the year, warning that demand for smartphones in Japan, Europe and East Asia was weaker than expected. He also warned that sales of his camera sector would likely lack forecasts, due to a disappointing demand.

The profits from Sony's gaming activities also dropped by 14%. Sales of its flagship PlayStation 4 (PS4) gaming console dropped to 8.1 million units in the last quarter, up from 9 million last year.

Although Sony has insisted that this was in line with expectations, badysts are worried that the company's gaming division, a major source of profits, is cooling down.

As Leo Sun of The Motley Fool said:

"Investors are disappointed by Sony's declining operating profits in its main gaming division."

In total, Sony has reduced its sales prospects for the current fiscal year (March) to 8.5 trillion yen, against 8.7 billion yen.

The operating profit should stand at 870 billion yen, while badysts expected an average of 884 billion yen, according to Bloomberg estimates.

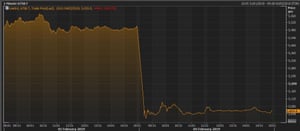

Traders pressed the push button, dropping Sony shares to 8% today – the biggest drop since 2015.

Stock price Sony Photo: Refinitiv

As one of the largest consumer electronics companies in the world, Sony is an important indicator of the global economy.

The chief financial officer, Hiroki Totoki, has certainly given us reasons to worry. He warned that the smartphone market was suffering from a "tough business environment," citing geopolitical tensions and China's economic slowdown, adding:

We can not be too optimistic for the future, as several macroeconomic and geopolitical risks have emerged since the second half of last year, including the smartphone market. "

David Buik

(@ truemagic68)SONY shares fell by 8% this morning – the numbers were light and the prospects of sales of games, cameras and phones considered unattractive!

Also coming today

Global stock markets are slowly starting the new week. After the sharp rise in the number of jobs in the United States last Friday, investors are wondering if the US economy is doing better than expected.

The FTSE 100 is expected to open flat, after finishing last week at 7020 points, its highest level in two months.

On the economic front, we have a health check of the construction sector in Britain. Economists predict that Markit's monthly PMI for construction will post a slowdown in growth (from 52.8 to 52.5).

In addition, new US durable goods sales figures

L & # 39; s calendar

9.30 GMT: British PMI for construction in January

15:00 GMT: US orders of durable goods for November

[ad_2]

Source link