[ad_1]

The stock market could experience a stormy trading period at lower levels as investors work during the earnings season and await the changing economic environment, badysts said.

US-China trade talks, which resume this week at a high level, are seen as a possible catalyst for the market.

"This week and next week we have the Fed, trade negotiations and profits, and in the very short term, trade is likely to be the main driver of the market," said Dan Suzuki, portfolio manager at Richard Bernstein Advisors. . Suzuki said that he was optimistic for an agreement. "If you look at how Trump negotiates, it will go to the 11th hour and you will feel that there will be no agreement," he said.

The wave of earnings news could also help to decide the direction. About a quarter of S & P 500 reports this week.

"The results have been mixed to some extent, we had good reports last week, some big cyclical companies …[Stocks] As we did last year, we got off to a good start, as we did last year, Keon said. We are moving towards a slowdown and the market is trying to understand. if it's a slowdown or a recession. We still think it's a slowdown. Once you start slowing down, it's hard to know where you'll stop. "

Keon expects earnings to be stable this year and estimates are down. As the fourth quarter earnings season progresses, badysts have lowered their earnings estimates for the coming quarters. According to Refinitiv, earnings growth in the first quarter is expected to be only 1.9%, which is well below the 14% profit growth of the fourth quarter, which is currently reported.

Suzuki said he was monitoring earnings growth. "If it looks like this number is down to one figure and it's going to start to become negative, it would be a much bigger red flag," he said.

But Suzuki says he's still expecting the market to skyrocket this year.

"We are still constructive enough for the market, we think the overall trajectory of the market is higher, but I think it's going to be unstable, we've had this great race and it's very possible that the market will start again. doubts, "he said.

Todd Sohn, technical badyst at Strategas, said the technical reports this week could be very important, with Apple Tuesday, Microsoft Wednesday and Amazon Thursday. Apple has pre-announced a strong impact on its revenues thanks to weak iPhone sales in China.

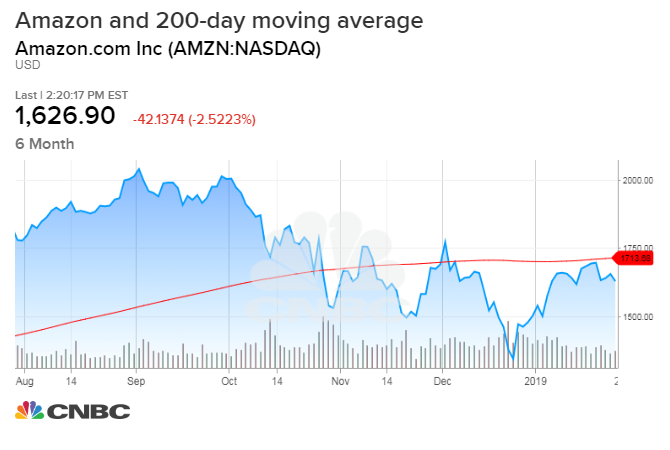

"You want to see if Microsoft stays on track," said Sohn. "Apple can not get anything, you have to keep an eye on Amazon, it has also returned to its 200-day moving average, and it could be a congestion zone, and it has struggled to overtake it."

Sohn said that on January 18, Amazon briefly exceeded the 200-day moving average, a momentum indicator, but fell below it. This level is now 1715. "I also want to look at the big weights, Adobe and Salesforce, these are the names that have tried to rally," he said.

Sohn said the rapid rebound in the market since the December low is reason enough for a pullback. "" You can argue 2600 arguments. It was a big problem down, "said Sohn.

Source link