[ad_1]

Economic shocks like the 2020 coronavirus pandemic only happen once every few generations, and they cause permanent and profound change.

Measured by production, the world economy is on track to recover from a crisis that almost none of its 7.7 billion people have experienced in their lifetime. Vaccines are expected to accelerate the rebound in 2021. But other legacies of Covid-19 will shape global growth for years to come.

Some are already noticeable. The resumption of factory and service jobs by robots will progress, while white-collar workers will be able to stay more at home. There will be more inequalities between and within countries. Governments will play a bigger role in the lives of citizens, spending – and owe – more money. The following is an overview of some of the transformations underway.

Leviathan

The big government has made a comeback as the social contract between society and state has been rewritten on the fly. It became common for authorities to track where people went and who they met – and to pay their wages when employers couldn’t handle it. In countries where free trade ideas had reigned for decades, safety nets needed to be mended.

Source: Bloomberg

Source: Bloomberg

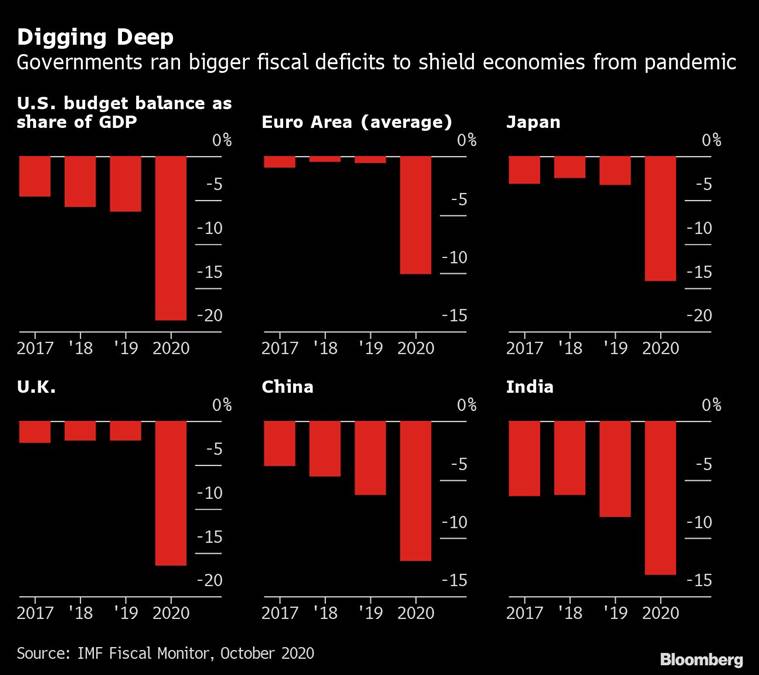

To pay for these interventions, governments around the world have run budget deficits totaling $ 11 trillion this year, according to McKinsey & Co.There is already a debate about how long this spending will last and when taxpayers should start paying. the bill. At least in developed economies, extremely low interest rates and unruffled financial markets do not indicate a crisis in the near term.

In the longer term, a major overhaul of the economy changes one’s mind about public debt. The new consensus indicates that governments have more wiggle room in a low-inflation world and should use fiscal policy more proactively to stimulate their economies. Supporters of modern monetary theory say they pioneered these arguments and that the mainstream is only catching up.

Even easier money

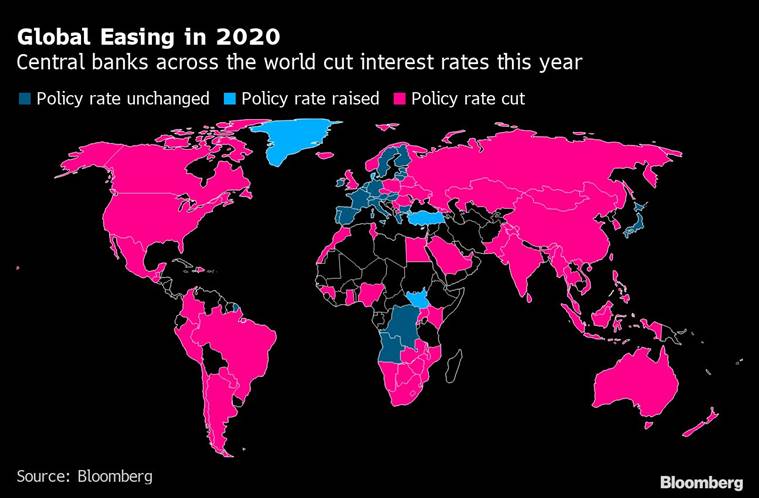

Central banks have been plunged back into printing money. Interest rates have hit new record lows. Central bankers have stepped up their quantitative easing, widening it to buy government and corporate debt.

All of these monetary interventions created some of the easiest financial conditions in history – and sparked a speculative investment frenzy, which has left many analysts worried about the moral risks ahead. But central bank policies will be difficult to reverse, especially if labor markets remain fractured and companies continue their recent acceleration in savings.

Source: Bloomberg

Source: Bloomberg

And history shows that pandemics drive interest rates down for a long time, according to an article published this year. She found that a quarter of a century after the disease struck, rates were typically about 1.5 percentage points lower than they would have been otherwise.

Debt and zombies

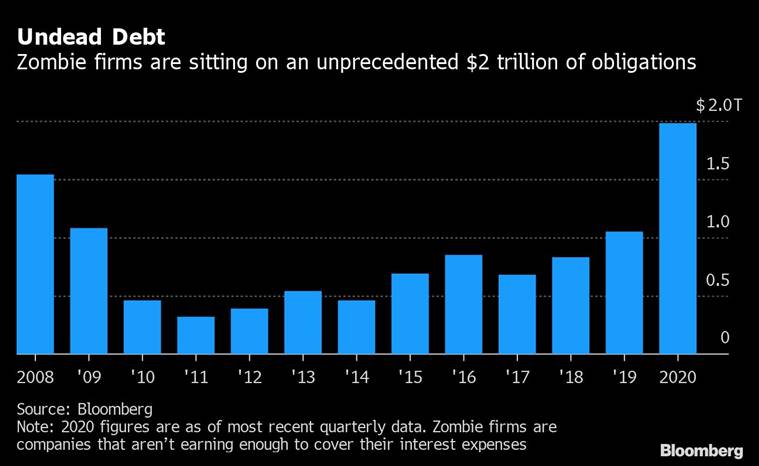

Governments have offered credit as a lifeline during the pandemic – and businesses have seized on it. One of the results has been an increase in corporate debt levels in developed countries. The Bank for International Settlements calculates that non-financial corporations borrowed net $ 3.36 trillion in the first half of 2020.

With incomes plunging in many sectors due to lockdowns or consumer cautiousness, and losses eating into corporate balance sheets, the conditions are ripe for a “major corporate solvency crisis,” according to a new report.

Source: Bloomberg

Source: Bloomberg

Some also see the danger of offering too much support to businesses, with too little discrimination as to who gets it. They say it’s a recipe for creating “zombie companies” that can’t survive in a free market and are only kept alive with state aid – making the whole economy less productive.

Major divisions

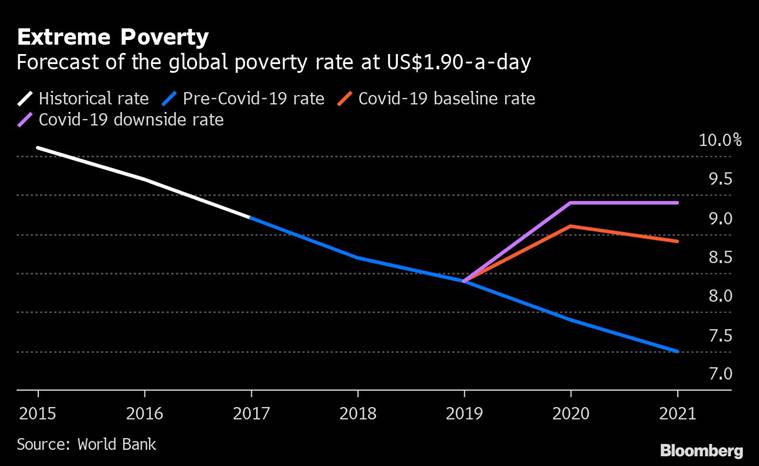

The stimulus debate may sound like a first world luxury. Poor countries lack the resources to protect jobs and businesses – or invest in vaccines – like their richer peers did, and they will have to tighten up sooner or risk currency crises and flight. capital.

The World Bank warns the pandemic is spawning a new generation of poverty and debt turmoil, and the IMF says developing countries risk a decade back.

Source: Bloomberg

Source: Bloomberg

G-20 creditor governments have taken steps to ease the plight of the poorest borrowers, but they have been criticized by aid groups for offering only limited debt relief and not obliging private investors to join the plan.

K-shaped

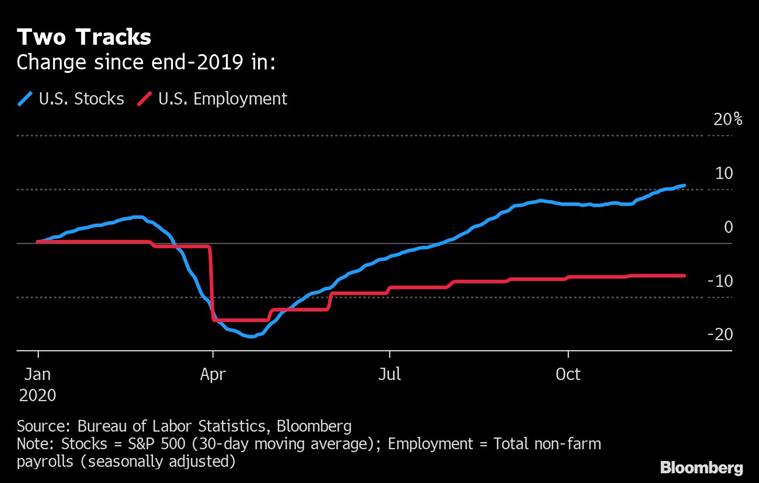

Low-paying service jobs, where there is more face-to-face contact with clients, tended to disappear first as economies stalled. And financial markets, where assets are predominantly owned by the rich, have returned much faster than labor markets.

Source: Bloomberg

Source: Bloomberg

The result was called a “K-shaped recovery.” The virus has widened the income or wealth gap across class, race and gender gaps.

Women have been disproportionately hit hard – in part because they are more likely to work in struggling industries, but also because they have had to shoulder much of the extra burden of childcare at home. the closure of schools. In Canada, women’s participation in the labor force has fallen to its lowest point since the mid-1980s.

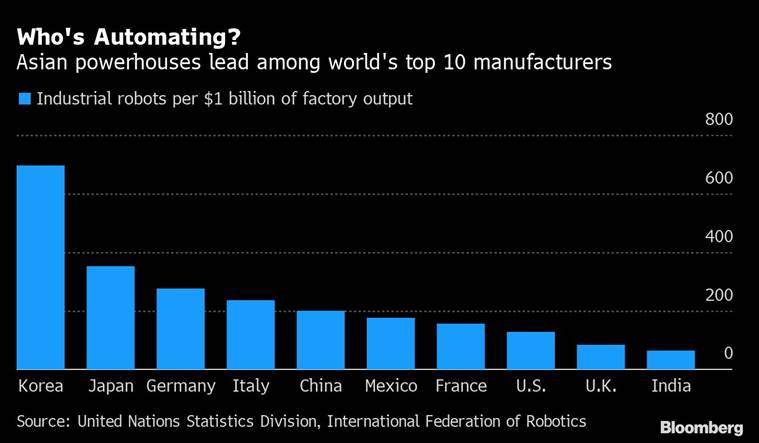

The rise of robots

Covid-19 has triggered new concerns about physical contact in industries where social distancing is difficult, such as retail, hospitality or warehousing. One solution is to replace humans with robots.

Source: Bloomberg

Source: Bloomberg

Research suggests that automation often gains traction during a recession. During the pandemic, companies have stepped up work on machines that can check in customers in hotels, cut salads in restaurants or collect fees at tolls. And shopping has moved more online.

These innovations will make economies more productive. But they also mean that when it’s safe to return to work, some jobs just won’t be there. And the longer people stay unemployed, the more their skills can atrophy – what economists call “hysteresis.”

You are muted

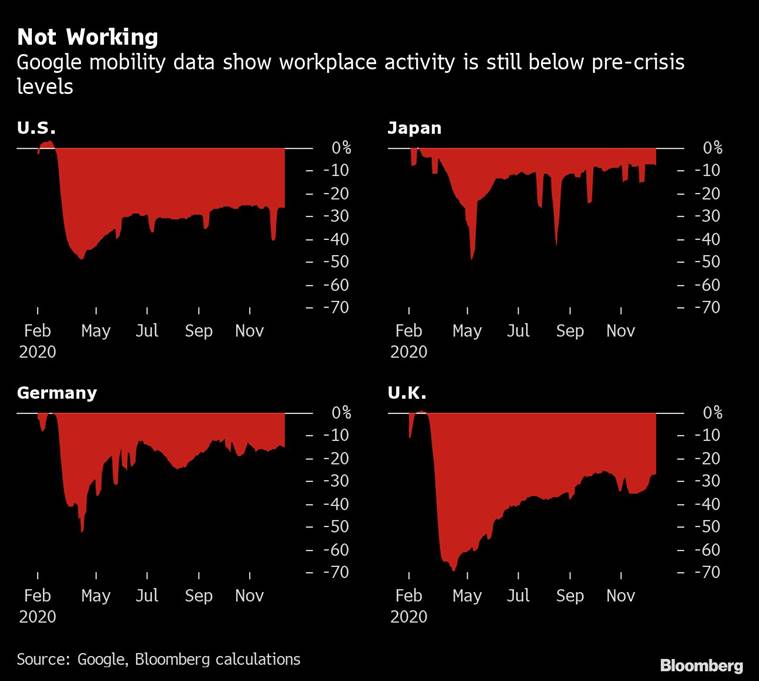

Higher up the revenue ladder, remote offices suddenly became the norm. One study found that two-thirds of America’s GDP in May was generated by people working from home. Many companies have told employees to stay away from the office until 2021, and some have said they will make flexible working permanent.

Working from home has mostly passed the technological test, giving employers and staff new options. It’s a concern for businesses that are indulging in the old infrastructure of office life, from commercial real estate to food and transportation. It’s a godsend for those building a new one: the shares of the Zoom video conferencing platform have grown more than six times this year.

Source: Bloomberg

Source: Bloomberg

The option of remote working, coupled with fear of the virus, has also triggered a rush of city dwellers to the suburbs or the countryside – and in some countries, a surge in rural property prices.

You’re not going anywhere?

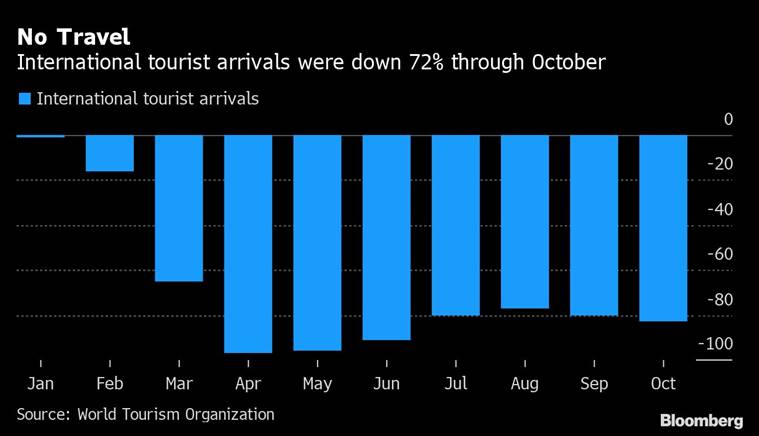

Some types of travel have been virtually interrupted. Global tourism fell 72% from the year through October, according to the United Nations. McKinsey estimates that a quarter of business travel could be gone forever as meetings move online.

Source: Bloomberg

Source: Bloomberg

With disrupted holidays and mass events such as festivals and concerts canceled, the trend of consumers to favor “experiences” over goods has been disrupted. And when activities resume, they may not be the same. “We still don’t know how the concerts are going to be, really,” says Rami Haykal, co-owner of the Elsewhere Hall in Brooklyn. “People will be more attentive, I think, to their personal space and will avoid places that are too crowded.”

Travelers may have to wear mandatory health certificates and go through new types of security. Hong Kong-based China Tech Global has developed a mobile disinfection booth that it is trying to sell at airports. General manager Sammy Tsui says he can clear pathogens from the body and clothes in 40 seconds or less. “You feel cool air on your body and mist,” he says. “But you don’t feel wet.”

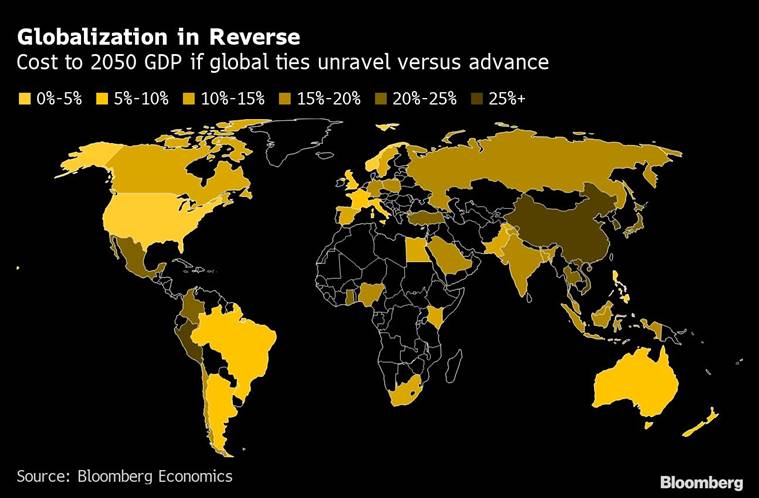

Another globalization

When Chinese factories closed at the start of the pandemic, it sent shockwaves through supply chains around the world – and prompted companies and governments to reconsider their reliance on global manufacturing powerhouse. .

NA-KD.com in Sweden, for example, is part of a thriving ‘fast fashion’ retail sector that follows social media trends rather than traditional seasons. After deliveries stalled this year, the company shifted part of production from China to Turkey, says Julia Assarsson, head of reception and customs.

Source: Bloomberg

Source: Bloomberg

This is an example of adjusting globalization without going backwards. In other regions, the pandemic may encourage politicians who argue that it is risky to rely on imports of goods vital to national security – like ventilators and masks have turned out to be this year.

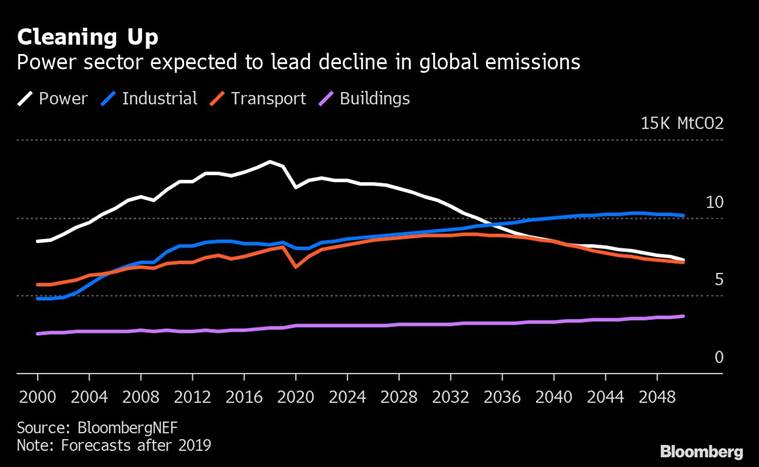

Go green

Before the pandemic, it was mostly environmentalists pondering peak oil theories – the idea that the rise of electric vehicles could permanently reduce global demand for one of the most polluting fossil fuels.

But when 2020 saw stranded planes and people staying at home, even oil majors like BP felt a real threat from the world that cared seriously about the climate.

Source: Bloomberg

Source: Bloomberg

The governments of California in the UK have announced plans to ban the sale of new gasoline and diesel cars by 2035. And Joe Biden was elected with the promise that the US will join the Paris Agreement. .

[ad_2]

Source link