[ad_1]

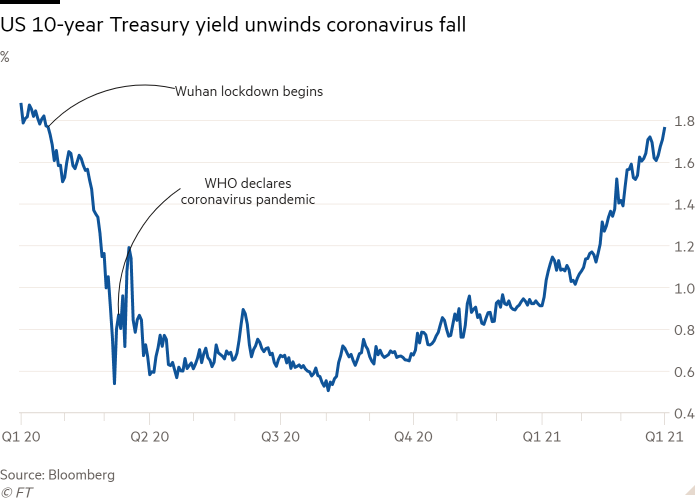

A key measure of long-term borrowing costs in the United States reached its highest level since the early days of the coronavirus crisis, as traders sold Treasuries at the end of a brutal quarter for global government bonds.

The 10-year Treasury yield rose 0.05 percentage points from Monday’s closing level to just over 1.76%, the highest point since January 2020, according to Bloomberg data.

The new wave of selling came as investors weighed in on continued optimism about the vaccine rollout in the United States and another plan to boost fiscal stimulus.

U.S. bond markets have led to a global decline in public debt since January as investors fear the Federal Reserve will allow the economy to warm up, with massive government spending combined with monetary stimulus to boost inflation .

A large Bloomberg Barclays index of government-issued debt in developed markets around the world has fallen 5% year-to-date on a total return basis, breaking four consecutive quarters up.

President Joe Biden on Monday pledged that by mid-April 90% of American adults would be eligible for the Covid-19 vaccine and have access to a vaccination site within 5 miles of their homes. On Wednesday, the president will travel to Pittsburgh, Pa., To outline plans for a $ 3 billion infrastructure package, which comes after this month’s $ 1.9 billion fiscal stimulus bill – this.

Rupert Thompson, chief investment officer at wealth manager Kingswood, said the “massive” scale of stimulus measures in the United States and around the world has caused “considerable nervousness about inflation and has been overwhelming. ‘origin of the recent liquidation of government bonds’.

The US five-year note, which suffered less from sales than longer maturities this year, was hit hard in Tuesday’s move. The 5-year yield hit its highest level since March 2020 at 0.94%, after rising 0.08 percentage point since the start of the week.

European government debt was also under pressure on Monday, with German 10-year Bund yields hitting their highest level in more than a week at minus 0.29%. UK 10-year gold yields stood at 0.83 percent, down from 0.74 percent at the start of the week.

“Bond markets are a way of assessing the economic recovery,” ING analysts wrote.

The sharp moves in bang trading earlier this year rocked the stock markets, although Wall Street futures trading has been tame in European transactions. Futures for the high-tech Nasdaq were down 0.3%, while contracts for the blue-chip S&P 500 were 0.9% higher.

Source link