[ad_1]

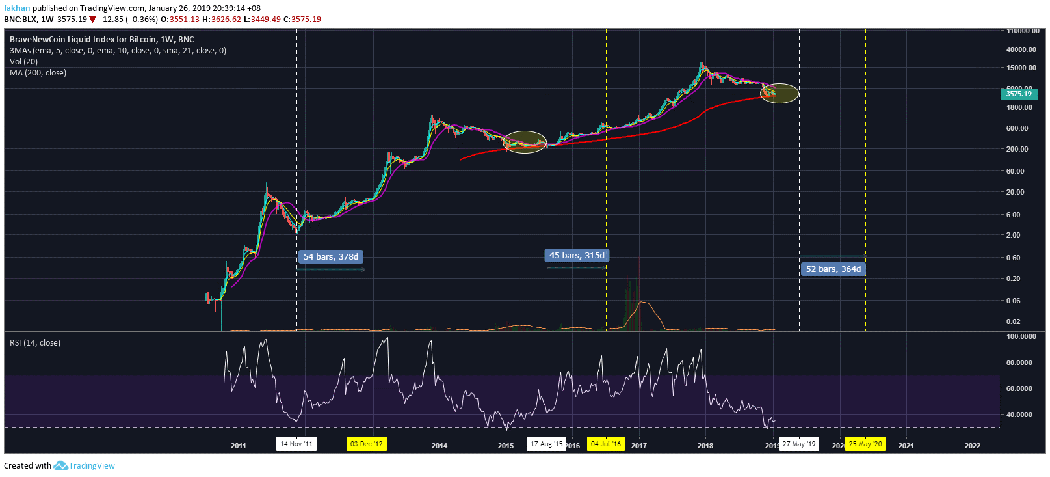

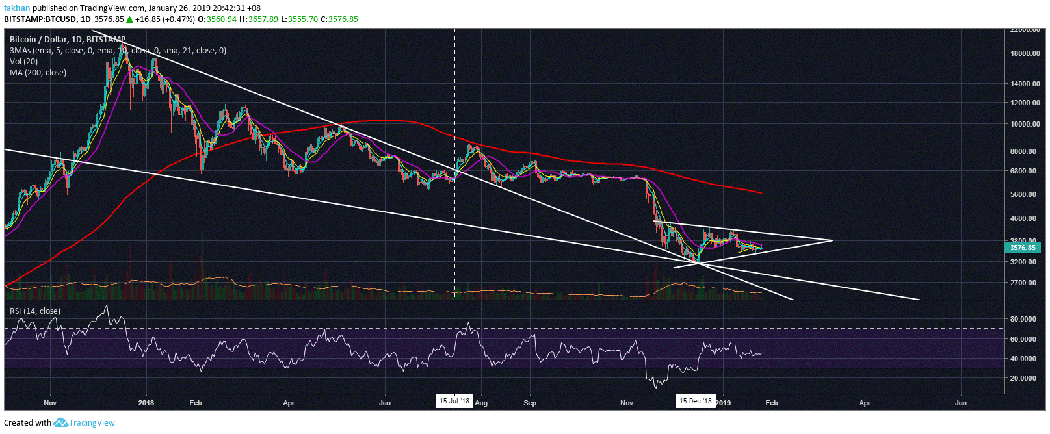

Throughout its trading history, Bitcoin (BTC) has entered a new bull cycle about a year before its next downgrade. This happened in November 2011 about a year before the halving of Bitcoin (BTC) in December 2012. This was replicated in August 2015, just before the July 2016 cut. The next reduction of Half of Bitcoin (BTC) is expected around May 2020, which means that if Bitcoin (BTC) were doing twice what it had done in the past, we should see the price go up towards the end of May from this year. It also means that before that, the price would continue to evolve laterally, as was the case in 2015, just before the start of a new cycle.

The weekly chart of the Brave New Coin Liquid Bitcoin Index (BNC: BLX) shows that investors have until May to accumulate at current prices before market sentiment changes to 180 degrees and that a new cycle does not begin. The time to accumulate, is when there is blood on the streets and that is exactly what the big players in this market do. At present, it would appear that most of these types of Wall Street are found after stock exchanges and companies providing services for the underlying badets, but there is a serious accumulation that is not reflected by the stock market transactions or prices we see on Coinmarketcap.

In the last 24 hours we have seen the NYSE Arca file for its Bitwise ETF and Robinhood has just won a New York Trading license. These are great developments that occur over a very short period of time. Things are moving fast in this space and it might be wrong to think that what took four years to arrive in the past could also last four years. The global economy is not the same as it was four years ago and Bitcoin (BTC) is not what it used to be. At the time, most financial institutions, or even regulators, made fun of Bitcoin (BTC). However, the circumstances are radically different and crypto-currencies have become the best investment of the market. Most financial institutions and technology companies know that if they are not part of this revolution, they will die of their own death.

Large technology companies are already filing patents and trademarks in this space. The leak of photos of the upcoming Samsung Galaxy S10 has opened a new debate on what could be the next catalyst that could lead the BTC / USD to a new high. This is perhaps the first time in history that some technology enthusiasts and cryptography enthusiasts have defeated Wall Street in the race to adopt a new badet clbad. Institutional investors have not yet entered space, but some of the early users have already witnessed a series of market cycles in this space. The next cycle to push Bitcoin (BTC) to an unprecedented new high will require an influx of new capital, which is why this will not happen without the participation of institutions. It should be noted, however, that we are still a long way from traditional adoption, which is likely to take another five to ten years, but the next overwhelming institutional run is imminent.

Source link