[ad_1]

Image (C) Adobe Stock

– Closures of auto factories lead to economic contraction

– But the economy has further progressed in the three months up to April

– The British economy and the pound sterling are likely to experience difficulties over the next few months

The British pound reacted negatively to data released on Monday that show the UK economy contracted by 0.4% in April 2019, according to the latest monthly monthly growth data set. Office of National Statistics.

Markets were waiting for a disappointing reading, but not at this margin, with economists forecasting a decline of 0.1%.

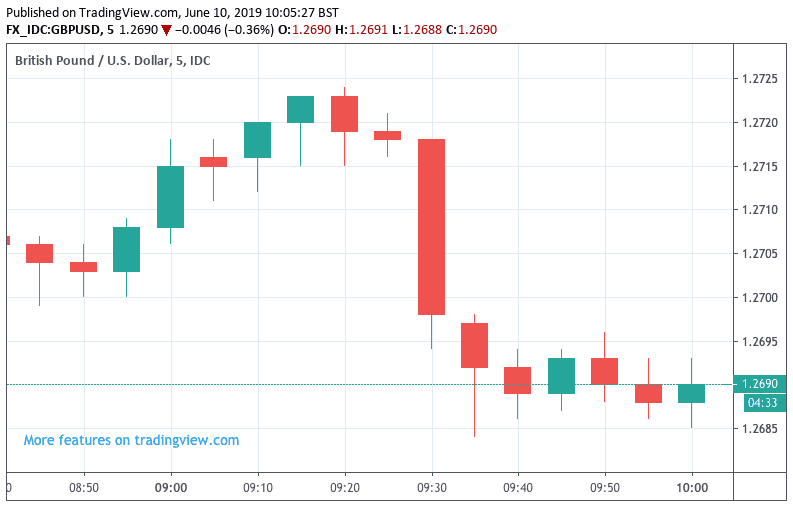

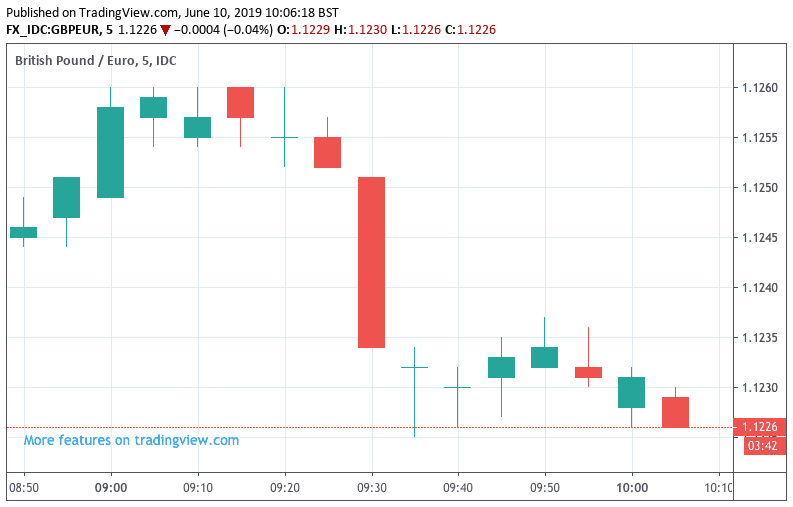

The disappointment corresponded to a fall in the pound to euro exchange rate from 1.1250 to 1.1225, while the pound-to-dollar exchange rate went from 1.2718 to 1.2695.

We did not expect much of Sterling's response to the data, but it seems that the extent of the disappointment can not be ignored by the foreign exchange markets.

ONS reports that while the economy fell 0.4% in April, it rose 0.3% in the three months to April.

"GDP growth has slowed somewhat over the past three months. The economy has contracted in April, mainly due to a dramatic drop in car production. The uncertainty preceding the departure date of the EU in the UK, resulting in planned closures, "says Rob Kent. -Smith, head of GDP at the ONS, said: "In April, the manufacturing sector also experienced widespread weakness, with the revival of orders being quickly completed before the start date of the year. EU in the UK, is blurred.

Separate data released by the ONS show that the manufacturing sector fell 3.9% in a month in April, while the forecast suggested that the market was looking for a -1.1%.

Industrial production fell 2.7% in April, as markets expected a contraction of 0.7%.

The disappointing data is putting additional pressure on Sterling, who is already grappling with political uncertainty as the Conservative leadership race is now fully under way, suggesting that the potential winner will only see success in the future. He is willing to woo a Brexit "without compromise".

Above: The clear reaction of the pound against the dollar to the publication of GDP data.

Above: The sterling pound's reaction against the euro to the release of GDP data

"However, Sterling clearly did not want to completely abolish this weakness, perhaps also concerned that the decline in industrial sector output is a sign of the break that could occur if the UK were to deal with a very messy Brexit: The British pound fell to 1.2685 dollar against the US dollar, compared to about 1.2725 dollar before the data, "says economist Victoria Clarke Investec.

The financial modeling of the Bank of England suggests that in the context of a Brexit "without agreement", the British economy would be negatively affected and that the value of the pound sterling would be considerably readjusted.

Economic statistics released Monday will remind traders and investors that the UK is facing significant economic vulnerabilities over the coming months due to persistent political uncertainty.

In response to the data, James Smith, a market economist developed at ING Bank, indicates that the slowdown in UK economic activity in April "is almost entirely due to a Brexit-related correction in the manufacturing industry".

The economic outlook for the future remains difficult, says Smith:

"Broad-based growth continues to look bleak, and while consumer spending may be a bit higher given the slight improvement in real wage growth, investment is likely to continue to decline over the course of the year. Summer, the uncertainty related to Brexit weighing on decision-making. "

New uncertainties are expected on the horizon to ensure bank of England chooses to keep interest rates unchanged for the rest of the year.

"Growing concerns about the possibility of a" no deal "with the Brexit, as well as the increasing likelihood of a general election in the fall, increase the likelihood that the central bank is still waiting this year, "Smith said.

For the pound sterling, a rise in interest rates – due to rising wages and inflation – would have been a rare source of support as currencies tend to rise when their central bank raises interest rates .

However, it now seems that the resilience of the British economy no longer offers the support on which the British pound has been supporting for the past few months.

John Hawksworth, chief economist at PwC, believes the UK should avoid a recession and grow modestly in the coming months:

"After a strong first quarter, GDP fell sharply in April due to planned factory closures and the reversal of stock build-up before the original Brexit date.

"Given these temporary fluctuations, the underlying growth of the UK economy remains modest, with Brexit uncertainty continuing to weigh on business investment, global trade tensions."

PwC believes that robust consumer spending, driven by continued employment growth and real earnings growth over the past year, as well as increased public spending, should boost the economy.

"By balancing these positive and negative effects, we expect UK GDP growth to remain modest, averaging 0.2% per quarter over the rest of the year," said Hawksworth.

It's time to move your money? Get 3 to 5% more currency from your bank by using the services of RationalFX Foreign Exchange Specialists. A specialized broker can provide you with an exchange rate closer to the real market rate, saving you substantial amounts of money. Learn more here.

* Publicity

Source link