[ad_1]

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

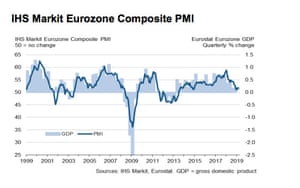

Is Europe's economy still stalled or running? Investors will get new clues today when the IHS data company Markit publishes its flash surveys of purchasing managers in France, Germany and the rest of the eurozone this month.

The month of March was rather bleak, with factories in the euro zone recording their largest drop in production in six years as trade disputes between the US and China provoked global ripples.

Reminder: last month's PMI report was driven by a slowdown in the manufacturing sector. Photo: IHS Markit

These new PMI reports, expected at 9 am, can show that activity resumes in April. This would be an encouraging sign, especially after China posted stronger than expected growth yesterday (6.4% in the first quarter of 2019).

The German manufacturing PMI should go from 44.1 to 45.2. This figure remains low, indicating that factories have continued to contract. But its services sector will likely continue to grow (with a PMI of about 55, down from 55.4 in March)

French data should not shine. The PMI of the French factories should go from 49.7 to 50, which would indicate a stagnation. The services PMI could rise from 49.1 to 49.8 (a slight contraction).

Jasper Lawler of London Capital Group explains why investors will look at:

Markets have the impression that the world economy is just starting to stabilize. Traders will pay particular attention to the German manufacturing sector, which has suffered a sharp contraction in recent months.

Investors are slowly starting to believe that the second quarter could be an economic improvement over the first. However, more economic data is needed to confirm these suspicions. Current data from the US PMI and the euro area could go a long way to confirm or refute such beliefs.

Also coming today

The latest retail sales figures in the UK are published. They should show that UK consumers spend less in stores in March, with retail sales (excluding fuel) down 0.3%.

Konstantinos Anthis, head of research at ADSS, Explain:

Uncertainty over Brexit over the last month, as the United Kingdom sought to expand the EU, should be taken into account in consumer spending figures.

In town, the giant of consumer goods Unilever and pest control company Rentokil publish financial results. They both posted strong sales growth.

Chris Bailey

(@Financial_Orbit)UK RNS Today # 1 –

Unilever – underlying sales + 3.1% with 1.2% of volume and 1.9% of price with underlying emerging market sales + 5.0%. Sales growth remains below half the range of 3 to 5% for the year but better noises around margins / cash flow

Chris Bailey

(@Financial_Orbit)UK RNS Today # 3 –

Polymetal – gold equivalent production + 27% yoy in Q1 and reiterates the outlook for the prior year. The Pox-2 project continues

Rentokil – "Good start to the year" with organic growth of 4% of its business turnover driven by pest control

The Domino pizza chain's board of directors is facing a shareholder uproar over its pay policy at its AGM today.

Plus, Pinterest will float on Wall Street.

CNBC Street Signs

(@StreetSignsCNBC)Today, the #StreetSignsEurope:

– Flash PMI of the euro zone for April

– Weakness of Asian markets

– Pinterest / Zoom IPOs with Richard Clode, @JHIAdvisorsUS

– Retail sales in the United Kingdom

– Easter trends with @Fortnums

– @nbctracie Announces Publication of Mueller Report

L & # 39; s calendar

- BST: Eurozone flash "PMI" for manufacturing and services in April

- 9:30 BST: Bank of England Credit Conditions Survey

- 9:30 am Paris time: British retail sales for March

- 1:30 pm Paris time: US retail sales for March

[ad_2]

Source link