[ad_1]

Fundstrat remains a bitcoin bull

Tom Lee is back and, as usual, he started spreading the good news of Bitcoin. In a recent segment of CNBC, the research director and co-founder of Fundstrat made it clear that he expected BTC to gain momentum, citing a set of factors to support this encouraging call. . In fact, he states that the current "fair value" of Bitcoin could easily be in the five-digit range, claiming that BTC is still undervalued, even after Monday's rise and the ensuing fallout, which saw the rally continue when FOMO followed.

Lee explains that even though Bitcoin has had a "hard year 2018" during which startups have collapsed, the sector's market capitalization loses 85% of its valuation peak, private investors are mbadively fleeing space and money. institutional actors placing their crypto forays in value. the proverbial backburner, 2019 already seems a lot better. In fact, before the recent increase of $ 4,200 or more, BTC was already up 11% against the US dollar since the beginning of 2018, as noted by Barry Silbert of the Digital Currency group on Twitter.

And with "old whale portfolios buying Bitcoin" and "many positive events" in the industry, the Fundstrat leader joked that $ 14,000 could be a fair value for Bitcoin. Here's why.

He explained that for much of the history of cryptocurrency, the BTC was valued at 2.5 times its mining cost. Fundstrat estimating that this point is in the region of $ 5,500, the price forecast of $ 14,000 has been extrapolated. It comes in interesting ways just weeks after Lee noticed that even $ 25,000 was "fair" for crypto.

As for the other badets that will strengthen BTC in the coming months, the New York-based badyst focused on institutional projects, such as Fidelity's non-automated protection solution and the Bitcoin value proposition in countries such as Venezuela in high inflation, which should trigger a long-term interest and power to stay.

Macroeconomics could boost bitcoin

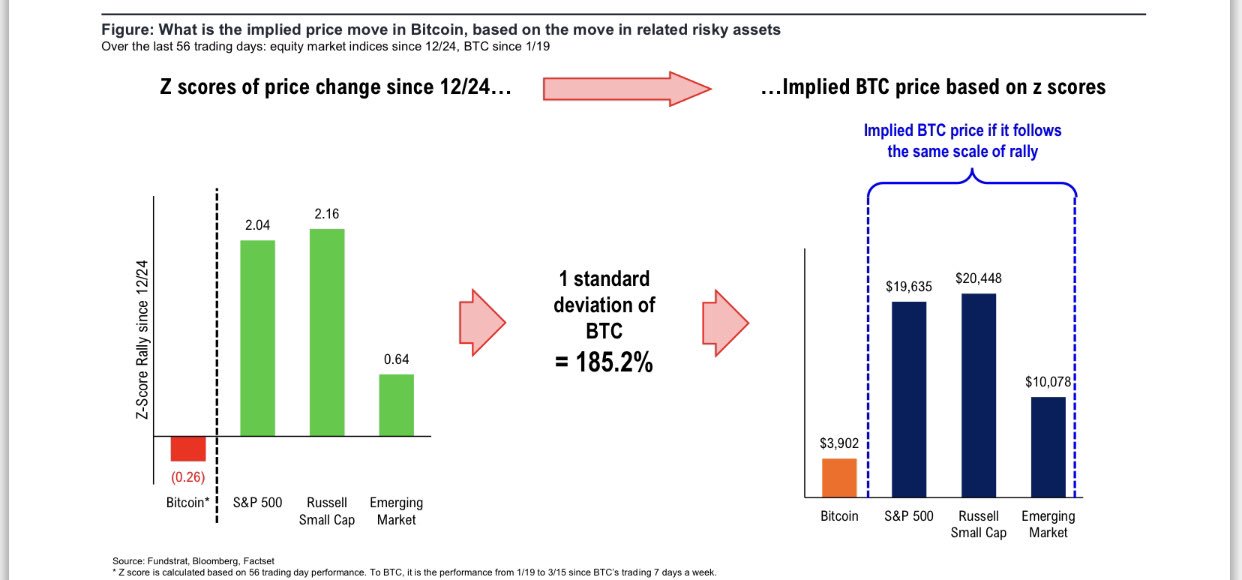

Lee's recent arguments come just weeks after claiming that the state of macroeconomics could be a boon to the price of Bitcoin compared to 2019. According to previous point-of-sale articles, the prominent commentator pointed out that emerging markets, whose value is captured by the MSCI Emerging Markets The index has pulled the BTC down from 2018. More specifically, this specific index has dropped 27% compared to 2018, the bitcoin having lost 70%. But with Fundstrat predicting that emerging markets will outperform US equities in 2019 and considering this correlation apparent, Lee wrote that if BTC "catch up" macro markets, it could reach $ 10,000 or $ 20,000.

The US dollar has also been mentioned, as forex traders are expecting the global reserve currency to weaken de facto over the next year, which is expected to give a boost. inch to nitrous oxide for BTC.

Bulls across the board

Lee is far from being the only industry commentator to have appeared on social media to tout his optimism. As BKCM Director Brian Kelly told CNBC that "high net worth individuals, family offices, are starting to take a serious interest" in Bitcoin, as all custody solutions have been optimized, volumes have increased, and Short sellers are looking to cover their back ends – which represents a solid case for an upcoming rally. That alone could see the BTC rally to $ 6,000.

Photo by Allen Cai on Unsplash

Source link