[ad_1]

Traders are working on the floor of the New York Stock Exchange (NYSE) on May 31, 2019 in New York.

Spencer Platt | Getty Images

Equities fell sharply last month as investors worried about US trade relations with China and Mexico and worried about global economic growth. However, drops like this are more common than people think.

Ben Carlson, director of institutional badet management at Ritholtz Wealth Management, said Wednesday in a tweet that 5% of S & P 500 index withdrawals had occurred in 65 of the past 70 years . He also pointed out that only five years have pbaded without a decline since 1950: 1954, 1958, 1964, 1995 and 2017.

"We all remember what happened in the fourth quarter, which blurs people's beliefs when trade war concerns intensify," said Brent Schutte, chief investment strategist at Canada. Northwestern Mutual Wealth Management. In addition, "after the Great Recession, people have been on the edge of the razor every time the market goes down, I think we all have PTSD in one way or another".

"This provides a backdrop to why people tend to overreact when the market falls to a normal trend," Schutte said.

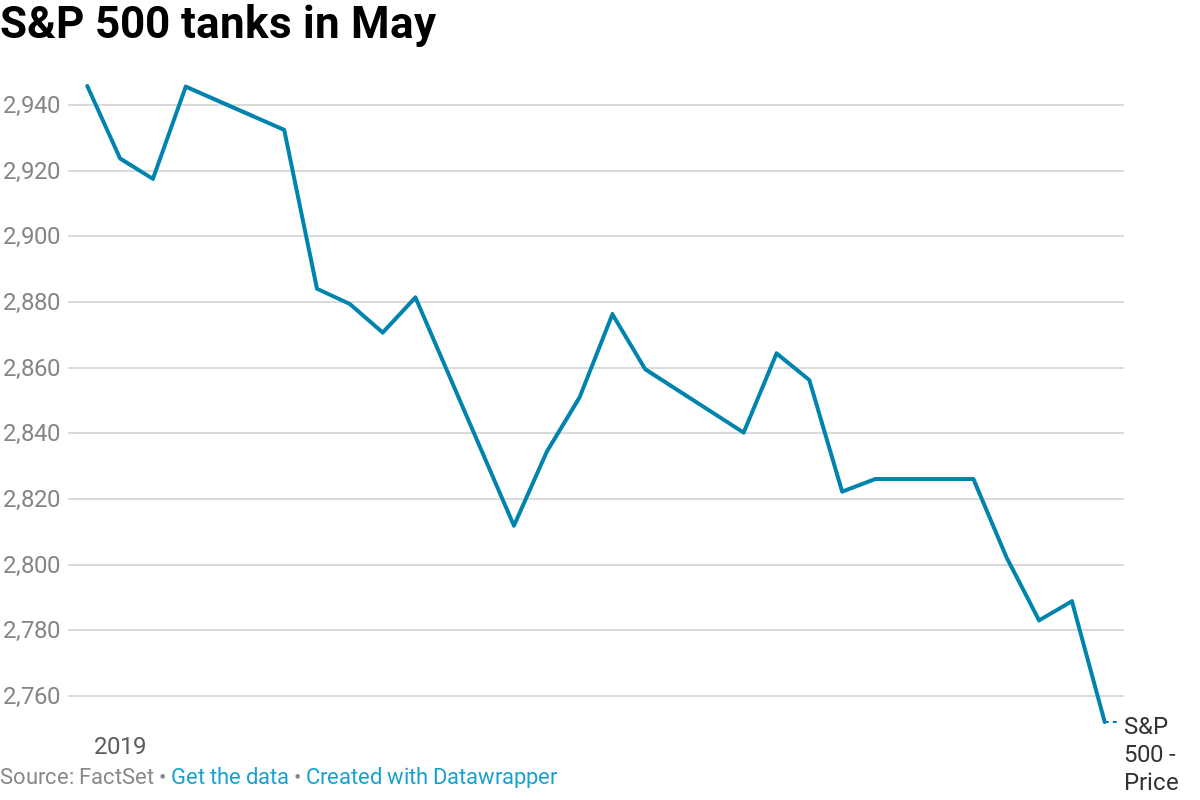

The S & P 500 fell 6.6% in May. It was its first monthly decline in 2019, after four months of consecutive wins.

Sale triggered by Trump's tweets

The decline in equities began after President Donald Trump threatened to raise tariffs on Chinese goods worth $ 200 billion. In a series of tweets from May 5, Trump said: "The rates paid to the United States had little impact on the cost of the product, mainly borne by China." Trade agreement with China continues, but too slowly, while they are trying to renegotiate. "

Trump's tweets surprised the market as officials on both sides had previously indicated that an agreement was being prepared. Trump followed his threat on May 10, when the United States lifted these taxes.

China has responded by raising tariffs on $ 60 billion worth of goods. The United States followed this decision by effectively banning US companies from doing business with Huawei, a giant telecommunications company in China.

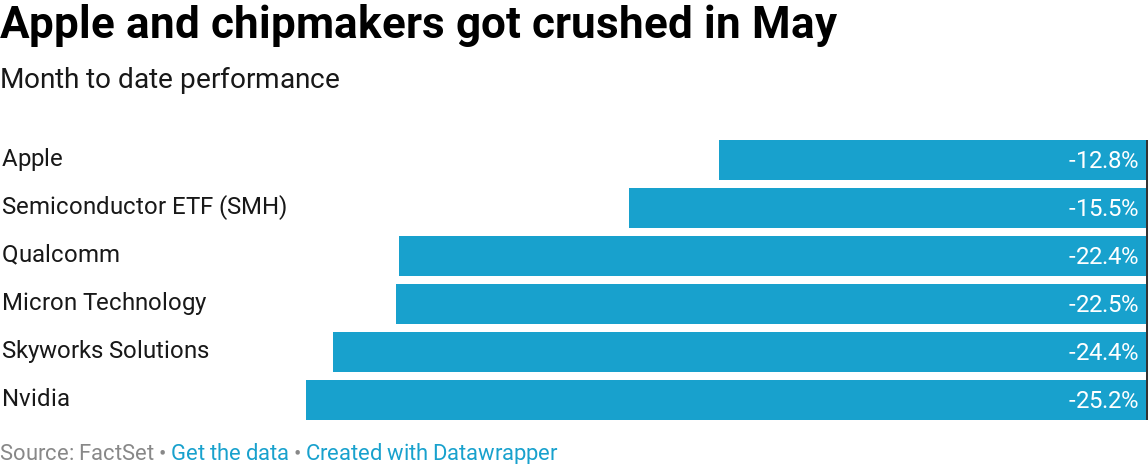

The intensification of trade tensions between the United States and China has proved problematic for Apple and several major chip makers. Apple has dropped more than 12% for the month. Shares of Micron Technology, Nvidia, Qualcomm and Skyworks Solutions lost more than 20% in May. The VanEck Vectors Semiconductor (SMH) ETF finished the month down more than 15%. These companies have significant parts of their supply chain in China, so higher prices increase their transaction costs in that region.

Salvatore Ruscitti, US equity strategist at MRB Partners, notes that investors need to remain cautious about semiconductors, given their high exposure to China.

"Chip stocks will remain vulnerable until trade negotiations between the United States and China improve, and we recommend staying on the sidelines with a neutral stance," he wrote. in a note on Thursday. "A further significant escalation in the US-China trade dispute that restricts access to the rapidly growing Chinese market would pose a significant threat to the long-term prospects of the semiconductor industry and would warrant a -weighting of the subgroup ".

The stock's sale intensified on Friday, the last trading day of the month, after Trump threatened to apply 5% of Mexican imports. Trump said the tariffs would come into effect on June 10 and would gradually increase "until the problem of illegal immigration is resolved." The White House also said in a statement that tariffs on Mexican products could reach 25%.

Constellation Brands shares lost 6.6% on Friday. General Motors and Ford Motor, two automakers with significant operations in Mexico, fell 4.3% and 2.3%, respectively.

Bond yields collapse

The intensification of trade tensions has led investors to embark on traditionally safer treasuries at the expense of equities.

The 10-year benchmark – which is changing prices – went from around 2.5% at the beginning of May to around 2.12%, which is close to its 20-year low. month. This decline led to a reversal of the yield curve, with the 3-month bond rate trading above its 10-year counterparty.

Experts believe that a reverse yield curve is the sign that a recession could be looming. Bond yields abroad also declined, global investors also worrying about the slowdown in the global economy.

.1559316261929.png)

"Bond yields generally drop significantly before recessions and often coincide with the collapse of a stock market, so the similarity investors have experienced over the past two weeks can not be ignored, "said Jim Paulsen, chief investment strategist for the Leuthold Group. a note.

"However, investors should also recognize that confidence in the private sector of the economy … has not only remained healthy, but has recently strengthened despite ongoing negotiations on the trade war and worsening fears on the bond market, "he said.

Where do the stocks from here is a draw

It is unclear exactly where stocks will go from here, even looking at historical data.

Sam Stovall, chief investment strategist at CFRA Research, said in a tweet Thursday that since the Second World War, the "substantial" gains of the S & P 500 between January and April are "generally digested" in May. Stovall added that the digestion period is followed by solid gains in June.

The data compiled by LPL Financial, however, indicates that more losses may be emerging. The company said in an article published on Thursday that the S & P 500 had recorded an average loss of nearly 1% over the past 20 years. LPL added that the S & P 500 had dropped more than 5% in May, only four times in the last 50 years. Subsequently, the index lost more than 5% in June twice.

But Craig Callahan, president of Icon Funds, thinks this decline is a buying opportunity.

"We are clearly oversold and we find good value for money," he said. "We find that the overall market is about 13% lower than our estimate of fair value.It's pretty much how the price was set when we hit our lowest points on December 24th. . "

Subscribe to CNBC on YouTube.

Source link