[ad_1]

One of the most important issues in global oil markets is oil production in the United States. OPEC would probably not want to know more than when oil production in the United States begins to decline.

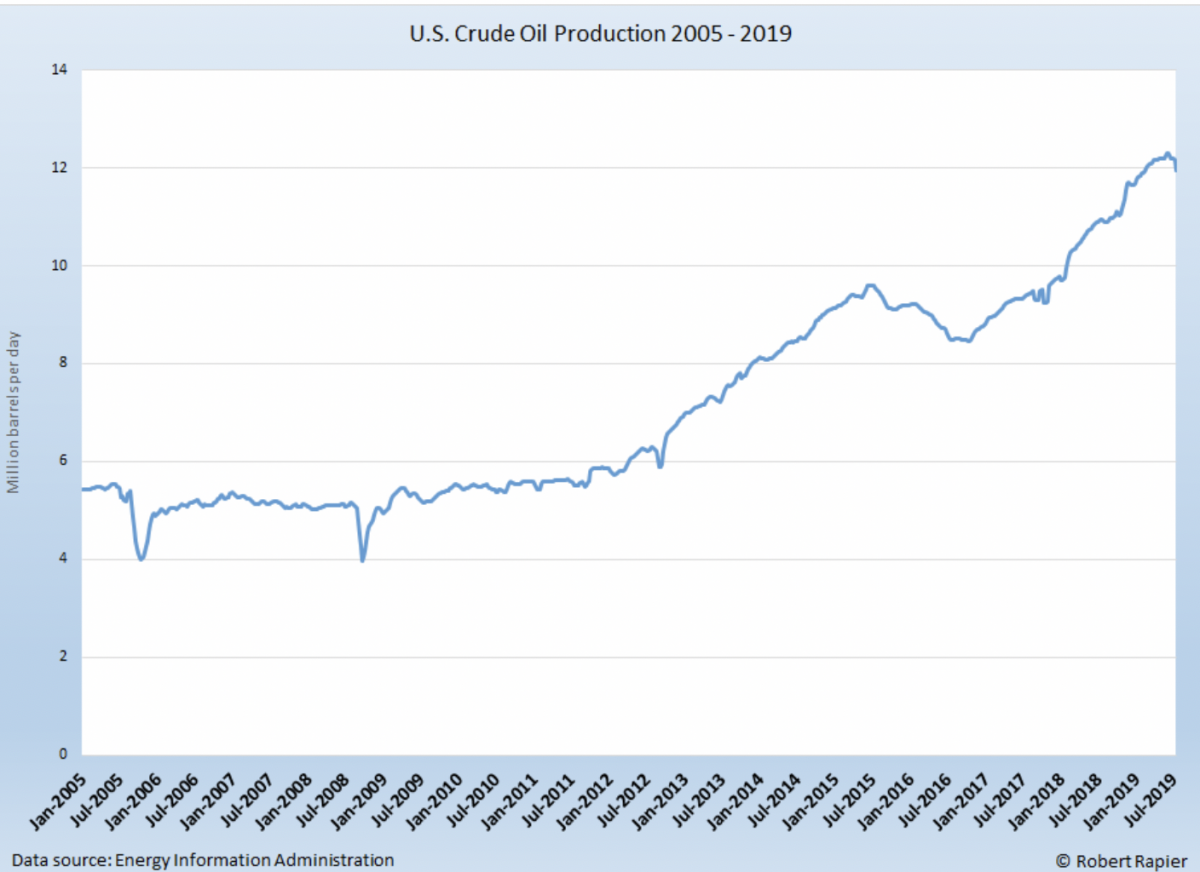

The resurgence of US oil production over the last decade has reduced OPEC's control of global oil markets. In less than eight years, oil production in the United States has gone from less than 6 million barrels a day to more than 12 million barrels. This increase is probably the only reason why oil prices do not exceed $ 100 per barrel (bbl).

(Click to enlarge)

Growth in oil production in the United States from 2005 to 2019.

OPEC's current strategy seems to be to wait for US production to start declining in order to regain control of the oil markets.

They may not have to wait that long.

In last week's article, I covered the slowdown in oil production growth in the Permian Basin. It is the largest oil-producing region in the United States, but it is of course not the only one. And while coverage of the recovery in US oil production was mainly focused on shale oil and tight oil, offshore oil production in the United States also jumped. Over the last decade, Gulf Coast oil production in the United States has gone from 1.2 million barrels to about 2.0 million barrels.

That's why I thought today that it might be interesting to look at the trends in total oil production in the United States. Note that in the previous graph, it seems that production starts to drop at the end of the time. In fact, the Energy Information Administration (EIA) has reported a slight downward trend in oil production in the United States since May. The key question is whether there is an anomaly or the beginning of a sustained trend.

By applying the same badysis that I did last week to the production of the Permian Basin – which focused on year-to-year changes in production – it is clear that overall production growth in the United States is declining even faster than that of the Permian Basin.

(Click to enlarge)

Annual change in oil production in the United States.

According to this chart, output growth has slowed since January and the slowdown has accelerated in recent months. Output growth is falling so fast that at the current rate, it will fall below zero before the end of the year. The sharp drop in the last EIA report was influenced by the closure of offshore production prior to Hurricane Barry. However, even though we badume that the rate of decline is slower since the beginning of the year, it looks like growth will fall below zero in a year. When growth falls below zero, it represents a decline in US production from one year to the next.

It is difficult to say whether the current decline will be permanent. It should be noted that a similar decline began in 2015, but this trend reversed in 2017, when oil prices rose from $ 30 / barrel to over $ 50 / barrel.

The current decline is unlikely to experience the same type of reversal, as the previous decline was the result of sharp reductions in capital expenditures, with oil prices rising from $ 100 per barrel to less than $ 30 per barrel. The current production decline occurs during a period of lower oil prices.

In any case, the only thing that can stop the current slowdown is a surge in oil prices from current levels. And unless this slowdown is halted, total US oil production is likely to decline again in the next year – and perhaps by the end of the year.

This is the result that OPEC hopes for. It is clear that their strategy is to keep oil prices up until oil production in the United States begins to decline, allowing them to regain control of global oil markets.

By Robert Rapier

More from Reading Oilprice.com:

[ad_2]

Source link