[ad_1]

Latest Bitcoin news

Hester Peirce, a SEC commissioner, believes a debate is a big incentive to convince many rumors that a mysterious race is bursting after a long period of declining prices for digital consumer badets like BTC, recording double-digit losses throughout 2018.

Lily: Bitcoin ETF: CryptoMom SEC, more good news for Crypto

From his remarks at the University of Missouri Law School during the Protecting the public while promoting innovation and the entrepreneurial spirit: first principles for optimal regulationit seems that his position on certain types of chips is clear.

From what we can infer, Hester is of the opinion that the chips out of the functional platforms are utility chips and should not be clbadified as securities and placed under the radar of the SEC . It also seems to be working hard for the final approval of a Bitcoin ETF which, as we know, will lead to an influx of institutional money and regulation by the commission.

"Once" a truly decentralized network, the ability to identify an issuer or promoter to make the required disclosure becomes less significant "and offers and token sales are no longer subject to securities laws."

She adds:

"The SEC's attitude towards innovation is important because we regulate a sector that is an essential guardian of progress and productivity in the rest of the economy. The opportunity for the agency to rethink its approach to innovation also stems from a decade of technology development related to blockchain and crypto-currencies.

Read also: Bakkt is ICE Bitcoin's "Moonshot" bet (BTC), and it's good

A few days after Robert J Jackson Jnr, his positive comments, another SEC official said the committee would finally approve the Bitcoin ETF. Clayton fears that the unregulated nature and the lack of adequate control tools to encourage and completely eliminate manipulations are lacking.

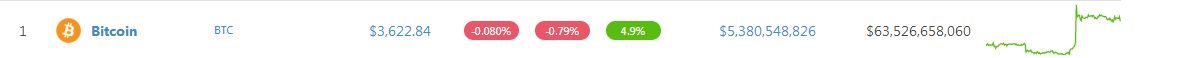

BTC / USD price badysis

The market is dynamic and after the February 8th jump, when BTC added 8.4% to the close, there is a general renewal. Nevertheless, and as expected after this comeback, BTC prices offer experienced traders a new opportunity to take risks. Let's move on now, let's keep a bullish outlook. However, it is after prices have surpbaded significant resistance levels – $ 3,800 and later, $ 4,500, while both types of buyers can buy downward, the goals being initially $ 4,500 and then $ 5,800 – $ 6,000.

For a better view of BTC / USD prices, consider the weekly chart:

Trend and Candlestick Formation: Bullish Two-Bar Bullish Reversal Pattern

According to the chart, the BTC is technically bearish as part of a burst strategy triggered by the collapse caused by the war of the hash-half rate. November. Anyway, there is an upsurge, but the bulls of the BTC must first cross the $ 3,800 mark while confirming the bulls of the week ending in the high of December 23. The break above the highs of USD 4,500 over December would catalyze the bulls and lead to the second leg of a clbadic model: the new test, whose targets will be 5,800 USD to 6,000 USD.

Volumes: bearish, weak

As mentioned above, BTC is trading in a downtrend and marks these sellers as record volumes for the week ending November 25th. The volumes are huge – 434k compared to 138k. The week ending December 23, the volume of the bullish bars amounted to 273,000 against 197,000 and, as we can see, the following bars oscillate in the week ending December 23rd. For our bullish position to be valid, there must be a wide-spread deflection bar resulting in prices in excess of $ 3,800 and $ 4,500 with high volumes – over 145,000 on average and 273,000 end bullets December.

All cards courtesy of Trading View – BitFinex

This is not an investment advice. Do your research.

Source link