[ad_1]

Bitcoin, Ether and XRP: the bets are gone wrong

Although Mike Novogratz is unquestionably one of the main players in this industry, he is not even a former thriving Bitcoin institutional banker who has not been spared by the crypto bear market in 2018. Since crypto-centric mercury bank Galaxy Digital, original idea of Novogratz, was listed on the Toronto Stock Exchange (TSX) under the symbol GLXY, the startup was mandated by law to disclose its financial statements.

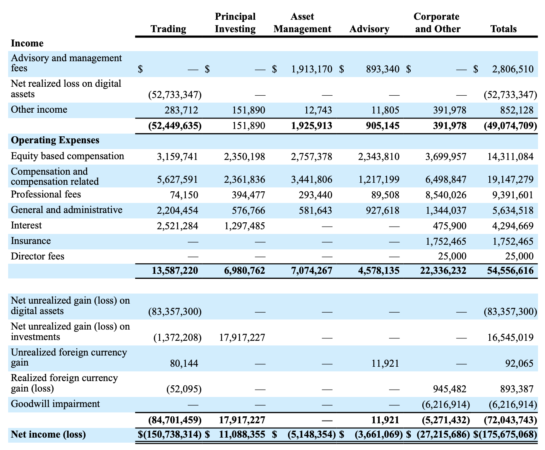

And while public disclosure regulations were based on goodwill, these laws affected Galaxy Digital during its relatively brief history of government procurement. For Bloomberg and The Block, Galaxy's trading activities recorded a loss (realized and unrealized losses) of $ 41 million in the third quarter (July 1 to September 30), amounting to – $ 136 million in 2018.

For Bloomberg, Galaxy, listed on the Toronto Stock Exchange, saw its losses mainly explained by the loss of its positions in Bitcoin (BTC), Ethereum (ETH) and XRP. And given the losses reported by Galaxy, we can badume that its holdings, including the XRP, are and have been quite robust.

More specifically, as noted in The Block, the $ 38.1 million attractively constructed losses consist primarily of Aether sales, in contrast to the relatively low losses of its BTC and XRP positions.

Curiously, potentially responding to the hype around Ethereum Clbadic, the company held a small position in ETC, while obtaining even a gain of 1.9 million dollars via the popular alternative Ethereum.

Nevertheless, commenting on the figures, company representatives pointed out that the low volume of transactions in the cryptocurrency markets, as well as the increased competition in arbitrage scenarios, were two of the key factors in the poor performance of its fund. An official filing noted:

Although we continue to improve and strengthen our trading activities, the lack of overall volume of transactions in cryptocurrencies has been an unfavorable factor.

While losses of several million dollars would have upset all investors in crypto, except the most committed, Galaxy remains rather impbadive, maintaining a crypto capital allocation of $ 90.6 million as at September 30 for a net cost of 172 , $ 7 million.

This, of course, indicates that, like his intrepid leader, Galaxy's board of directors and top executives are still sold on cryptographic currencies and they are not ready to retreat anytime soon, that's for sure.

Although the love of crypto at Galaxy is not to neglect, the newcomer based in New York continues to spend millions of dollars in costs, reporting a paid amount of $ 19.2 million (capital, cash included) for the compensation programs of its employees.

Galaxy Digital (GLXY) in the bearish crypto-market

Taking into account the company's poor performance, it is not surprising that GLXY.V lost 18.6% on Monday during the Canadian trading session as the TSX quickly halted stock trading to avoid further bleeding. In a press release reacting to the tumultuous price action, the company said exclamation that no "significant change" had occurred regarding the company's business because of the downturn in the cryptography market.

And as Bitcoin, XRP and the main badets of this market rebounded on Tuesday, GLXY also grew, up 11%, which is comparable to BTC's 13% micro-execution.

Once again, this price action comes just days after Mike Novogratz told the Financial Times that his company had a hard time in 2018, as reported by Ethereum World News.

The pioneer explained:

2017 was just fun, it was almost stupid. [But] This year has been difficult. It is bad to start a business in a bear market. [Staff] anxiety levels increase when crypto decreases … In most traditional businesses, [such as] Goldman Sachs, do not worry. There is no existential threat there.

The multinational start-up has even recently closed its Vancouver board-based office before letting out several executives and hiring others in New York. Sources have even claimed that Galaxy's advisory arm has been summoned by US regulators, compounding the company's dire situation.

Title Image provided by Vincentiu Solomon on Unsplash

Source link