[ad_1]

"We believe that a short-term business strategy of buying on troughs from late February to early March, aiming for a subsequent yield reversal, is interesting." Takada wrote.

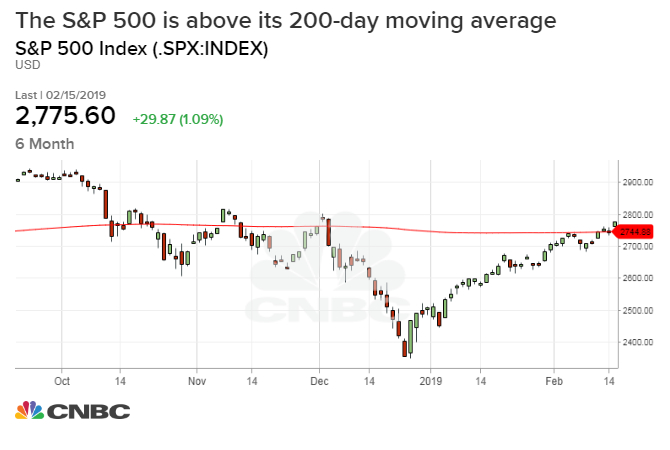

This rise comes after a sell-off in December, which briefly sent the S & P 500 into bearish territory on an intra-day basis.

The recent rally propelled the S & P 500 above its 200-day moving average, a technical level closely watched by investors. Usually, when a stock or index exceeds its 200-day moving average, this indicates a strong bullish momentum.

"At this point, the SPX has managed to resume the 200 day AM after reversing the bearish trend of the October highs," said Craig Johnson, chief market technician at PiperJaffray. "An additional hike from here is leaving the range 2,800-2,815 as the next major hurdle to suppressing the index."

The S & P 500 has not closed above 2,800 since November 8 and currently stands at 0.9% of this level. On Friday, the S & P 500 index closed at 2,775.60.

"Although the recent price action of the S & P500 has been too volatile and accurate, it has returned to the point where these investors are targeting around 2,800 again," said Takada of Nomura.

Subscribe to CNBC on YouTube.

Source link