[ad_1]

- A better mood in risky badets rose further north of the 1.1200 handle.

- The EU summit, the Brexit negotiations and the new trade dispute between the United States and the European Union appear to be the main drivers of price action in the short and medium term.

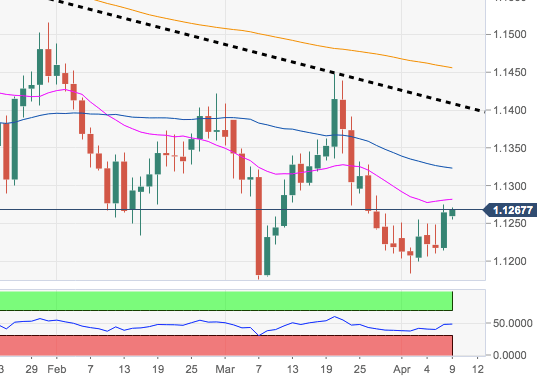

The recent evolution of market sentiment towards riskier badets has strengthened the position of the single currency and pushed the EUR / USD to a level above 1.1200, although the trend towards the rise seems to be out of breath in the region of 1.1280, where the SMA 21-day alignment is located.

The next combination of FOMC minutes, the ECB meeting and another chapter of the Brexit saga at the EU summit would be essential to determine the orientation of the pair short term. Adding to the above – and not yet taken into account by market players – another conflict could take place if the US managed to impose tariffs on EU products, this could be considered a prologue of customs duties on the most important auto sector Syndicate.

The immediate bullish target remains at the 200-week SMA critical at 1.1337. Ideally, spot should clear the area above the 1.1400 handle to reduce the downward pressure and allow a new focus from 1.1500. In the event that the sales bias is average, recent lows in the 1.1180 region should be controversial, helped by those of 2019 to 1.1176.

The immediate bullish target remains at the 200-week SMA critical at 1.1337. Ideally, spot should clear the area above the 1.1400 handle to reduce the downward pressure and allow a new focus from 1.1500. In the event that the sales bias is average, recent lows in the 1.1180 region should be controversial, helped by those of 2019 to 1.1176.

Source link