[ad_1]

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

Today, we discover the evolution of the British economy in February, facing the Brexit block and the weakness of the global economy.

The February GDP report is expected at 9:30 am today. City economists have a range of forecasts, ranging from solid growth of 0.3% to a frightening contraction of 0.2%. But the consensus is that there was no growth at all during the month.

Service companies and industry groups are expected to have grown slowly, while construction output may have declined.

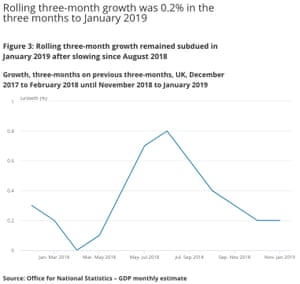

This would mean that the United Kingdom grew only 0.2% in the last quarter, like last month, after a contraction of 0.4% in December but growth of 0.5% in January.

British GDP picture: ONS

If this is the case, it would suggest that the impossibility for Theresa May to get her agreement on Brexit in Parliament has harmed the economy. The economic weakness of the euro area and the repercussions of the trade dispute between the United States and China would also be questioned.

The data this morning should also show that Britain recorded its traditional trade deficit in February at around £ 3.9 billion.

TD Securities badysts say:

"Our forecasts are based on weak gains in services and intellectual property, offset by a contraction in construction.

The data in the coming months will likely be jerky, and we would not read much in the month-to-month observation until Brexit's uncertainty diminishes. "

Also coming today

Investors will watch Frankfort, where the European Central Bank holds a monetary policy meeting. Fireworks are not expected, however, as Lukman Otunuga, Research Analyst at FXTM, explains:

Mario Draghi and his fellow policymakers are expected to sit idly by this month, with little room for headwinds against the headwinds.

While political tensions in France and Brexit are beyond the control of the central bank, the IMF has pointed out that these factors exert downward pressure on growth, giving the ECB time to look at how these risks are manifesting itself in the economy. real economy.

They will then focus on Brussels, where the European leaders will examine tonight the last request for extension of the United Kingdom concerning the Brexit (a long delay seems likely).

On the business front, supermarket chain Tesco has recorded an increase of nearly 30% of its profits, its recovery plan is paying off. British retailers Dunelm and ASOS also publish the results today.

Ashley Armstrong

(@Ammstrong_says)Tesco Fy sales rose 11.2 percent to £ 63.9 billion, while profits jumped 28 percent to £ 1.7 billion, exceeding expectations with best results under Dave Lewis

L & # 39; s calendar

- 9.30 BST: UK GDP report for February

- 9:30 am BST: United Kingdom industrial and commercial production figures for February

- 12.45 BST: European Central Bank decision on interest rates

- 13:30 Paris time: ECB press conference

[ad_2]

Source link