[ad_1]

In the past 72 hours, the cryptocurrency market was relatively stable at $ 111 billion, with the price of Bitcoin not having initiated any major movement.

Bitcoin has struggled to break through key resistance levels or fall below critical support levels, demonstrating a stalemate for more than three weeks.

Since January, Bitcoin has remained in a low range between $ 3,200 and $ 4,000, unable to engage in a significant price move in the short term.

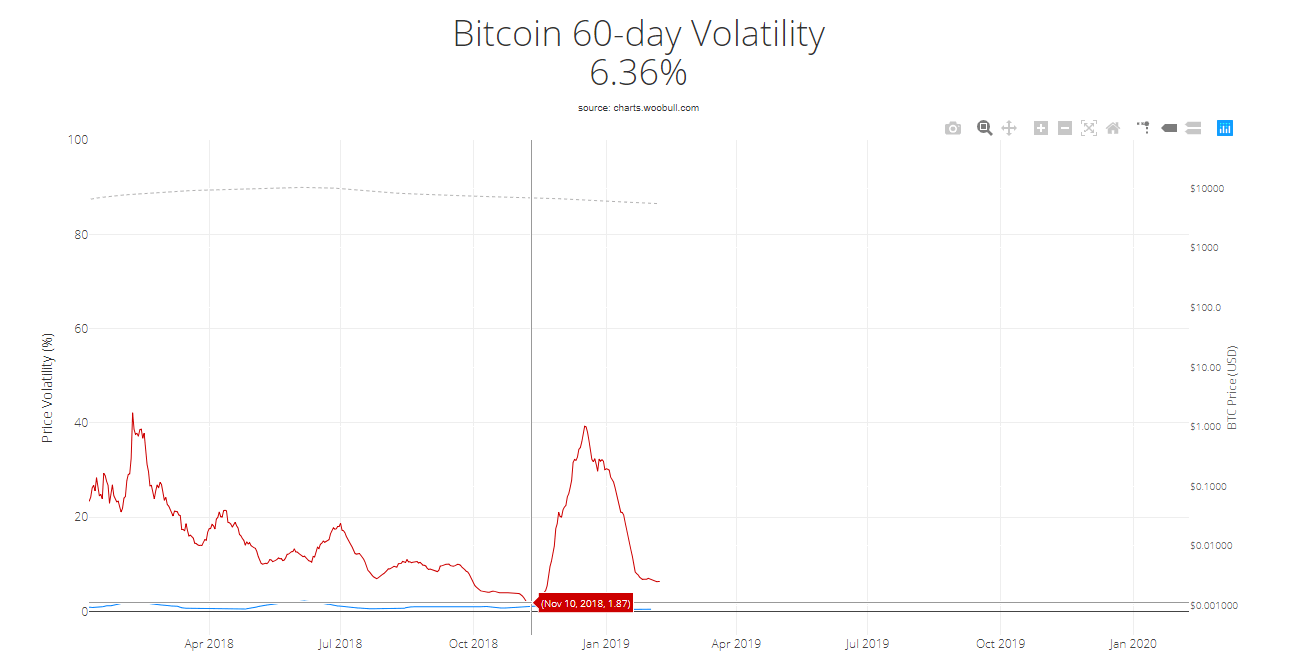

The volatility of falling bitcoins can mean bad news

The volatility of Bitcoin has declined significantly since mid-January, with dominant cryptocurrency showing stability in a narrow range in the low region of $ 3,000.

$ BTC volatility in free fall. Almost as weak as the lowest volatility recorded by this index in November. pic.twitter.com/zL9ntksqrP

– Luke Martin (@VentureCoinist) February 7, 2019

The last time that Bitcoin's volatility registered a free fall was in November. After a few stable weeks, the price of the BTC plunged from $ 6,500 to $ 3,122 in one month.

In a relatively short time, the price of the BTC dropped by more than 51%.

Analysts have already begun to lower their forecasts for BTC's short-term performance.

Fundstrat, a firm led by Tom Lee, a Wall Street badyst who has consistently said that Bitcoin would reach $ 25,000 on January 28, set BTC's price target at $ 2,270.

Robert Sluymer, a market strategist from Fundstrat Global Advisors, said:

"The price structure for most crypto-currencies remains weak and seems vulnerable to imminent downside deterioration. The Fundstrat advance / decline indicator may fall to new lows.

A break under the fourth quarter's troughs at $ 3,100 would imply a drop to $ 2,270, while a $ 4,200 overshoot is needed to signal that Bitcoin is starting to improve. "

Source: Woobull.com

Similarly, well-known traders such as DonAlt and The Crypto Dog have stated that bitcoin would likely fall in the low-income region of $ 2,000 if it did not recover more than $ 4,000 in the near future.

However, although BTC's next likely decision is to mark a slowdown in the coming weeks, The Crypto Dog has noted that selling a short-term badet is still risky.

"Short circuit [Bitcoin at] 33XX is like a 63XX short circuit. Maybe the floor is breaking, or maybe you're going to go wrong 5 times in a row. (Maybe it never breaks) Hold shorts from above – yes, that's perfectly reasonable. "

Hsaka, a technical badyst of cryptocurrency, also suggested that it was difficult to sell a short bitcoin because it defends the $ 3,300 level of support with relative strength.

Would not run this now.

• Sitting in daily support

• Consolidation (3340 to 3480) taken.

• Begins to round.If we pump, you will want to see how the price will react to the 3440-3450 zone. pic.twitter.com/oNwW0EFCV9

– Hsaka (@HsakaTrades) February 7, 2019

A problem could arise if Bitcoin continued to display stability in a narrow range and the price trend of the main cryptographic badets stagnated.

Previously, Mark Dow, a trader who had cut Bitcoin short of his all-time high, had pointed out that if BTC did not recover at $ 6,000 quickly, it could cause short-term badet problems.

"Another beautiful card. If bitcoins can not sell between $ 5,000 and $ 6,000 at the earliest, that's a bad sign for cyberbulls. And if it falls through the yellow line at some point, even HODLers need GTFO, "Dow said.

Therefore, even if BTC recovers up to $ 4,000, it is not clear to declare an appropriate fund and enter a consolidation period.

Crypto markets need some volatility

A handful of chips such as 0x, ICON, Aelf and Chainlink have recorded decent gains over Bitcoin and the US dollar in recent days.

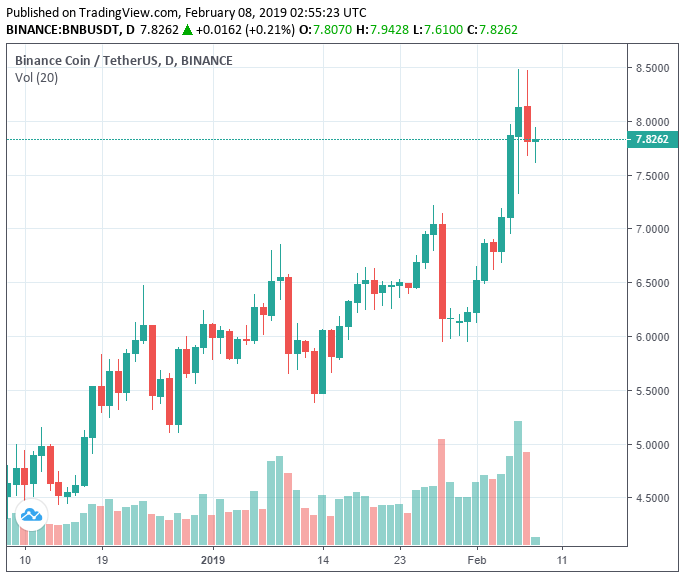

Binance Coin, for example, which recently became the 10th largest cryptocurrency in the global market, has increased 25% against the US dollar from $ 6.25 to $ 7.84 in the last seven days .

Due to the bear market, cryptocurrencies began to post independent movements, which could be considered a positive element of the sector's long-term growth.

However, many cryptographic badets also risk seeing their very low margins drop relative to the USD, while a handful of them defend key support levels, resulting in a bloodbath short term.

Click here for a real-time bitcoin price chart.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link