[ad_1]

Titan, a startup that is building a retail investment management platform for the next generation of “everyday investors,” closed on $ 58 million in a Series B funding round led by Andreessen Horowitz (a16z).

Funding comes just over five months after Titan raised $ 12.5 million in a Series A round led by General Catalyst, and brings the startup’s total raised since its inception in 2017 to $ 75 million. He values the company at $ 450 million.

General Catalyst has also put money into the Series B round, as well as BoxGroup, Ashton Kutcher’s Sound Ventures and a group of professional and celebrity athletes including Odell Beckham Jr., Kevin Durant, Jared Leto and Will Smith.

The startup, which describes itself as “an active investment manager of the new guard,“ launched its first investment strategy in February 2018 and now has 30,000 users. Titan’s platform has grown 500% in the past 12 months, much of it organically, according to the company, which plans to cross its first billion in assets under management Later this year. During its last increase in February, Titan co-founder and co-CEO Joe Percoco said that the startup was approaching $ 500 million in assets under management and its cash flow was positive last year.

“What Fidelity and its iconic mutual funds were to baby boomers, Titan is to new generations. Titan is the first DTC, mobile first investment platform where everyday investors, regardless of their wealth, can have their capital actively managed by investment experts in long-term strategies, ”said Percoco.

He went on to describe the mutual fund or ETF as “basically just technology for an investment manager to take money from someone in order to invest in securities.” He likened this technology to a VHS tape that “gets the job done, but is archaic for a number of reasons.” Those reasons, he said, are that the investor is “anonymized dollar value” and the products have cost layers with high minimums and are difficult to create.

“The factory that creates the mutual fund itself is very old. The entire investment management industry relies on these VHS tapes, ”Percoco said. “These are the archaic technologies used. We are completely rebuilding it. Fidelity is an old factory. Titan is indeed a new factory.

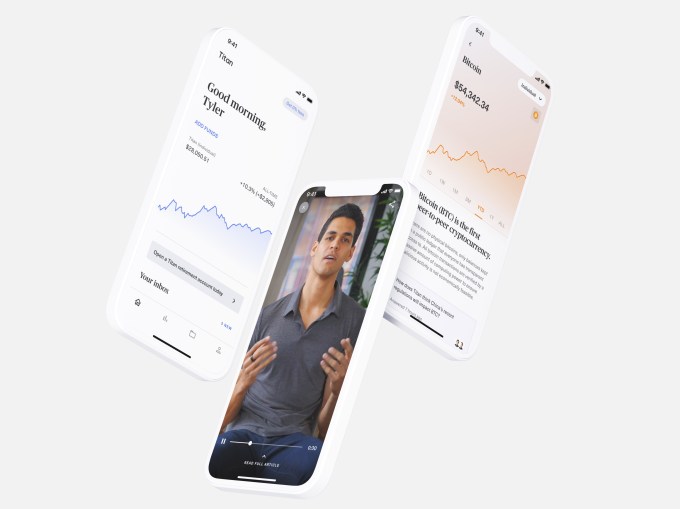

Image credits: Titan

On August 3, Titan plans to throw his cryptocurrency offer, which the company says will be the first and only portfolio of actively managed cryptocurrency assets available to U.S. investors. At launch, Titan Crypto will be available to all US residents except those with a home address in New York. Access for New York-based residents will be provided once Titan’s custodial partner receives regulatory approval for state jurisdiction.

Going forward, Titan said it plans to allow other investment managers to launch their products from its “factory.”

“The initial strategies on Titan’s platform are primarily stocks,” Percoco said. “We are already receiving requests from multi-billion dollar managers asking to launch products on Titan. “

The company plans to use its new capital to further develop its underlying platform and range of investment products as well as to hire. It currently has around thirty employees, compared to seven one year ago. Percoco expects Titan to employ 100 people by this time next year.

General partner A16z Anish Acharya said that since meeting the Titan team last year, his company has “always been impressed” with Titan’s vision, execution and product team.

“If we take a step back and look at consumer investment trends, we can see that the younger generations are taking more risk when investing, demanding easy-to-navigate, mobile-centric interfaces and transparency of their businesses. banks, and they want to deeply understand how their money is invested and participate in the lessons of that process, ”said Acharya, who will be joining Titan’s board of directors on the financing.

In his view, Titan stands at an “interesting intersection” between passive robo-advisers and active stock valuation, “allowing their clients to ride alongside some of the best fund managers in the world, thereby gaining the returns and knowledge of stock selection without having to make the decisions themselves.

Source link