[ad_1]

Compared to the great cause of climate change or the personal interest of the income tax, competition policy is a decidedly not bady election issue. It is therefore not surprising that no party expresses this problem – not even the Labor Party, even though it has implemented notable reforms in the electoral lists.

But the politics of competition concerns us all.

It is necessary to be able to choose goods and services with a range of prices and quality on the one hand, and on the other hand, to be dictated by one or more sellers who ask for as much and offer them the least possible.

For markets to remain competitive, a debate is needed on the economy, law and regulation. It may be technical but we pay dearly if we do not have it.

Existing policies to protect competition in Australia are not in bad shape. The Australian Competition and Consumer Commission (ACCC) is considered one of the best competition regulators in the world. But there is always more to do.

Above all, the commission needs more empirical evidence to see if it is doing enough to prevent competitive markets from being skewed by a few dominant companies.

Highly concentrated

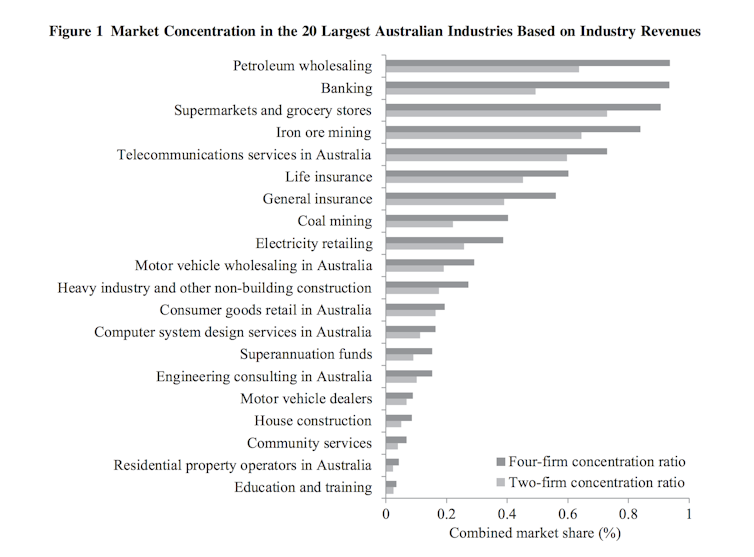

Many Australian markets are concentrated – dominated by a few big players. Think of banks, energy retailers, telecommunications, supermarkets and gasoline sellers.

The Australian Economic Review, FAL

Each year, ACCC reviews hundreds of mergers or acquisitions that add to the concentration.

The competition watchdog has the power to initiate formal proceedings to block a merger if it is deemed to give the merged entity too much market power. In reality, the regulator is opposed to very few acquisitions.

In 2017-18, for example, the ACCC examined 281 mergers. He has "pre-rated" 252 as not requiring any examination. Of the 29 reviewed, 17 (61%) were unconditionally liquidated. This means that only 4% of all mergers reviewed were opposed. The previous year, it was also only 4%.

Australia's high levels of concentration are due to lax merger control standards, which remains to be debated. The same is true if the concentration necessarily impairs competition.

The Grattan Institute pointed out other factors: excessive regulation in some sectors, creating barriers to entry (such as zoning laws for food retailers), and insufficient regulation in the industry. others (such as access conditions for ports).

It is generally accepted that further industrial consolidation may be warranted to allow for economies of scale in a relatively small and geographically dispersed economy. Increased efficiency should mean lower prices for consumers.

At least, that's what economic theory says. But is this happening in practice?

Merger retrospectives

In other countries, economists and policymakers benefit from empirical studies that measure the effect of mergers or acquisitions on prices and other aspects of market performance. The studies examine merger agreements not blocked by the competition authorities. They examine whether the acquisitions match the claims made by the merging parties at the time of the transaction.

These "merger retrospectives" have shown that mergers, by reducing the number of competitors, actually raise prices. A comprehensive review of merger retrospectives in the United States found that prices increased by 4.3% in almost 95% of cases where mergers resulted in six or fewer major competitors in a market. This discovery is not unique to the United States. A study conducted in 2016 in Europe had similar results.

Retrospective badyzes are regularly conducted by agencies abroad, particularly in Canada and Great Britain. But not in Australia.

This would tell us if the ACCC merger review system works. Depending on their scope, merger retrospectives can also provide valuable data for other important policy debates, including whether concentration levels inhibit or increase investment, innovation, and wage growth. inequalities.

Work proposals

In 2013, the Abbott government launched a major independent review of Australia's competition policy framework and laws. This review, known as Harper, was completed in 2015. Several important changes have been made. The most important was the introduction of an "effects test" – to determine whether unilateral conduct had the purpose or likely effect of substantially reducing competition.

Read more:

Explainer: What is the "test of effects" of competition?

The federal Labor Party is now supporting further reforms, including a retrospective badysis of mergers.

These exams can be complex and expensive, but the Labor Party also proposes an increase in the ACCC budget.

It also proposes heavier fines for companies that violate competition laws. This is based on the fact that Australia stands out on the international scene with respect to the relatively low fines it imposes for punishing and preventing violations of competition laws.

The proposal is to increase from A $ 10 million to A $ 50 million, or 30% of annual sales of the product or service relating to the violation, the maximum penalty for violation of consumer and competition laws. multiplied by the duration of the offense. This mimics the European approach to calculating fines. This would mean that the starting point of the fine inflicted in the infamous price fixing case in the Visy case would have been more than A $ 200 million, instead of A $ 36 million.

Read more:

Cartels caught in the act of stealing from Australian consumers should be subject to heavier fines

ACCC is in favor of increasing the fines imposed on businesses. This proposal must therefore be taken seriously.

But reforms should not just be about anti-competitive behavior. This will not solve the damage done to businesses, workers and consumers.

What matters most, if not more, is having a legal framework to ensure that markets do not become too focused, giving undue power to a handful of businesses in the first place.

Source link