[ad_1]

Welcome to The TechCrunch Exchange, a weekly startup and market newsletter. It is inspired by what day of the week Exchange column dig, but free, and made for your weekend reading. Want it in your inbox every Saturday? Register now here.

It’s the end of a short week, but instead of not having much to discuss, we have a lot. But it’s a lot of fun, so let’s make the most of it!

Let’s talk about the dear four-legged animals first.

Trillion dollar horse?

The stock market began to dig into the venture capital market in the second quarter of 2021 this week. Thanks to Anna’s help, our first track came out pretty well, I think. We have a lot more to come soon. But the unicorn stats really grabbed me by the neck. Consider:

- 136 unicorns were minted in the second quarter of 2021, a historic record.

- As CB Insights notes, it is “almost 6 times the 23 unicorns born a year ago in T2’20, and already more than the 128 unicorns born in 2020.”

The result of this boom in the horned equestrian population is that there are now 750 unicorns in the world. When the old TechCruncher and the excellent human Katie Roof tweeted this statistic, my first thought was Damn, that means unicorns are worth over $ 1 trillion.

I was path disabled. The actual number is almost $ 2.4 trillion (CB Insights data). Which is an incredibly high number. In comparative terms, the world’s unicorn population is worth almost exactly what Apple is worth today – $ 2.42 trillion, per Yahoo Finance.

Maybe I’m overreacting to the amount of unicorn equity that’s currently sitting, much of it frozen, in private markets. Especially when the unicorn outings are in place. But are even today’s high output levels enough to clear that particular ledger over time? No, I do not think so. Not when we hit 1.5 unicorns a day in the second quarter, counting weekends and the like and the number of unicorns keeps increasing.

Funding cycles

I only wrote about one fundraising round this week – this r2c round which was quite interesting – mainly because I had a bunch of other things to chew on. But I have also seen my inbound venture capital round launches slow down since I said I would not cover rounds that did not include more detailed financial information.

It is not yet known if the pitch volume is down due to the holiday week, or if I have scared everyone. But I am using my incoming volume of fundraising launches both globally and in sector–directional terms to help assess what’s going on. So hopefully (1) people send me stuff and (2) they do and also share a lot more information at the same time.

SPAC in space

Y Combinator is a neat entity. One of his recent companies was Albedo, a startup that hopes to build a network of low-orbiting satellites that will take very high-resolution photos of the planet. It’s hard to do it of, as Natasha Looks like, but maybe possible thanks to some satellite parts (sort of) out of the box, in-orbit refueling, and a bunch of other new stuff.

Albedo and his ilk are the reason I still trot every year to watch Demo Day. I can see what could happen, and it’s a lot of fun, illustrative.

All this to say that when two satellite imagery companies announced that they would go public via PSPC this week, I was intrigued. Turns out they don’t really compete with what Albedo wants to do, as they offer lower resolution images. But they are… notable for other reasons.

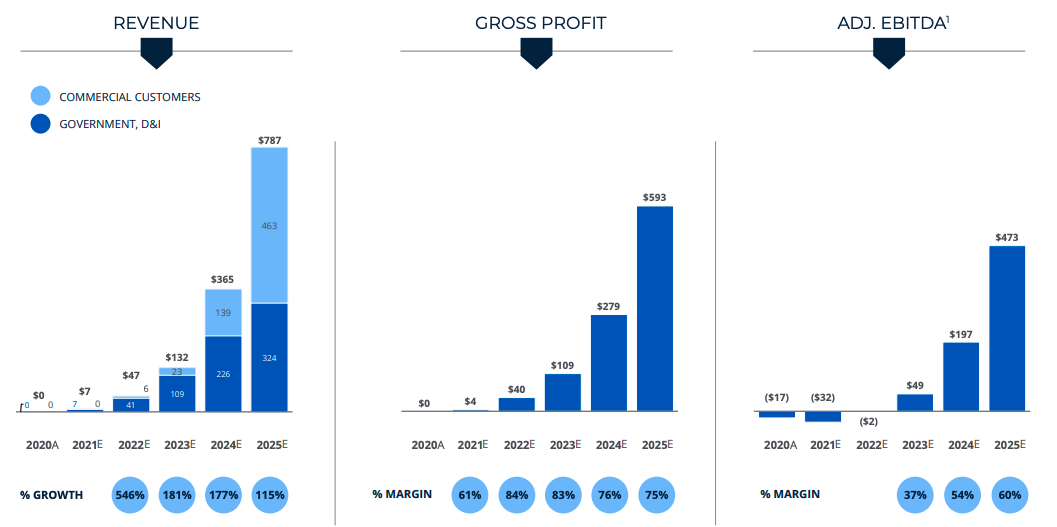

Satellogic to have this simply nifty series of charts (make sure you stick to the dates in each chart):

Image credits: Satellogic

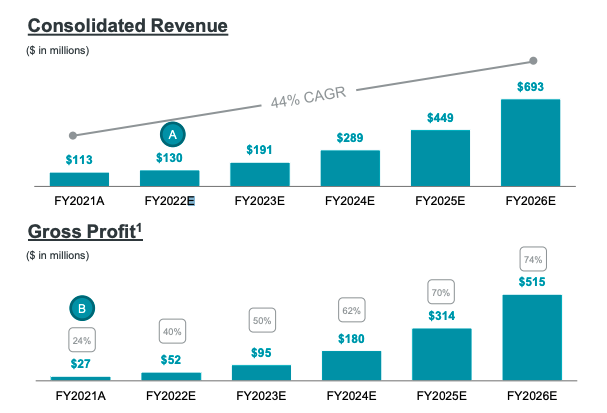

And Planet for the following, which is a look at how the economy of satellite technology is fairly heavily weighted towards the future:

Image credits: Planet

The company’s long-term gross margin goal is 80-85% (15-20% COGS, per deck), but you can see how long it takes to get there. This poses an interesting problem for the venture capital world.

Namely, companies like Albedo are going to need a lot of time and money to build their constellations and grow. And, I guess, to accommodate the kind of gross margins software companies can generate from day one of selling their product.

This is one of the reasons there is so much money chasing software products with even a hint of sustainable growth; High margin recurring revenue is the business equivalent of a cheat code when it comes to creating value. So every investor wants to put money into it. Satellite technology, while great fucking review in general, is simply more expensive and slower.

My question: is software so effective at generating returns on venture capital that other forms of start-up work will struggle to compete for attention and capital? Are they already?

Future

Finally, Future. Or more precisely, the future of Future. I’m curious about the a16z post.

Since launching, I have checked several times a week, hoping to see what was coming out of the collective mind of the venture capitalist. I don’t just because I’m a huge dweeb – I am! – but also because after everything I’ve read about the media’s hatred for technology – no! – I was curious about what a cosmically well-funded venture capital group would build. He hired some great people, after all.

It looks like we’re in between publication cycles on the Future blog. The last pieces of the main content came out almost a month ago, and its most recent entry was on June 25. And this post is just a note promising more content in July.

Everything seems a bit flat? Considering the budget, the promise, the realm of fantasy, and the number of people in the world a16z who should have things to say? Why not make more words appear? Let’s see what July brings.

Ok that’s enough for me for the week. I kiss you and talk to you Monday morning on the pod.

Your friend,

– Alexis

[ad_2]

Source link