[ad_1]

Copyright of the image

Getty Images

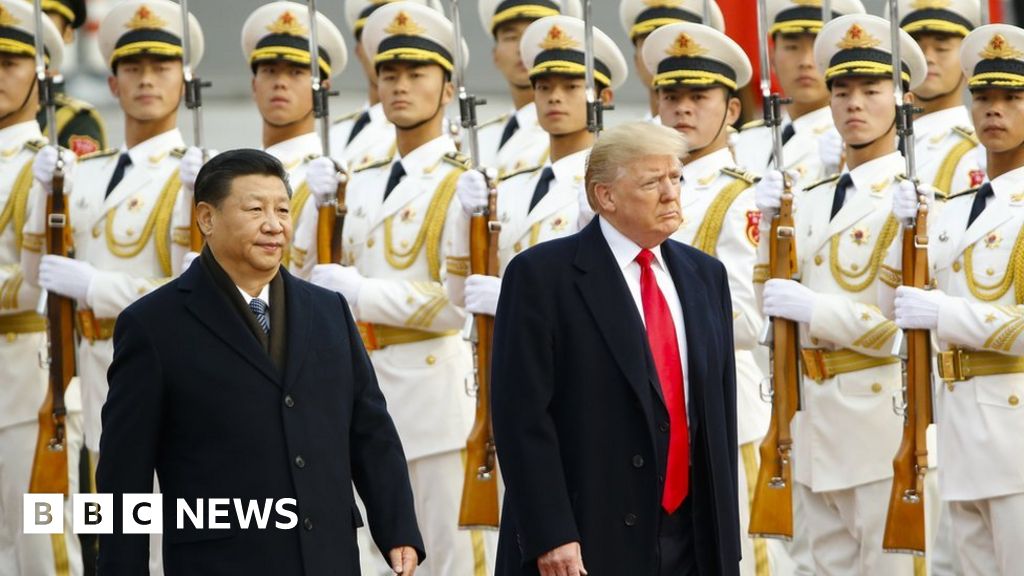

US President Donald Trump and Chinese President Xi Jinping to meet again this week

The stakes are high at this week's G20 summit, where President Trump is scheduled to meet Chinese President Xi Jinping.

Hopes that the meeting could pave the way for a deal on trade between the two countries have been undermined by recent threats from the US president.

Just days before the summit in Argentina, President Trump announced that current tariffs of $ 200 billion ($ 157 billion) Chinese imports would increase as expected.

He also threatened to pay tariffs on 267 billion dollars of other Chinese exports to the United States.

Conditions could now be prepared for a possible escalation of the trade war between the two countries.

- World leaders gather for G20 summit

- Merkel plane baffled after a technical hitch

What will probably come out of the meeting?

President Trump began the dispute with China earlier this year, accusing the Chinese of "unfair" business practices and the theft of intellectual property.

The United States has received a total of $ 250 billion worth of Chinese goods subject to tariffs since July, and China has responded by charging $ 110 billion worth of US goods.

China had already hit the United States with tariffs of $ 3 billion in April, in response to US tariffs on global imports of steel and aluminum.

President Trump launched a glimmer of hope earlier this month when he said he thought the US could reach a trade deal with China.

Copyright of the image

Getty Images

Trump has long accused the Chinese of unfair trade practices

But only a few days before the summit, he poured cold water on such optimism.

President Trump told the Wall Street Journal that he intended to make his plan to raise tariffs on the $ 200 billion worth of Chinese goods – introduced for the first time in September – by 25% (against 10%) from January 2019.

President Trump also said that if negotiations fail, he would threaten the remaining $ 267 billion in annual exports from China to the United States with tariffs of 10 to 25%.

The Trump administration has also recently accused China of not changing its "unfair" business practices.

"I think the most likely scenario is that Xi Jinping does not offer enough concessions to Trump, and that so the G20 meeting does not have a lot of results," says Capital's Julian Evans-Pritchard Economics.

Recent summits also do not bode well for G20 resolutions.

The Asia-Pacific Economic Cooperation (APEC) summit recently concluded with no official declaration by the leaders because of the divisions between the United States and China on trade.

And a G7 summit in Canada in June ended in dismay when Trump withdrew from joining the joint statement.

"Unfortunately, I think the United States and China are very far apart from each other on issues related to the trade dispute, so we are not overly optimistic," said Valerie Mercer-Blackman. , Senior Economist at the Asian Development Bank.

"The lack of agreement on the press release at the meeting of the Apec (…) also suggests that there is a fairly significant distance between the two parties and that". there does not yet seem to be any specific proposal on the table to end the stalemate. "

What is at stake?

The stakes are high.

"If the meeting does not result in a truce, the United States will certainly raise tariff rates [on $200bn of existing Chinese goods] January, and further rate expansion is quite likely, "said Evans-Pritchard.

Copyright of the image

Getty Images

US tariffs on Chinese imports worth $ 200 million could go from 10% to 25% in January

An increase in these tariffs would see many multinational companies speed up their plans to relocate supply chains in China, while tariffs on additional Chinese imports would pose "a significant political and economic risk for Trump," said Hirson , director for Asia of the Eurasia group.

"The remaining US imports from China are more consumer-oriented, and US households, especially those in lower income groups, will feel more impact than their tariffs on past cycle tariffs. ", he adds.

What happens next?

If the US imposes tariffs on additional Chinese products, China may seek retaliation, but would have limited room for maneuver to do so through trade.

Indeed, the current Chinese tariffs of US $ 113 billion on US products are not far removed from the US $ 130 billion imported from the United States in 2017.

International trade

More from the BBC series taking an international perspective on trade:

Instead of aggressively retaliating with more tariffs, China is more likely to defend its economy by easing its fiscal and monetary policy, letting its currency fall and forging trade deals with other countries, said badysts.

Copyright of the image

Getty Images

China has also been affected by US tariffs on global imports of steel and aluminum

"China's strategy towards Trump will promote resilience against retaliation," Hirson said.

If the conflict between China and the United States continues to intensify, non-tariff barriers, especially in the technology sector, are likely to become more and more popular.

The United States has already taken steps in this direction. He recently banned US companies from selling parts to a Chinese company for reasons of national security.

"While tariffs are attracting the most attention, non-tariff measures are just as important in this trade war and will likely be even longer," said Hirson.

"On the US side, this includes measures such as recently enacted legislation that tightens investment restrictions and export controls … In China, this involves the use of foreign investment. regulatory instruments such as antitrust investigations to compel US technology companies to take advantage of domestic competitors. "

Source link