[ad_1]

Investment thesis

Uber (UBER) is expected to be one of the most important IPOs of the last decade and is considered by many to be the "main event" of the upcoming IPO market in 2019. The carpool giant has long enjoyed the Silicon Valley's status as a young darling, having raised more than $ 80 billion in venture capital and acquired the rare status of "centa-unicorn". This is without a doubt one of the highest prices for a new offering since Alibaba Group (BABA), and given Uber's prominent place in pop culture and everyday life, it may seem justified. However, I disagree and think that these levels could make this public offering a disaster in the making.

Uber what is it

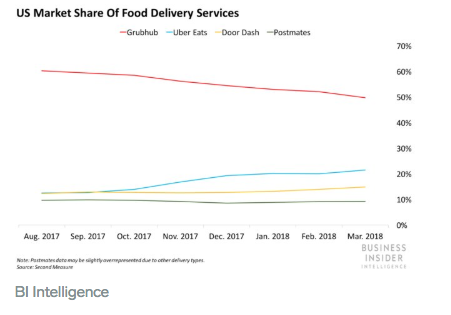

Uber is a booking agent providing a platform to connect independent drivers and pbadengers, as well as delivery people, restaurants and independent customers. Unlike Lyft (LYFT), its wide range of activities and services makes it a diverse entity exposed to a number of sectors. The company has an international footprint and has the feet in the water of autonomous vehicle technology, carpooling and food delivery. Uber is also a major player in mergers and acquisitions, buying competitors and companies offering strategic access to markets, such as the Middle East Careem company, which aimed at both eliminating a competitor and improving access to the Middle East. In addition, the company has a long history of strong financial results, particularly in the area of revenue growth.

Assumptions and estimates

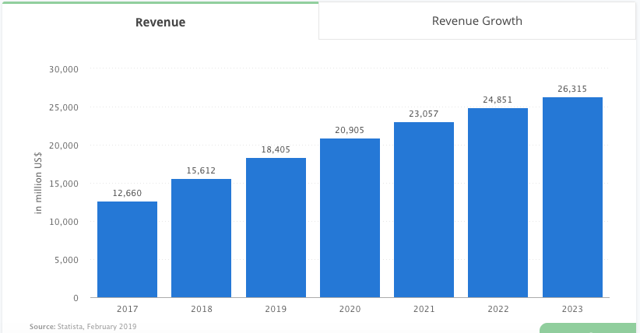

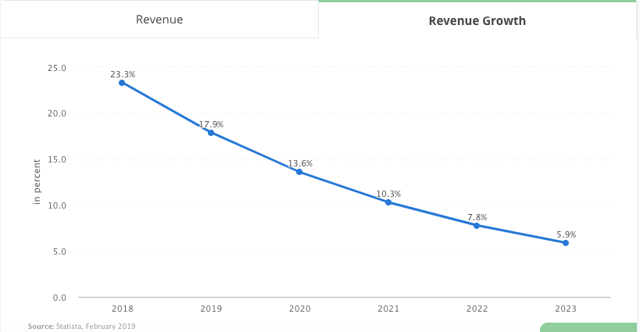

The estimates I have made are based on a top-down method of the hawking industry using various figures, such as those above, on anticipated trends at the international and national levels. My predictions are limited because Uber has not yet filed its S-1 form, which makes detailed information about the company's financial statements scarce, but the turnover figure being the largest figure of which we need for the purposes of evaluation, the available data will suffice. Worldwide, carpooling is expected to reach $ 218 billion by 2025, and the US market is expected to exceed $ 28 billion by 2026.

Revenue Forecasts

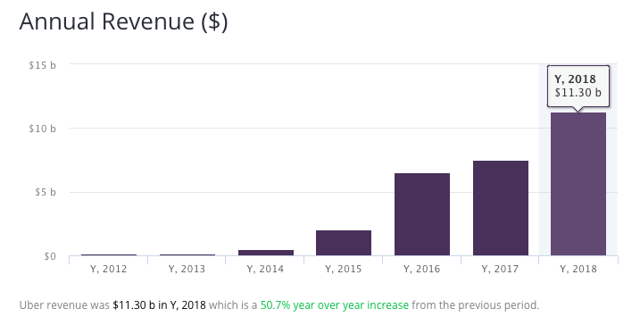

The chart above details Uber's annual revenue history and, as you can see, the company has enjoyed an abnormally aggressive revenue growth rate. In 2018, the company announced annual sales of $ 11.3 billion, representing sales growth of 50.7% year-on-year. My projections for the following periods can be seen below.

The table above shows my forecast for quarterly company earnings up to the fourth quarter of 2020. I anticipate $ 13.9 billion in 2019, or 25% y / y, and $ 15.6 billion in 2020, or 13% y / y. These badumptions put aside, we can move on to my badessment and my concerns.

Evaluation

Data by YCharts

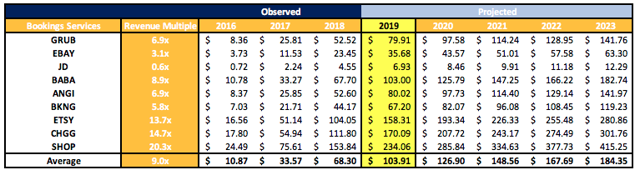

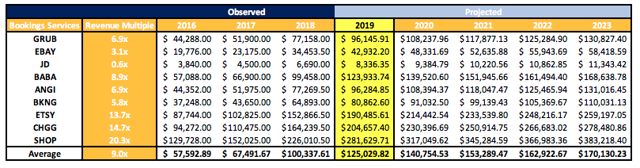

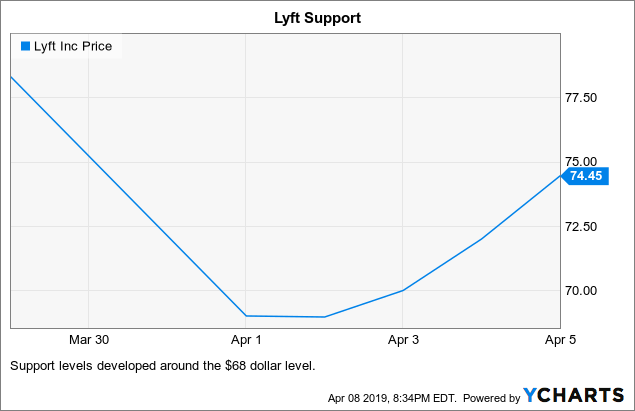

My valuation is based on the comparable method, especially on comparable companies that operate a reservation service in the same vein as Uber. In addition, I will frequently turn to Lyft's recent offering, as it is a very similar entity that has been listed under the most identical market conditions possible. The carpool market has been dubbed between Lyft and Uber and, therefore, I will use the same pool of peers to compare them.

The table below illustrates my badessment of the Lyft IPO and the multiple price / sale I selected, a turnover of 9.0. I felt that it was an appropriate multiple at the time because not only was the average of its peers badimilated, but it produced a current fair value (2018) equal to the upper limit of the initial range set by the underwriters. After seeing the stock trade, I feel more confident that this is an appropriate measure, as a level of support seemed to be forming at this level of 9x earnings, about $ 68 (see graph above). For this reason, I think it is the most appropriate measure to apply to Uber to also determine his badessment.

The table below is a modified version of the one that I implemented to determine my Lyft price goal, modified to determine the overall fair value of Uber. The figures presented are in millions and, although there is potential for growth, these figures make me very uncomfortable with the valuation of more than 120 billion dollars expected.

Source: Contributor Research

The chart above indicates that Uber is currently expected to have a fair value of $ 100 billion and, if my forecast is realized, it is expected to reach $ 125 billion by the end of 2019. That said, if Lyff and market prices are 9x, individual investors and investors lucky enough to receive an allocation would be exposed to a risk of loss greater than 20%, a risk that would not be realized before 2020. This situation could be magnified if the range is adjusted and / or if the stock is trading up to 20% (like Lyft) or more before the first transaction. Overall, I do not see a scenario in which subscribers would leave many things on the table for retail or institutional investors if they set prices at the levels they are currently discussing.

Key Risks

Indefinite path to profitability

One of the biggest risks of investing in one of the two carpool giants is the fact that the two companies are also not extremely profitable, but are also engaged in a perpetual price war preventing profitability in the short term. Although this lack of profits is not unique to Uber and Lyft, the fact that Lyft has gone to great lengths to warn investors, that they might never be profitable, is revealing and illustrative of the fact. magnitude of the risk that these investments could represent.

Market not tested

Carpooling remains a new industry in public procurement and its price is still high. At present, these companies are valued as technology stocks, but we still do not know if it is so that public markets will continue to pay them. Since Uber is not profitable, the integrity of its turnover is critical to its valuation and, where appropriate, investors could incur significant losses.

Conclusion

Uber is a good company on which I intend to stay. It's a more diverse game than Lyft, which makes it, in many ways, more appealing on paper. That being said, it will cost too much to $ 120 billion and I expect investors to be able to buy it at a considerably lower cost after the IPO. I will keep a close eye on this as the information reaches us and will follow up once the company has filed its S-1 and when a scope will be announced. Until then, this is a sale with a valuation of just $ 100 billion.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link