[ad_1]

A worker on the Jaguar Land Rover site in Castle Bromwich, West Midlands. Photography: Jaguar Land Rover / PA

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

With the unresolved Brexit, the trade wars between Washington and Beijing and the slowdown in the global economy, the UK is going through a difficult period. But could Britain really flirt with the recession?

A new health check of the British economy, expected this morning, should show that growth has slowed sharply in recent months.

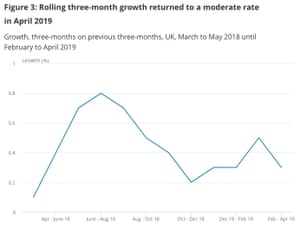

Economists predict that today's report will indicate that GDP increased only 0.1% in the March to May quarter, compared to 0.3% in February-April.

This would fuel fears that the economy actually contracted in the second quarter of this year (we will find this in a month).

Photography: ONS

We already know that the month of April has been tough: the economy of the United Kingdom has declined, car manufacturers stop their production in case of Brexit without a contract. Industrial production and manufacturing should have rebounded in May with the return of the automotive industry.

Economists predict GDP growth of only 0.3% in May after a contraction of 0.4% in April and 0.1% in March.

But the overall picture may not be encouraging, especially as Britain's trade deficit is likely to remain large.

Adam Cole of Royal Bank of Canada Explain:

The monthly release of May's GDP this morning is significant after a sharp weakness in April and growing expectations of a contraction in the economy in the second quarter.

Most of the decline in April is expected to reverse in May (0.3% m / m after -0.4%) and RBC economists are slightly above the consensus. Nevertheless, the arithmetic is such that a new monthly increase of 0.5% or more would be needed in June to avoid a negative reading of the quarterly average …..

Despite monthly distortions around Brexit's initial data, there are growing rumors that the UK would be "on the verge of recession" if data continues to add to negative quarterly growth.

Meanwhile, the British pound is approaching its lowest level in two years, as traders worry about the impact of Brexit's uncertainty on the British economy and the economy. the threat of a "no-deal" for Halloween if Boris Johnson became Prime Minister.

Investors will also follow later Capitol Hill, where Fed Chairman Jerome Powell will testify before the House's Financial Services Committee. He will discuss the state of the US economy and the chances of interest rate cuts required by President Trump.

Michael Brown

(@MrMBrown)Set to be a busy day for # markets:

– #UNITED KINGDOM GDP (May) should show a slight monthly expansion

– #BoC leave rates on hold, but probably with an optimistic tone

– #Nourris Testimony of President Powell, mkts request confirmation of the July Cup

– #FOMC Minutes of the June meeting for clarity on perspectives

L & # 39; s calendar

- 9.30: BST: UK GDP report for May (growth is expected to slow to 0.1% in the last three months)

- BST: UK trade figures for May (the deficit is expected to widen to £ 12.5 billion, from £ 12.113 billion)

- 3:00 pm: Federal Reserve Chairman Jerome Powell testifies before the House of Representatives

- 3:00 pm TSB: Bank of Canada decision on interest rates

[ad_2]

Source link