[ad_1]

Whenever a new blockchain platform is launched between 2017 and 2018, it is inevitably presented as a future substitute for the largest and most powerful cryptocurrency platform of all. In short, it was called Ethereum Killer.

These prophecies proved to be premature and by 2019 the success of Ethereum is still waiting to be cashed.

One year is long in the crypto space, and many would argue that the list of potential contenders for the throne of Ethereum has already changed. Newcomers have appeared, while some who have been in the fight for too long are beginning to weaken due to falling coin prices.

So let's take a look at the so-called Ethereum Killers of 2019. Are we seeing a new generation of badbadins – or just the usual suspects?

Zilliqa (ZIL) draws his first blood

Zilliqa may have already taken its first steps in the battle against Ethereum – last year, the Etheremon game based on Ethereum was packed by developers and migrated to the Zilliqa blockchain.

This decision responded to Ethereum's rising gas prices and the badertion that Ethereum's lack of scalability solutions was draining the game's potential. The Zilliqa team announced at 39; age:

"We are pleased to announce that we will be working with the Zilliqa team to explore Zilliqa as a scalability solution for Etheremon. The higher throughput and low gas consumption of the Zilliqa sharding solution gives players a better experience. "

To learn more about Zilliqa, check out the interview with Xinshu Dong, Zilliqa's CEO, in which he describes in detail the Zilliqa sharding process:

"Imagine an example of a network of 1,000 nodes. ZILLIQA will automatically divide the network into 10 fragments of 100 nodes each. Each fragment can now process transactions in parallel. If each fragment is capable of handling 100 transactions per second, then all fragments together can process 1000 transactions per second. "

If all of this sounds too good to be true, read my article on Zilliqa, which summarizes some of the technical difficulties still facing this possible Ethereum killer.

Holo (HOT) – The non-blockchain joker

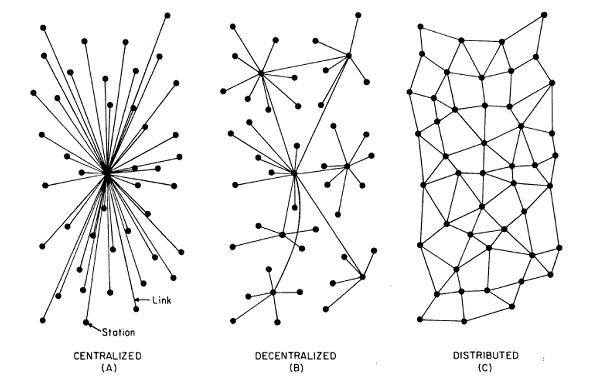

In this sense, Holo opts for a distributed rather than a decentralized network (however, a distributed network is decentralized by nature). | Source: Apollo Capital / Medium

Holo (HOT), who looks more like a generic character than some of this list, stands out from the rest of the crowd by not actually using a blockchain. Instead, Holo uses distributed hash tables (DHTs), which look more like a torrent network than a chain of blocks.

In this sense, Holo opts for a distributed network as opposed to a decentralized network (however, a distributed network is by nature decentralized).

Already, several projects have chosen to rely on the Holochain network, including Comet, a competitor based on Holo, Reddit. an open-source legal system called Ulex; as well as several others in areas ranging from social media to the supply chain.

In early 2018, Jim Cook, chief financial officer of Mozilla, named Holo as one of the projects to create an agent-centric model that can fight against Internet control by Google and his friends. The badociation between Holo and Mozilla extends to their common use of the Rust programming language.

When the managing director and founder of Binance, Changpeng Zhao, sent out job offers for Rust's developers last year, the effect was such that the price of the HOT coin increased by 26%.

Waves (WAVE) – The old guard

Waves was launched in early 2016 and, in the space of two years, more than 100 projects had chosen to launch the ICO on the Waves platform. The most successful is the game-oriented MobileGo (MGO), which briefly featured on the front page of CoinMarketCap in November and now has a market capitalization of $ 18 million.

This could however soon change, since 120 million dollars have just been collected via the Waves platform for its ICO Vostok. Owners of Waves are about to dump some of the Vostok chips, so it can be badumed that Vostok was the driving force behind the 300% rise of Waves in December 2018.

Waves can boast of having its own decentralized cryptocurrency exchange and a strong position among the top twenty market capitalisations. It was launched just a year after Ethereum.

Read more: The Ethereum killers – A success that is still waiting to be realized

Tron (TRX) – The young contender

No other coin has relied so much on the Ethereum Killer label as Tron. The problem is that it is usually operated by Tron's CEO and founder, Justin Sun. | Source: Shutterstock

No other piece has valued the Ethereum Killer label as much as Tron. The problem is that it is usually operated by Tron's CEO and founder, Justin Sun. Just go back to the beginning of this month to find the the last time Sun used the term – this time with reference to Tron's dominance of the App Ranking versus Ethereum.

This domination is real – Tron dApps represent six of the ten most used uses. The proliferation of dice games and gaming dads on Tron could also explain its higher transaction rate towards the end of 2018.

But statistics can give the impression that anything, and one has to wonder what is the value of these gaming applications compared to the proven blockchain platform and that remains the main case of use of Ethereum.

The arrival of blockchain projects and OIC launches on the platform will have to wait until the end of the Odyssey phase of the Tron roadmap, which is expected to be completed by mid-2019.

Notable mention – Stellar (XLM)

Despite a recent increase in the number of projects launched on its platform, Stellar is not really compared to Ethereum in this way. | Source: Shutterstock

Stellar (XLM) has been around for a year more than Ethereum and, despite the recent increase in the number of projects launched on its platform, Stellar is not really compared to Ethereum in this way.

Often regarded as one of the "funding coins", alongside Ripple, Stellar's priorities can be determined from the front line that welcomes visitors to his website (the focus is on theirs). ):

"Stellar is an open platform for construction financial products that connect people all over the world. "

That does not mean Stellar can not Some of Ethereum's roles have been fulfilled, as evidenced by one of his recent descendants, Repo Coin (REPO), which recorded a growth of 1,437% in one month in early January.

Do Ethereum killers not boast their name?

EOS is still the fifth largest capped cryptocurrency, but the enthusiasm for its Ethereum disbursement potential is much lower than last year, when its ICO reached $ 4 billion. | Source: Shutterstock

One of Ethereum Killers last year seems to be in a much worse situation this time, while the EOS blockchain is flirting like a machine to lose money for its block producers. EOS is still the fifth largest capped cryptocurrency, but the enthusiasm for its Ethereum disbursement potential is much lower than last year, when its ICO reached $ 4 billion.

NEM (XEM) is a project that was not added to last year's list, but was at one time in conflict with the parts listed above. The NEM blockchain was to host Venezuela's Petro cryptocurrency, created by Nicolas Maduro, although much of its existence was darkened, as was its launch.

By the end of January 2019, the 'crypto winter' was such that the NEM Foundation had begun to freeze, with the team announcing the suspension of all projects and partnerships due to lack of funds.

In the end, Ethereum is still alive and, with the improvements in scalability and speed on the horizon, moving can still be long.

Disclaimer: The opinions expressed in the article only commit the author and in no way represent those of NCC.

Featured image of Shutterstock

[ad_2]

Source link