[ad_1]

Vodafone Group Plc seeks to raise up to 2.58 billion euros ($ 3.1 billion) through an IPO of its European mobile tower unit in Frankfurt, in what will be one of the largest stock quotes in the region this year.

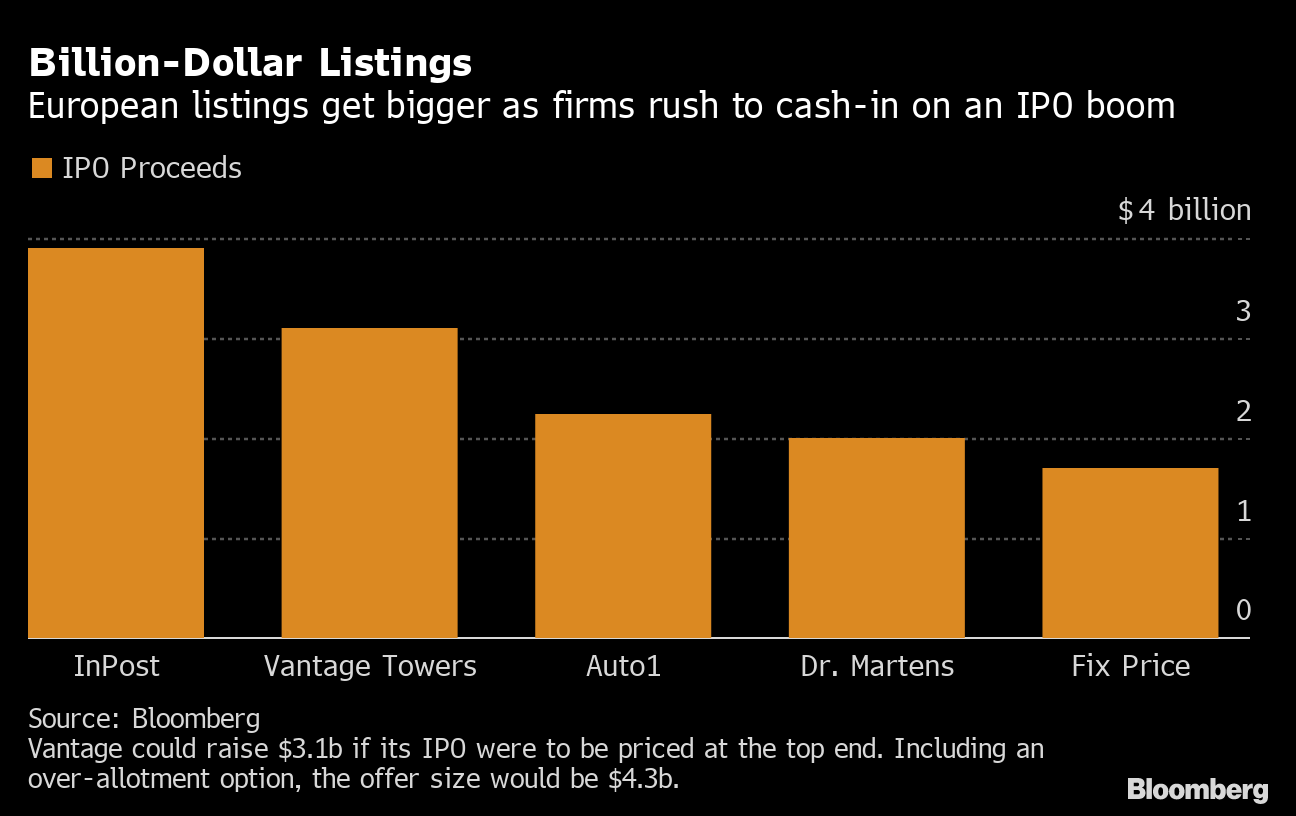

The British telecommunications giant plans to sell 88.9 million shares of the unit at 22.50 euros to 29 euros each, according to a statement Tuesday. At the top of the price bracket, Vantage is believed to be the biggest European IPO since InPost SA is in January.

Two investment funds, Digital Colony and RRJ, have agreed to purchase € 500 million and € 450 million of shares respectively as part of the offer, which will run until March 17. The new stock will start trading on March 18. The IPO values Vantage at up to 14.7 billion euros. The proceeds will be used to reimburse the parent company pile of debt, said Vodafone.

Vodafone’s shares were little changed at the start of trading in London.

Vodafone and other European carriers, affected by increasing competition, regulation and the Covid-19 pandemic, are considering derive value from their mast and fiber assets. Efforts to deploy fifth generation networks are also driving demand for increased tower capacity, fueling a wave of consolidation and restructuring.

And for yield-hungry investors, these assets promise steady returns, as tower companies typically sign long-term, inflation-linked contracts for the space they lease to mobile carriers. Vantage expects to pay out 60% of recurring free cash flow annually as dividends, and intends to distribute 280 million euros in July for this fiscal year, the company announced last month.

Billion dollar listings

European listings grow as companies rush to cash in on IPO boom

Source: Bloomberg

Yet mobile operators looking to lease capacity from Vantage are direct competitors of the majority shareholder and major customer of the tower company in all geographies: Vodafone. Independent European mast operators like Cellnex Telecom SA do not have this drawback.

In the high price range, the IPO would raise 2.58 billion euros. Vodafone has the option of selling an additional 22.2 million shares, while underwriters can sell an additional 13.3 million shares to cover any over-allotments. If all these shares were sold in the high end, the offer would raise 3.6 billion euros.

Vantage’s successful offering will put the German IPO market into its best year since 2018, according to data compiled by Bloomberg. And a host of other offerings are being considered, ranging from units carved out of large conglomerates such as Volkswagen AG and Daimler AG to many potential announcements of younger companies.

Language app Babbel and dating platform ParshipMeet, owned by ProSiebenSat.1 Media SE, consider IPOs, Bloomberg News reported last month. Lists of open source software developers SUSE, online eyewear reseller Mister Spex, cybersecurity provider Utimaco GmbH, manufacturer of prostheses Ottobock SE & Co. and e-commerce site It is also said that About You GmbH is in the works.

(Updates with Vodafone shares in the fourth paragraph)

Source link