[ad_1]

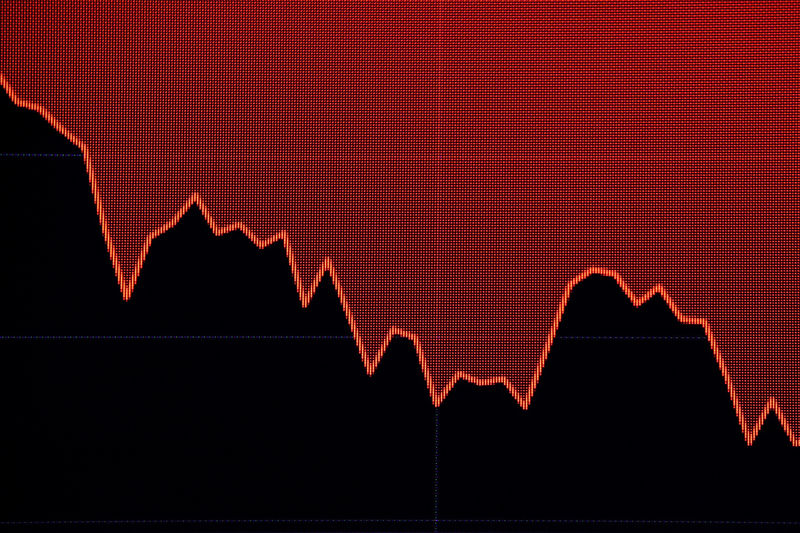

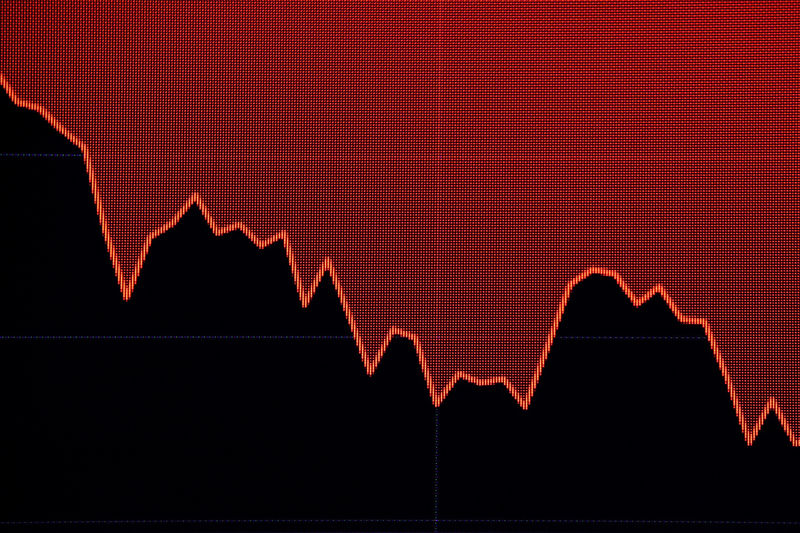

© Reuters. A screen displays a graph showing the evolution of the Dow Jones Industrial Average during trading day on the NYSE trading floor in New York.

By Medha Singh

(Reuters) – US stocks fell for the third straight day on Friday, as skepticism over a US-China trade deal before the impending deadline concerns about slowing global growth.

Another round of talks is scheduled for next week in Beijing, but President Donald Trump on Thursday expressed his concern when he said he was not planning to meet with Chinese President Xi Jinping before the deadline set for March 1 to reach an agreement.

If the two countries fail to reach an agreement by then, new US tariffs on Chinese imports will come into effect.

Trade-sensitive industrial companies lost 0.63 percent, while shares of chip companies, which derive a huge share of their revenue from China, also fell. The Philadelphia Flea Index lost 1.25%.

"The two main hurdles we are looking at weaken data outside the eurozone, and some uncertainty around the trade dispute with China is impacting the markets," said Shawn Cruz, head of trading strategy at TD Ameritrade. Jersey City, New Jersey.

Fears over global growth resurfaced on Thursday after the European Union reduced its economic growth forecasts and as the Bank of England warned that Britain would face its weakest economic growth for a decade.

Nevertheless, it is about 14% higher than its lowest level in 20 months in December, boosted by a dovish federal reserve, hopes for a trade agreement between the United States and China and largely positive results for the fourth quarter.

"After the strong January rally, people are just taking a step back and evaluating the fact that we have not solved many of the problems currently in the markets," said Jeremy Bryan, Portfolio Manager at Gradient. . Investments in Arden Hills, Minnesota.

Interest-rate-sensitive financial stocks fell 1.72%, weighing mainly on the S & P 500, while yields on 10-year US Treasuries fell.

Ten of the top 11 S & P sectors were down, while the defensive utility sector was the only one to post a gain.

At 12:32 ET was down 200.49 points, or 0.80%, to 24,969.04%, the S & P 500 down 15.70 points, or 0.58%, to 2,690.35 and down 40.87 points, or 0.56%, to 7,247.48.

Nasdaq and Dow were heading towards their first weekly defeat for the year.

According to Refinitiv's IBES data, 71.5% of S & P 500 companies have released estimates that outweigh their profits, and have pbaded the halfway point of the earnings season.

However, the slowdown in earnings growth remains a concern. Analysts now expect earnings for the current quarter to fall 0.1% from estimates of 5.3% growth earlier in the year.

Coty Inc. jumped 27.05% – the highest on the S & P 500 – after the cosmetics maker published quarterly results above expectations.

Mattel Inc (NASDAQ 🙂 gained 24.19% after the manufacturer published a surprise quarterly profit, benefiting from the makeover of its iconic Barbie doll.

Falling issues outnumbered defenders for a ratio of 2.22 to 1 on the NYSE and a ratio of 1.19 to 1 on the Nasdaq.

The S & P index posted 17 new highs over 52 weeks and two new lows, while the Nasdaq recorded 24 new highs and 30 new lows.

[ad_2]

Source link