[ad_1]

Updates from US banks

Sign up for myFT Daily Digest to be the first to know about US banking news.

The lending activities of the big American banks are doubling on the richest customers, as well-off Americans borrow to buy second homes, invest in the stock market and potentially lower their tax bill.

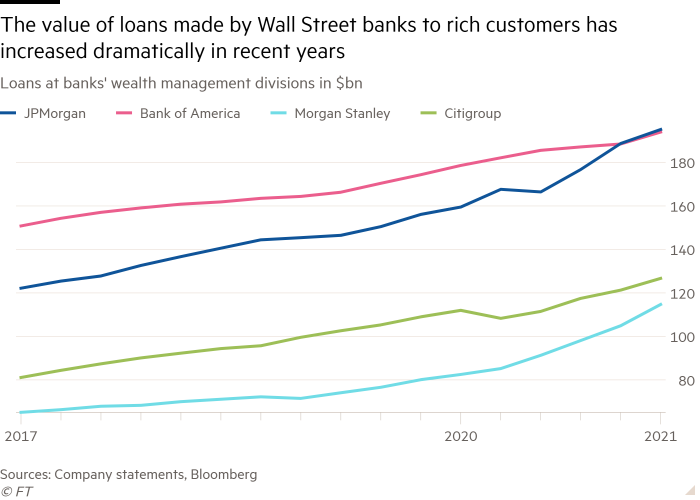

The combined value of loans made by the wealth management branches of JPMorgan Chase, Bank of America, Citigroup and Morgan Stanley exceeded $ 600 billion in the second quarter, up 17.5% from a year earlier. This represented 22.5% of total banks’ loan portfolios, up from 16.3% in mid-2017.

Banks do not hesitate to grant these loans because they have very low losses, but they are not without risks. Market turmoil during the early stages of the Covid-19 pandemic last year prompted wealth managers to ask clients to pledge additional collateral.

“What worries me is you have this flood of credit, all against the backdrop that the rich never go wrong,” said Peter Atwater, chairman of Financial Insyghts, describing the allocations that the banks hold on their portfolios of “skinny” wealth.

This type of borrowing has been on the rise for more than a decade, but the pace has accelerated since the Federal Reserve cut interest rates in response to the pandemic. For a two-year loan against liquid investments such as stocks, wealth management clients can expect to pay a rate of around 1.4%, according to bankers and advisers.

“The rates are so remarkably low that they consider it to be cheap money,” said Christopher Boyett, co-chair of the private management practice at Holland & Knight law firm.

The contrast with the banks’ consumer and corporate credit portfolios is stark. Wealth management loans at JPMorgan, Bank of America, Citi and Morgan Stanley have increased by 50% over the past four years, compared to just 9% for their overall loan portfolio.

JPMorgan and Citi now lend more to a small number of high net worth customers than to their millions of credit card customers. Ten years ago, JPMorgan lent five times more to credit card customers than to private customers.

Swiss bank UBS, which is the world’s largest wealth manager and has significant US business, said this week it intends to lend more to the US.

Loans to high net worth borrowers are often used for financial investments, as well as for the purchase of second homes and luxury items. Investors also take out loans to invest in their own businesses, bypassing banks’ business lending divisions to borrow cheaper and faster.

“There has been this change in lifestyle as people reconsidered where they want to live,” said Scott Milleisen, US head of lending solutions for JPMorgan’s private bank. “They need the money to buy new houses or to renovate houses, to spend on furniture and works of art.”

Controversially, borrowing can also be used to reduce taxes. Instead of selling assets to raise cash – and face a capital gains tax bill – high net worth clients get financing by borrowing against the value of their investments.

“The other way for these families to get cash from these assets would be to sell them and that would of course have tax consequences and those would not be favorable,” said Sabrena Silver, partner at the White law firm. & Case.

Silver said the tax issue “is relevant but not a primary consideration” for high net worth bank clients, but critics of the practice disagree.

Frank Clemente, executive director of the liberal rights group Americans for Tax Fairness, said wealthy borrowers were engaging in “legal tax evasion.”

“The rich, they operate under a completely different tax system where all this accumulated wealth is not taxed unless they sell – and they are so rich that they don’t have to sell,” Clemente said. .

Emmanuel Saez and Gabriel Zucman, economists at the University of California at Berkeley, estimated earlier this year that American billionaires have collective wealth of $ 4.25 billion, of which $ 2.7 billion was untaxed earnings .

The Biden administration’s proposed tax bill would increase capital gains taxes from 20% to 39.6% and close the so-called “enhanced base” loophole, which allows wealthy families to shift capital gains without tax between generations.

Such an increase in capital gains tax could push lending to the rich even higher. However, advisers say the future pace of lending by wealth management banking services is likely to depend more on interest rates than on determined fiscal policies in Washington.

“I don’t see him as motivated by tax as much as by investment,” Boyett said. “The attractiveness will disappear if the rates go up.”

Source link