[ad_1]

Highlights

- "From the company's point of view, there is a willingness to engage in this new technology and in this ability to transfer money around the world without any barriers at a very cost effective. The market is looking for speed, especially in the perspective of a global organization. Governments are still trying to regulate their own borders and limit the transfer of funds, intellectual property and trade. And I think that's the barrier we're all trying to break. "

- "I think innovation happens on two levels. The first is the consumerization of innovation and the other, the depth of innovation in terms of technology, in terms of ability to provide technology in a 'no-guard' way. I can build an innovation around childcare services or not. . And blockchain allowed non-retention – what does that mean? It basically means that control is in me, the user, and that the responsibility lies with me as an individual. It is very difficult to attack and spread innovation on a non-custodial basis. "

- "The value does not lie in the intellectual property, but in the ecosystem that I have developed and that contributes to the global blockchain, or bitcoin.cash, or to the underlying algorithm."

Listen to the podcast version

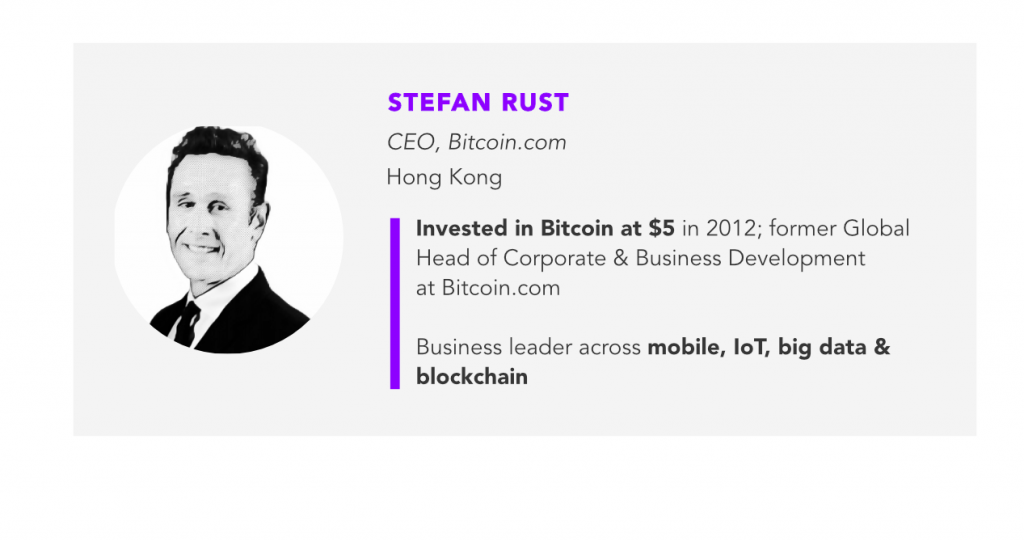

In April 2012, Stefan Rust bought Bitcoin for the first time at $ 5. Today, 7 years later, he is CEO of Bitcoin.com, a company that wants to make Bitcoin Cash and Bitcoin Core the same way more accessible to the general public, and that hosts all kinds of cryptocurrency services. via its eponymous web portal.

In this episode, our editor-in-chief, Angie Lau, met Rust to talk about the future of crypto-currencies and blockchain technology. Recent events, including the US Senate Banking Committee on Facebook Balance, President Trump and pessimistic comments by US Treasury Secretary Mnuchin, as well as the tightening of the Financial Action Task Force regulations have revealed a retreat worldwide against Facebook Libra and cryptographic currencies in general. Rust argues that this skepticism and mistrust of cryptocurrency is the product of the underlying reluctance of the government to move away from traditional border regulation and transfer limitations. " money, intellectual property, trade ".

Rust also badumes that national governments do not trust large, high-tech companies with large amounts of data, which has been supported by much evidence in recent years. However, what Rust says is that, contrary to what governments believe, the value of cryptocurrency is not in intellectual property or the data it contains, but in the ecosystem of contributors to an open code base, a code base made possible by blockchain. Technology.

Despite government regulation and consumer skepticism, Rust expects the changing population of the world's population to spread cryptocurrency. The government's reactions to Facebook Balance are in stark contrast to the growing adoption of crypto-currencies around the world; Like the Internet boom of the '90s, bureaucratic mistrust can point to a revolutionary new technology.

Full transcript

I'm the editor-in-chief, Angie Lau, and today we're going to focus on this growing global repression, that quasi-reaction, if you will, against blockchain and cryptocurrency. And sitting next to me to explore a little deeper a man who bought Bitcoin at $ 5, then I would say he is rather prolific in space. Welcome to Stefan Rust, the new CEO of Bitcoin.com.

So welcome Stefan, you traveled a lot. I have traveled a lot too. We talk to a lot of people. You talk to people who are really in the weeds, contractors, blockchain projects, and they feel the heat.

Thank you for having me. First, you will notice changes. We talked about it a little earlier, but governments are also starting to feel the heat, I think more than true entrepreneurs. entrepreneurs love change. They like fluidity and can find and manage opportunities. And in change, there are always opportunities and entrepreneurs really like that. It's just a sign that regulators are starting to get really nervous, as the state and the money start to separate, and I think we're trying to drive this separation further and I think crypto allows a lot of that, very similar to the church and the state, how these two separate – how do we separate money and the state?

It's a really interesting concept that I'd like to explore, because right now in India, for example, they're looking at a proposal that anyone who shares cryptographic data could be sentenced to 10 years in prison. And then, US Treasury Secretary Steven Mnuchin said that Bitcoin would no longer exist in a few years, that it was a worthless badet, echoing the words of US President Donald Trump, who also said: something very, very similar. So why is it almost now? Is this Facebook Balance effect?

I think that the grouping of companies involved in Libra, the size scale of the companies involved in Libra simply shows that there is, from the business point of view, a willingness to engage in this new technology and in this ability to transfer money on a global scale without obstacles at a very cost effective. The market is looking for speed, especially in the perspective of a global organization. Governments are still trying to regulate their own borders and limit the transfer of funds, intellectual property and trade. And I think that's the barrier we're all trying to break. And the government does not play in this game.

Well, why would they do it? I mean, there are central banks around the world that are responsible for ensuring that their national economy is maintained within a global economy, which means the ability to control inflation for eventually create hard or soft landings for all economic cycles. Cryptocurrency removes this power from central banks. Is this a good thing for us?

We believe it And if you look in 2008, who has benefited from all these impressions of new money? Has it been distributed to the general population? Did people in Wyoming or Chicago, on the outskirts of Chicago, have their water lines modernized so they could not have rusty water at the taps? Has this ever happened with all this new printed money? Has this infrastructure been improved for the general population in the central United States? And I think a lot of the population just did not see that. They saw this money printed, these financial institutions rewarded for a disaster created by these new financial instruments that were created, and the benefit was not transferred to the general population.

So why is cryptocurrency better?

Because cryptocurrency has a defined set of inflation. Inflation is therefore defined on the basis of a contract, it is not controlled by a single power, it is distributed and decentralized between several different entities involved in this specific cryptocurrency. Each cryptocurrency has its own inflation and its own policy regarding who is rewarded in this model of inflation, but Bitcoin, for example, has its inflation defined. The amount of currency will never be greater than 21 million coins minted, and Bitcoin Cash also, in the same pattern.

That may be true, but in actual adoption, it is very difficult to buy coffee with a Bitcoin worth $ 11,000 or maybe 95-82 in an hour. So, how does the industry – and the industry has evolved, there is no doubt about it – where does it go, how is it evolving yet to ensure that the products that are worth it for the average consumer can still support real transactions?

So that's a valid point. The industry has developed; it is a very young industry. We are 10 years old, that's right, the crypto industry. Bitcoin Cash is two years old. We are very young. But we talked about traveling, I was just in Ljubljana, a city in Slovenia, we had more than 450 merchants in Ljubljana who accept Bitcoin Cash.

I arrived, I took a taxi from the airport to my hotel, I paid my hotel, I went karting, I had a haircut – and by the way, karting was the most fun experience of the lot – I went to the Apple Store, an Apple dealer, I went to a supermarket, in all those – I went to a bar, I went in a restaurant – I paid with Bitcoin Cash in every point of sale. The only place I could not pay with Bitcoin Cash was a subsidized, government-controlled public pool when I wanted to do my training. I had to pay 1.50 euro for a nice swim in a nice 50 meter pool. But other than that … And it was a great experience to be able to do that by dragging a phone from my wallet onto a QR code and settling right away. The capacity and rate of adoption were made possible thanks to stablecoins. So the possibility of creating an environment in which, as a merchant, I do not need to deal with this variability, with which the crypto industry actually suffers … But the stablecoins is really a way to help and, as the volume increases, the crypto becomes more and more stable. And I think the other thing that has changed since the last waves we went through is the maturity of the sector. We are therefore much more aware of cryptocurrencies. We are also much more mature in creating liquidity and the financial instruments that have entered the cryptocurrencies have allowed us not only to examine trading at this time, but also to build our future forecasts and be able to anticipate a little better the future and manage the exposure we could have to the cryptography industry.

The repression is real however. On the political front, we have the Senate Banking Committee and Facebook Balance, which really defends the project and the technology at some point. What are the current global misconceptions that governments and regulators feel about the threat of crypto or blockchain?

So I think governments are torn between two angles. On the one hand, they want to be able to limit the amount of data that these big tech companies have.

So we have rules such as the GDPR that requires you to clearly define the data you collect, to make sure that data is available and to be able to delete it at any time …

The right to be forgotten.

The right to be forgotten. And then, I want to collect data. As for the money, I want to collect as much data as possible. From a user I will have this KYC, I want to have these pbadport controls, and all these new rules on data collection. So, on the one hand, I want to limit the data and the ability to delete all the data, and on the other, I want to collect as much data as possible. This collection of data is centralized – it is up to the government, but the centralization of the data applying to all these other websites, it is not allowed to go to the government or any other company. I think there is a big conflict there. And how do you manage that, especially in companies when you collect money data? Thus, banks, as a business, will collect money and share this data with any government institution or regulator requesting data badociated with a specific bank account.

But it seems that the threat of innovation that the blockchain has already given us in cryptocurrency is very real. If regulators and countries repress, if China says that ICOS is illegal, this cryptocurrency is illegal, India: "You are punishable by 10 years imprisonment," say the United States, "we are going to investigate, shut down your business because you exchange security or merchandise with US citizens without registering with us …" This is currently happening around the world. is there a potential threat that all this innovation that has taken place is about to be closed?

So I think innovation happens in two stages. One is the consumerization of innovation and the other is the depth of technological innovation, in terms of the ability to provide technology in a very complicated term "without custody". So there is this word. I can either create innovations around childcare and non-custodial services. And blockchain allowed this thing called non-custodial – what does that mean? It basically means that control is in me, the user, and that the responsibility lies with me as an individual when it is very difficult to attack and disseminate innovations.

However, it is a centralized point. I can attack this centralized point, shut it down and say that you are innovating in a negative way or in a way that we think is inappropriate. But when it comes to a decentralized way where the end user controls his own data, his own money, it suddenly becomes a very different way of managing, doing business, which was not the case in the past. has been met. The disadvantage of non-private mode is the user experience. It's a bit more difficult. I must have my private key, I must have these 12 words that I must remember. If I lose those 12 words, I lose my private key, I lose all my money, I lose all my data. And it's something that suddenly the user has to take responsibility, and I think the population is at an inflection point where a certain part of the population is ready to badume this responsibility and that this population on the global scale is growth. On the other hand, there is still a large part of the population, and let's be fair, it's the majority of the world's population, it's not ready to do that. But you see the young emerging generation – the gaming community, the eight, nine million people a day who watch Friday Fortnite on Twitch. These people are more willing and more willing to play with digital money and take control of their own mobile phone, their own hardware portfolio, their badets or their secure digital devices.

This evolution is happening, it's a revolution or an evolution, but I think you're right, it's an evolution because the younger generation is really more comfortable with this technology. But currently, we have a generation under control, where the Internet existed for many of them only much later in their lives, and then we have a system that has given us the FATF, namely the Group. financial action that examines money laundering and addresses very, very precisely, the notions of your client's knowledge, KYC and AML, the fight against money laundering, because crime, terrorism – c is a real threat, even in traditional fiduciary money. Now cryptocurrency –

There is definitely a threat, and I think if I look at the surf, as you call it, that we have experienced in the last two or three weeks, particularly with the FATF, the G7, the G20, the hearings we held. had, Mnuchin, Trump tweets etcetera – you look at all this, the backlash is a result more of the need to educate regulators on what crypto-currency really is. And the fact that he does not exist … I met the CEO of one of the largest banks in the world. It was always an idea of who was losing in all of this. There must always be a loser. If I win, someone loses. There is always this team of tags and it is very difficult to identify in the world of cryptography. There is no loser, there is no one I can catch.

And I think that the world of cryptography is changing and that regulators better understand how it really works and what I need to better regulate, do I have to do code audits? And everything is transparent from elsewhere, on the blockchain, right? Every transaction you can follow. So, if there is a very large transaction, like a $ 100 million transaction, I can see it on a blockchain. I can then follow these transactions and check them. There are companies specialized in this audit. So, if I really want to deepen the understanding, I just need to re-educate my staff to understand how to audit a blockchain.

What are the three things you would like to educate regulators, defeatists and skeptics?

I would like to emphasize the transparency provided by blockchain algorithms. Audit of the algorithm, so as not to mislead people, certification, algorithm so that all of the code base, all our smart contracts are audited by independent companies that audit our code base so that we know that anyone using our software development tools can audit the code, know that it is audited, certified and authentic; there is no cheating. The code base is open-source. Since it's open source, anyone can see any threat. The third point is the ecosystem. The value does not lie in the intellectual property, but in the ecosystem that I developed that contributes to the global blockchain, or Bitcoin.cash, or to the other underlying algorithm.

Really the first democratic technology.

Yes, definitely, and if you look, it's an evolution. Suddenly, tools appeared on the market. You have GitHub, where all programs and codes can be opened, which is quite funny, belongs to Microsoft, which is a centralized organization, but has been acquired for a large amount. This built the community and allowed the community to share the code. And then, I would ask others to adopt it, use it and contribute to it, and because they had used it and noticed flaws, they wanted to share this defect with others because they had so invested in this base that there was a mutual feeling of investment. And if we all invest in this with time, effort and code, it will increase all the tides and we will win, it will lift all the tides and we will all benefit.

Lift all the boats in the ocean so to speak.

It's a very socialist concept, but I think it's …

But that's something we already know very well. Internet – on the eve of that, a very clear decision was made as to the direction of the World Wide Web, and it was actually a recognition of the fact that, to change the society and allow this technology to flourish with us, it must be open. source. And from what came new industries, new talents …

Jobs have been created, wealth has been created through all these innovations.

Now here is the next wave, it is Blockchain, it is cryptocurrency. It's very scary. But what are you saying is that if we will refute it? It really boils down to one thing: open source, transparency and trust is a trust-based system because I do not need to trust you anymore. I just know this transaction is going to happen, it's real. I can not go wrong, you can not fool me. The system ensures that trust so that you and I do not have to …

We have never seen each other, we never have to do due diligence with each other. We have a commitment, you are Hong Kong, I could be in Vanuatu, off the island of Micronesia, and do a transaction with you. We have never met, but we can do many things against each other because the contract is in the system, defined and validated by independent parties.

And then the skeptic will say, but anonymity is not that dangerous? Because the only people who are anonymous are those who want to hide what they do. So how are you…

But this is not true. It's not just anonymity.

Well, that's right. I care about my anonymity when I have certain transactions, why do I want everyone to be aware?

Yes, but it's also practical. Sometimes you do not want to use your credit card all the time, when you go buy a coffee; you may want to put a $ 10 bill on the table. It's just fast; this transaction is frictionless. So there are different areas of concern. If it's a bigger sum of money, some people may want to exchange a bigger sum and I want to buy this artwork but I do not I do not want to know how much it is really exchanged, because it could raise everything. art prize, or anything.

But it's good because at the end of the day, do not blame the technology for being transparent and giving you the opportunity to be anonymous. Fight crime, right? Technology is not the criminal. The things you want to regulate? Nobody says, "Do not do it." But attacking the technology itself would be a bad service.

You mentioned previously the number of jobs created, the amount of hope created by the Internet … and look, today, everyone has their hands on a mobile phone. They can search for anything. They have access to all the libraries, to all the books that they wish to consult, to all the information. Everything is at your fingertips thanks to technologies derived from Internet innovation. What technologies will emerge and how much economic value will be created as a result of frictionless transactions around the world, to which everyone can suddenly participate in this global economy.

Do you think regulators will wake up and realize and learn?

I think they're going. Everyone hates change. Change is always … I mean, you remember the time when 'the Internet will never happen. Oh, Facebook. It will not exist anymore. I was in a meeting with big monolithic companies with CEOs and COOs, as I was yesterday, and always with negativity. "It will never happen; it will never exist. They are not going to upset my big communication company; they will not disrupt my banking business; they will not disturb my research and the people who come to my libraries. And that has changed.

Well, in truth, this is changing even among regulators and world leaders. We just talked about Japan and Mark Zuckerberg found a friend in Japan. Taro Asō, Minister of Finance, is really defending the potential of blockchain technology and cryptocurrency. We have seen Japan really be at the forefront of this conversation as a developed country. And in fact, when you look in Asia, you see nations and regulators within those nations waking up and saying, "It's a possibility for us to commit to a level at which we had never been able before. "

I could not agree more. The best example is even just across the border from Hong Kong: China. You are watching WeChat. WeChat took what I called a voice over IP business and started a MoIP company. They started with the game, so the entertainment. They then realized very quickly that people wanted to chat when they were entertaining themselves. So they have this chat app that has disrupted the way people communicate. We no longer communicate on the phone and do not talk to each other anymore. We chat all. The number one button on your phone today is the chat application. The voice call application? Nobody talks anymore about calling themselves. And companies have not even adapted to it yet. Now they have evolved to WeChat Pay with 20 or 30 different ways to perform a transaction on your WeChat application, so that money has become the social object for which we all need more , and that we interact, and that cryptocurrency allows any group interest to create a currency in which we can suddenly share and exchange that interest that we have around a currency and give it a value, and proceed to very fluid transactions around that.

Hence Facebook and therefore Libra. 2.7 billion people in their ecosystem. Suddenly, are they a bank? Do they create the new economy? And some will say that they could potentially be

But I would not say Facebook. I think some of them, Amazon and Alibaba, have a large number of merchants and a large number of users.

Potentially, they could have their own version of Libra. Really no matter who in the ecosystem.

Anyone who has an ecosystem. Again, the value lies in the ecosystem itself: the number of users, the merchants, the ability to aggregate people …

Do you mean that someday I could have a family crypto then my kid could do his chores and I could do crypto in the family.

You can pay them crypto instead. The pocket money would come in some form of Angie-cryptos or Angie-corners, and they would receive their Angie-coins, they would win it. They can then exchange it for a compact application and convert it immediately into Bitcoin Core, Bitcoin Cash, Ethereum …

And that's certainly another conversation, but thank you for being here today. I think it was very enlightening and there was a lot of discussion about how to better educate us about cryptocurrency and not to let specific political-driven conversations dictate our opinion about it. . Thank you very much for that.

Thank you very much for having me. Thanks Angie.

Great, Stefan, thank you. And thank you for joining us.

Source link