[ad_1]

Legendary fund manager Li Lu (who Charlie Munger supported) once said, “The biggest risk in investing is not price volatility, but the possibility that you will suffer a permanent loss of capital. So it can be obvious that you need to consider debt, when you think about how risky a given stock is, because too much debt can sink a business. We can see that CVS Healthcare Company (NYSE: CVS) uses debt in its business. But the most important question is: what risk does this debt create?

Why Does Debt Bring Risk?

Debt helps a business until the business struggles to repay it, either with new capital or with free cash flow. Ultimately, if the company cannot meet its legal debt repayment obligations, shareholders could walk away with nothing. However, a more common (but still costly) situation is where a company has to dilute its shareholders at a cheap share price just to get its debt under control. Of course, many companies use debt to finance their growth without negative consequences. The first step in examining a company’s debt levels is to consider its cash flow and debt together.

Check out our latest analysis for CVS Health

What is CVS Health’s net debt?

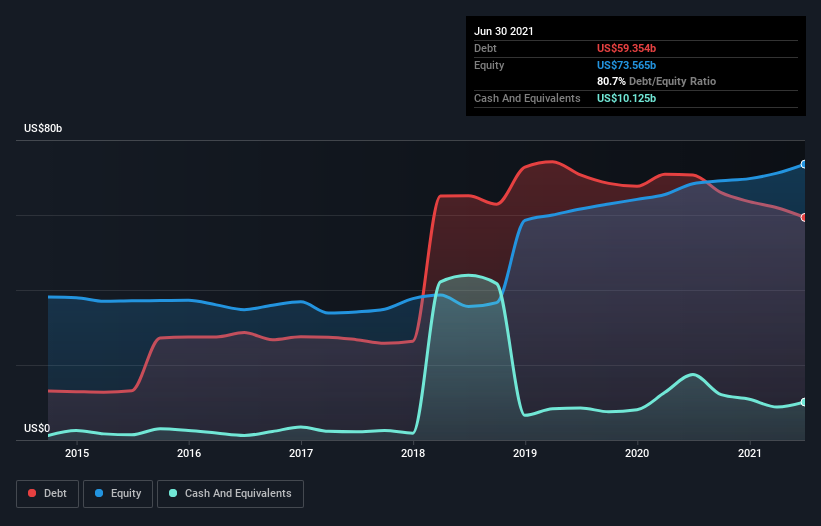

As you can see below, CVS Health had $ 59.4 billion in debt in June 2021, up from $ 70.7 billion the year before. However, it has $ 10.1 billion in cash offsetting that, leading to net debt of around $ 49.2 billion.

How healthy is CVS Health’s track record?

We can see from the most recent balance sheet that CVS Health had liabilities of US $ 59.3 billion maturing within one year and liabilities of US $ 98.3 billion maturing beyond that. . In compensation for these obligations, it had cash of US $ 10.1 billion as well as receivables valued at US $ 24.2 billion due within 12 months. As a result, its liabilities exceed the sum of its cash and (short-term) receivables by $ 123.3 billion.

When you consider that this deficit exceeds the company’s massive US $ 115.4 billion market cap, you might well be inclined to take a close look at the balance sheet. In the scenario where the company had to clean up its balance sheet quickly, it seems likely that shareholders would suffer a significant dilution.

We use two main ratios to inform us about the levels of debt compared to earnings. The first is net debt divided by earnings before interest, taxes, depreciation, and amortization (EBITDA), while the second is the number of times its profit before interest and taxes (EBIT) covers its interest expense (or its coverage of interest, for short). Thus, we consider debt versus earnings with and without amortization charges.

CVS Health has net debt relative to EBITDA of 2.8, which suggests that it uses good leverage to increase returns. But the high interest coverage of 7.9 suggests that he can easily pay off that debt. Unfortunately, CVS Health has seen its EBIT drop 5.5% over the past twelve months. If incomes continue to decline, managing that debt will be difficult, like delivering hot soup on a unicycle. When analyzing debt levels, the balance sheet is the obvious starting point. But it is future profits, more than anything, that will determine CVS Health’s ability to maintain a healthy balance sheet in the future. So if you are focused on the future you can check this out free report showing analysts’ earnings forecasts.

Finally, while the IRS may love accounting profits, lenders only accept hard cash. We must therefore clearly check whether this EBIT generates a corresponding free cash flow. Over the past three years, CVS Health has recorded free cash flow totaling 87% of its EBIT, which is higher than what we usually expected. This positions it well to repay debt if it is desirable.

Our point of view

CVS Health’s total liability level and EBIT growth rate certainly weighs on this, in our view. But its conversion from EBIT to free cash flow tells a very different story and suggests some resilience. It’s also worth noting that CVS Health is part of the healthcare industry, which is often seen as quite defensive. Looking at all the angles mentioned above, it seems to us that CVS Health is a somewhat risky investment because of its debt. This isn’t necessarily a bad thing, as leverage can increase returns on equity, but it’s something to be aware of. There is no doubt that we learn the most about debt from the balance sheet. However, not all investment risks lie on the balance sheet – far from it. For example, we have identified 1 warning sign for CVS Health that you need to be aware of.

At the end of the day, it’s often best to focus on businesses with no net debt. You can access our special list of these companies (all with a history of profit growth). It’s free.

If you are looking to trade CVS Health, open an account with the cheapest * professional approved platform, Interactive Brokers. Their clients from more than 200 countries and territories trade stocks, options, futures, currencies, bonds and funds around the world from a single integrated account. Promoted

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. Our aim is to bring you long-term, targeted analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price sensitive companies or qualitative material. Simply Wall St has no position in the mentioned stocks.

*Interactive Brokers Ranked Least Expensive Broker By StockBrokers.com Online Annual Review 2020

Do you have any feedback on this item? Are you worried about the content? Get in touch with us directly. You can also send an email to the editorial team (at) simplywallst.com.

Source link