[ad_1]

Bitcoin has fallen more than 80% in the last twelve months. The all-too-impressive bull race of 2017, which drove the value of the digital currency to the top of 20,000 USD, followed a total bearish year during which the price sank to nearly 3,000 USD. According to badysts, the lack of institutional investors and strict regulation were one of the main reasons for the Bitcoin crash.

No ETF in Q1 2019

Bulls hoped that 2019 would be a bitcoin correction year when some of the largest financial companies announced products for its market. Fidelity, a $ 2.5 trillion badet management company, has, for example, launched depositary and trading services for Bitcoin. Goldman Sachs, a banking giant, also confirmed that he would start trading futures for bitcoins.

However, exchange-traded funds remained the most exciting bitcoin product for bulls. Analysts have estimated that the launch of a regulated Bitcoin ETF would attract billions of dollars in investment. Traders expected the US Securities and Exchange Commission (SEC), the US securities regulator, to approve the world's first Bitcoin ETF by Feb. 28. The feeling allowed Bitcoin to float above $ 3,000.

But in a surprising turn of events, VanEck, the firm that had asked the SEC for permission to negotiate Bitcoin ETF on the CBOE exchange, withdrew its bid on Wednesday.

US Govt Shutdown Or?

According to VanEck, it was the partial closure of the US government that pushed them to withdraw their Bitcoin ETF record. The SEC had already delayed its decision on the VanEck filing twice in 2018. Previously, the commission had rejected nine ETF applications citing concerns about the manipulation of the Bitcoin market. But now, with 90% of its staff on leave, the board had more reasons to delay or dismiss the filing of the ETF file by the VanEck.

"The SEC is affected by the closure … we engaged in discussions with the SEC on bitcoin issues, conservation, market manipulation, prices, and that had to stop. And so, instead of trying to get through or something like that, we just withdraw the application and we will re-record and resume the discussions when the SEC will leave, "said Jan van Eck, Executive Director from VanEck. CNBC.

Jake Chervinsky, a crypto-belief and securities law expert with the US government, said VanEck had more reason to withdraw his bid for Bitcoin ETF. He added that the American company was waiting for the SEC to refuse their request. And, he did not want any more bad publicity about his cryptographic product.

CBOE withdrew the proposal from ETF VanEck / SolidX Bitcoin (https://t.co/812Ym7U7Hh).

They have not yet given any reason, but the withdrawal implies that they were expecting a denial and did not want another SEC order setting a bad precedent for the future.

There will be no Bitcoin ETF in Q1 2019.

– Jake Chervinsky (@jchervinsky) January 23, 2019

The delay is better than the rejection

Chervinsky's statements build on the SEC's past concerns with the bitcoin spot market. The regulator had stated that it would only approve a Bitcoin ETF if the plaintiff insures no price manipulation in the underlying Bitcoin retail markets.

"This proposal had very little chance of success," said Mati Greenspan, Senior Market Analyst at eToro. "SEC chairman Jay Clayton pointed out that the bitcoin market was not mature enough for an ETF yet."

While the closure of the government put more pressure on the ETF Bitcoin process, VanEck made the right decision by deciding to re-file its application in the future. The company must have understood that it could not convince the regulator before the deadline. The judgment, it seems, provided VanEck with a perfect excuse to voluntarily delay the launch of its ETF.

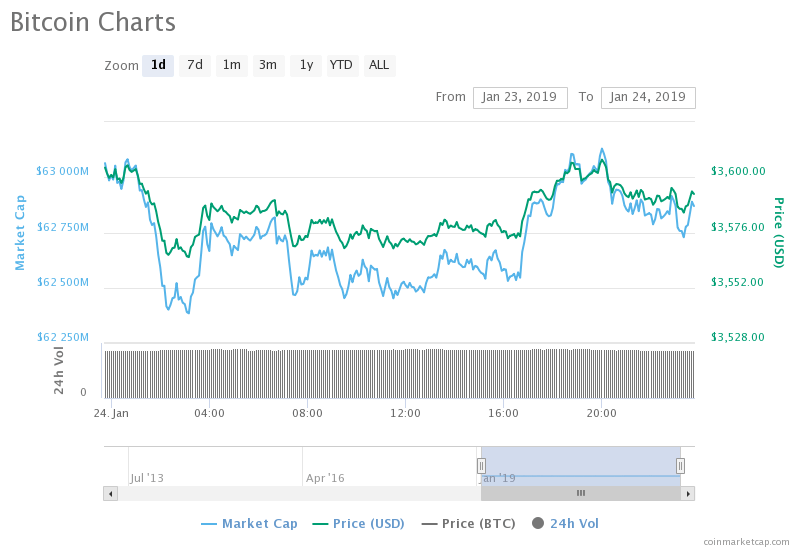

Source: CMC

At least this has convinced retail traders, who have not reacted to the news about ETF withdrawal, despite its vital importance for the Bitcoin trading market. The action on BTC / USD prices, after the time of the announcement, continued to be between $ 3,500 and $ 3,600.

This proved that investors remained bullish for a Bitcoin ETF product this year, if not in the first quarter of 2019. Had it been totally rejected, the market could have suffered.

VanEck is now waiting to come back with a better prepared application. Although the company takes its time, the bitcoin market has proved that it was not dependent on centralized authorities to pursue its trends.

"The shy market response to this news is a clear sign that investors are beginning to understand: the cryptography market is dependent on no government or any financial institution and no product or service "It has the power to create or destroy bitcoin," said Greenspan an email.

[ad_2]

Source link