[ad_1]

Overview of the British CPI in February

The cost of living in the UK, represented by the Consumer Price Index (CPI), is expected on Wednesday at 09:30 GMT.

Overall CPI inflation is expected to be 0.5% between February and the annualized value should stabilize at 1.8%. The core inflation rate excluding volatile food and energy products is expected to remain unchanged at 1.9% last month.

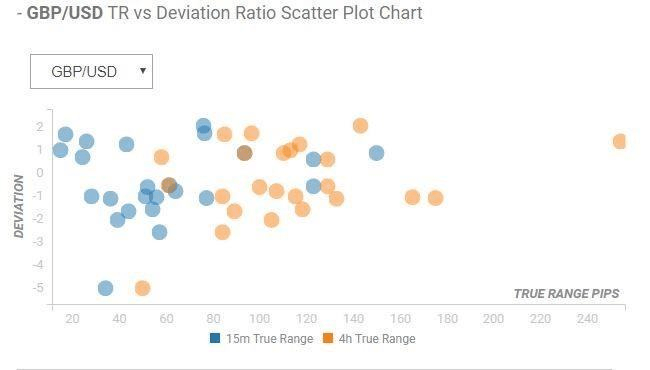

Impact of deviation on GBP / USD

Readers can find below the exclusive FX Street Diversion Impact Card. As observed, the reaction will probably remain confined between 15 and 80 pips in deviations of up to 2 to -3, although in some cases, if it is sufficiently noticeable, a deviation can generate up to 39 at 120 pips.

How could this affect GBP / USD?

On a positive surprise, the GBP bulls will be saved, which could help rates return to the 1.3250 barrier, above which the next bullish targets are at 1.3269 / 74 (5-DMA, daily pivot) ) and at 1.3300 (rounded number).

If the readings are disappointing, the GBP / USD could extend the last leg lower to test the 1.32 handle below which the stages will open for a test of 1.3183 (18 March low) and of 1.3150 (psychological levels).

However, the reaction to the data is likely to be short-lived, as the main objective remains the priority. Letter from the British Prime Minister Theresa May to the President of the European Council, Tusk looking for an extension of Brexit.

Key notes

GBP / USD Forecast: Traders appeared unaware of the recent Brexit chaos, the UK, the IPC / FOMC, looking for momentum

GBP futures: another likely approximation

British inflation overview: Why GBP / USD risks are biased upward?

About the British CPI

The Consumer Price Index published by the Office for National Statistics is a measure of price movements by comparing the retail selling prices of a representative basket of goods and services. The buying power of the GBP is dampened by inflation. The CPI is a key indicator for measuring inflation and the trend in the trend of purchases. In general, a high reading is considered positive (or bullish) for the GBP, while a low reading is considered negative (or bearish).

Source link