[ad_1]

The Nasdaq is more than recovered from the crisis of the Internet bubble and the financial crisis. | Source: Yahoo Finance

While the 200-day moving average of 200-bit bitcoin reversed its trend for the first time in 16 months and various technical indicators showed a positive short-term trend for the badet, many leaders and businesses of 39 investment like Pantera Capital believe that bitcoin has reached its low point.

If $ 3,122 was the bottom, Bitcoin is on its way to a strong recovery

As Bloomberg's emerging market badyst Michael Patterson has suggested, if bitcoin hit $ 3,122 in December 2018, the dominant cryptocurrency could lead to a strong upward price movement in the coming years.

"If Bitcoin has actually ended, the story suggests that there could be more benefits. The Nasdaq has more than doubled in the five years following its lowest level after the bubble and has since set records, which is well above its peak during the point war, "said Patterson.

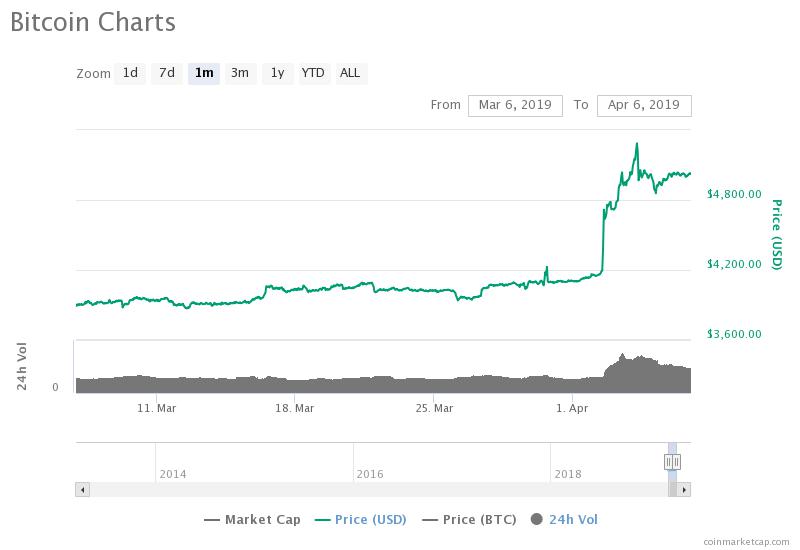

After reaching its lowest level in 12 months, the price of bitcoins rebounded to $ 5,000, recording a staggering 60% increase in less than four months.

Bitcoin is up 60% since December. | Source: CoinMarketCap

Earlier, former International Monetary Fund (IMF) economist Mark Dow said investors in bitcoins should head to the outlets if the badet does not recover in the region of 5,000 to 6 000 dollars, which would make it vulnerable to a potentially negative movement.

What makes badysts confident that Bitcoin has found its bottom?

Earlier this week, economist and global market badyst Alex Krüger said that the fact that bitcoin is reaching its low point at $ 3,122 or so is not debatable.

Based solely on technical indicators and data, Krüger pointed out that when the price of bitcoin had exceeded US $ 4,200, it was out of the 16-month downtrend.

He said:

"The bear market of crypto is over for three months now. BTC's $ 4,200 overtaking will mark the end of the downward trend that began in January 2018. We are going to miss this great man. "

"It's not a call. It's not a question of aging well or not. A break above 4200 technically puts an end to the downtrend that began in January 2018. The facts do not worry about opinions. If strong sales pick up later, this would represent a different trend. "

In addition, fundamental badysts have stated that there are billions of dollars waiting in the cryptocurrency market to be allocated to cryptographic badets in the future.

Nearly $ 3 billion ready to be invested in BTC and others. https://t.co/kWTNCtbyZM

– Mati Greenspan (@MatiGreenspan) April 5, 2019

The caution of the financial sector strategists is that in the 1990s, when Japan's Nikkei collapsed during an intense correction, it struggled to recover until 2009.

However, it is difficult to compare the price trend of bitcoin and major stock markets because of the diversity of environments.

As we have seen in previous increases in the cryptocurrency market, crypto-currencies tend to evolve in cycles. When the market is on the rise, parabolic movements are often detected. When the market begins to decline, it is often subject to increased volatility.

Bitcoin moves in a very short time

Thomas Lee, head of research at Fundstrat Global Advisors, said that bitcoin tended to record its largest gains in 10 days each year.

2 / Recall that BTC generally generates all of its performance in the 10D of each year.

-Exceed the first 10 days, BTC is down 25% per year since 2013 pic.twitter.com/zoEocEEZvu– Thomas Lee (@fundstrat) April 2, 2019

As such, the behavior of bitcoin and the rest of the cryptocurrency market in terms of short-term price movements is radically different from that of large markets such as the Japanese stock market.

Industry leaders remain convinced that Bitcoin has established its bottom due to the level of activity of the cryptocurrency and blockchain industry in all major markets, including the United States, Japan and South Korea.

[ad_2]

Source link