[ad_1]

Instead of focusing on building the second vertical layer over the bitcoin network, the sector was obsessed with the development of competing horizontal basecoats in the form of new block chains, often at great expense and with few results.

At least that's what Ryan Radloff, General Manager and co-founder of CoinShares, says.

2 / Over the past three years, our industry has focused on horizontal (not vertical) growth by creating new "base layer" networks on which to build and compete #bitcoin, mainly because of Bitcoin defects:

-Not fast enough

-Not enough programmable

-etc …– Ryan Radloff ⚡️ (@RyanRadloff) February 10, 2019

And there is one particular technology that is witnessing accelerated adoption, achieved not by inventing a "better" blockchain, but simply by reinforcing what already exists: it's the Lightning Network.

Nodes matter and Bitcoin is always on top

As of Feb. 10, Bitcoin was in first place with 10,336 knots, Ethereum was second at 7,574 and Lightning was third in third place with a total of 6,088.

Litecoin, Bitcoin Cash and Ripple (1,869, 1,589 and 1,047, respectively) rank somewhat in fourth, fifth and sixth positions.

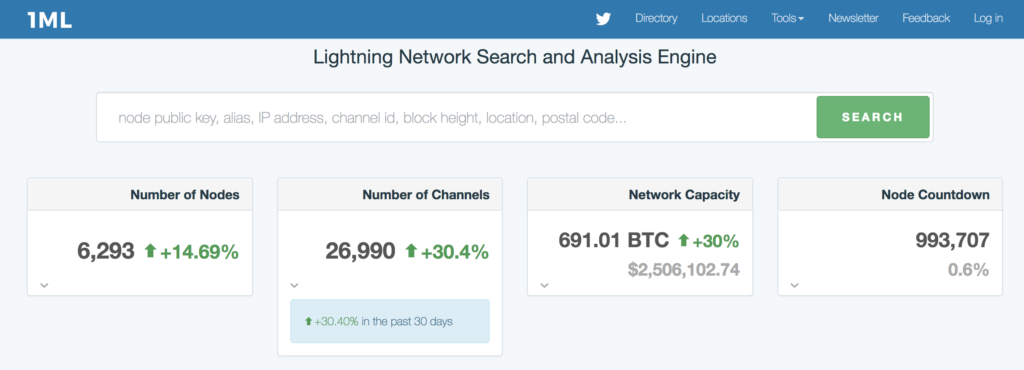

At the time of writing, the number of Lightning nodes has reached 6,293, an increase of 14.6% over the last 30 days, according to the Lightning 1ML data site. The capacity of the network jumped by 30% during the same period to reach $ 2,506,102 (691.01 BTC) and the number of channels rose to 26,990.

Go vertically with Bitcoin as new dapps launch but idleness increases

OK, we can have an argument about listening for Bitcoin (full nodes) and non-listener nodes (SPVs) that do not have open ports and similar issues to consider on other networks, but you see the idea. Bitcoin is by far the most decentralized network, although the "political" control of these nodes is taken into account, given the pockets of concentration of mining control that ASICs have brought to the world. Maybe we should say that bitcoin is the densest (and most secure) network.

Radloff says that for the last three years, the sector has focused on horizontal development by creating new "basic layers" with a "crypto-keynesian" type of spending model – mobilizing a ton of capital and spending it on projects that favor network growth, hoping spending would boost parts speeds and user growth … Now the data shows that it does not work. "

Although this is not mentioned by Radloff, it should be noted here that a recent study of LongHash on Ethereum showed that 10% of dapps "working" on its blockchain were inactive.

Other data published in the State of Dapps report in January revealed that 17% of all dapps were inactive, while the graph of new applications showed an upward trend.

Radloff compares EOS and Tron to the bitcoin network in somewhat discouraging terms, lamenting that they "still can not get the same network size or number of nodes as Bitcoin or even more embarrbading, bitcoins. [sic] second layer – lightning network ".

He argues that the approach of EOS and Tron is apparent to that of governments that implement Keynesian-inspired public spending to manage aggregate demand in an economy in order to stimulate the economic growth.

On the other hand, according to Radloff, the development of the Lightning Network continued according to the principle of "minimal funding by the" boot strap "". And in doing so, we show by our example that there is another way to go that is not only less expensive, but probably more fruitful.

However, the critics of Lightning believe that its system of pre-funded channels to open between the parties in transaction will ultimately make it difficult for network growth and ultimately, an unsuitable solution for large-scale payments.

Does cash and pizza prove the point?

Which brings us to some news on Lightning's front that perhaps illustrates Radloff's point.

First of all, Jack Dorsey, CEO of Twitter and Square, said, "It's not an 'if', it's a 'when' for the integration of Lightning Network into the Cash app, as announced by EWN this week.

Dorsey is what could be considered a maximalist of bitcoin in altcoins circles, since he rejected all requests for support of the best cash altcoins.

Last December, Cash was the most downloaded application in the Finance section of the Google Play app store. And December 8th, it was the most downloaded application of the No. 1 on the Apple App Store. No wonder people are jumping on the fact that Dorsey brings Lightning to the app.

Let's now examine the launch of Lightning Pizza by the users of the encrypted Fold payment application.

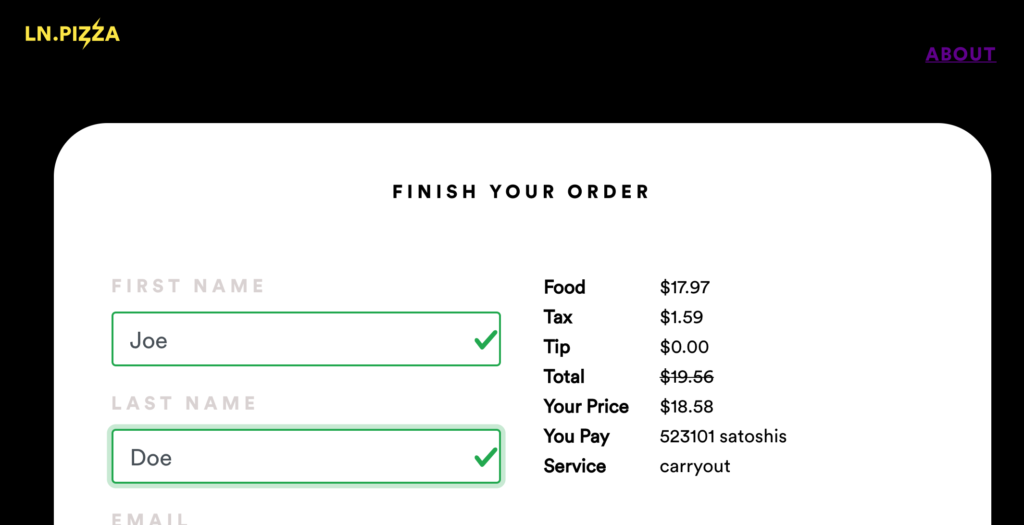

As its name suggests, the new service allows consumers to buy Domino's Pizza pizzas with Bitcoin. A cheese pizza, a pepperoni pizza and a clbadic garden salad purchased at the New York store at 181 Church Street cost 523,101 satoshis ($ 18.58). LN.Pizza users benefit from a 5% discount.

Winter Altcoin

The reader should be aware that Radloff's comments arrived a few days before the announcement of XBT's subsidiary CoinShares, which was planning to launch an encrypted basket tracking fund.

The group already has two powerful products in the field of cryptography: Bitcoin and Ethereum tracers.

An ETN is designed as a debt security and provides the owner with exposure to the underlying badet. Although similar in appearance, ETNs are not exchange traded funds, despite trading on a stock market. Confusion on this point has led XBT Provider products to be suspended in the United States by the Securities and Exchange Commission. Bitcoin Tracker One and Ethereum Tracker One are both listed on the Swedish stock exchange.

In a report released by Bloomberg on February 13, Laurent Kssis, chief executive of XBT Provider, explained the reasoning behind the cancellation of the crypto-basket fund, explaining that the company did not have an understanding sufficient of the situation of the hard forks affecting the chains of blocks.

"It is important to ask how the community reacts to the split and who will support one badet over the other. If we are wrong, these badets will fall and if they are part of the basket, we can not go back, because it is in the last spreadsheet, "said Kssis.

Given the mess surrounding the hard Bitcoin Cash fork which saw the creation of Bitcoin SV, which is still the subject of much controversy, as shown by Jimmy Song's recent accusation that it is a "scam" , doubts about a fund tracing a basket of cryptobadets at this point might be sensible, although that may not be the whole story.

With a number of projects in danger of running out of funds as the crypto-winter progresses, the XBT supplier risks cooling its altcoins, with the exception of Ethereum, hence Radloff's taste for bitcoin.

Lightning 'Pbad The Torch' lightens the way

The progress of the Lightning Pbad The Torch on Twitter is apparently more frivolous, and the crypto-luminaries "pbad the torch" by receiving a Lightning transaction, then adding 10,000 satoshi and pbading the torch to someone else. other in the crypto community.

It was recently in the hands of Changpeng Zhao, the managing director of Binance, who pbaded it on to Justin Sun of Tron, who has now confided the imaginary flame to Erik Voorhees of ShapeShift. Attempts to bring Elon Musk aboard have so far failed. Dorsey and Elizabeth Stark have already been carrying the flame.

At the very least, the Flame Game reinforces the profile of the Lightning Network on crypto twitter, if not the rest of the internet.

Lightning has seen several development teams create competing implementations, with Elizabeth Stark's Lightning Labs undoubtedly in the lead. Dorsey is an investor in the company.

Back with Radloff, how does he see Lightning and other second layer efforts taking place over the next few years? Vertical expansion of course.

7 / So I predict that the theme of the next three years will not be horizontal expansion, but vertical expansion #bitcoin

– Ryan Radloff ⚡️ (@RyanRadloff) February 10, 2019

To give some context to the evolution of Radloff's thinking in December 2017, he viewed the competing parts market as a positive "Darwinian" struggle.

Maybe this fight is over and that the "Bitcoin 2.0" he's talking about in the 2017 interview with CNBC turns out to be Lightning and other upcoming second-best technologies, not Ethereum, EOS, Cardano, etc.

History of cryptocurrency much bigger than Bitcoin: CoinShares of CNBC.

[ad_2]

Source link