[ad_1]

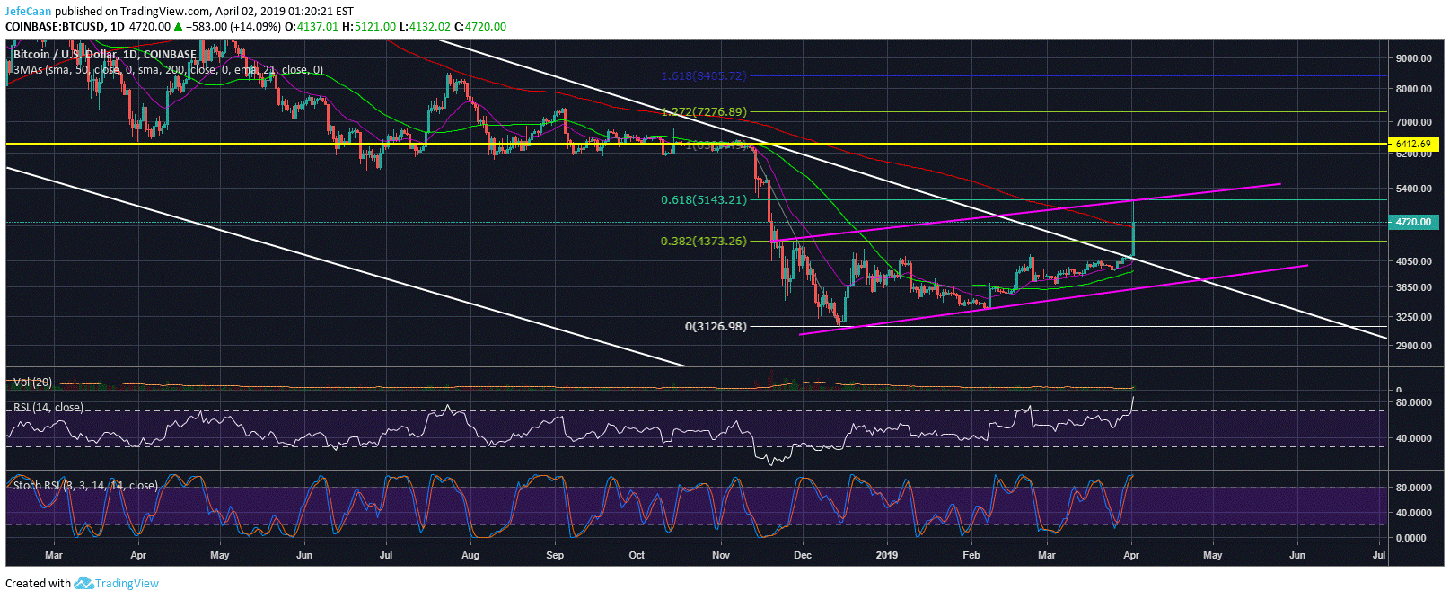

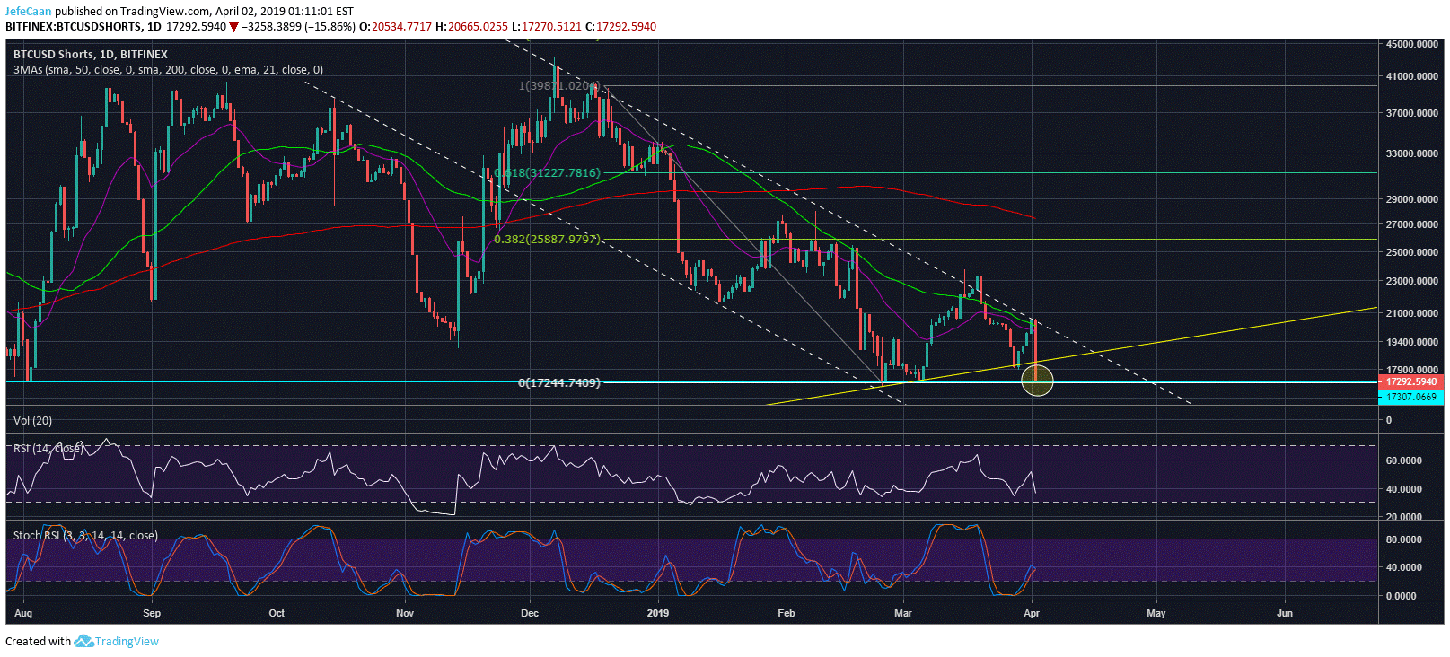

Bitcoin (BTC) surprised the entire cryptographic community with a sudden spike of 20% today in less than 5 minutes. Until now, no one knows what triggered this spike. We do not know if it was a big whale that had placed a big order in a big stock market or a shark that had liquidated short positions that had led to the sudden outbreak. At the present time, the number of shorts has also fallen significantly, by 20%, but those who followed BTCUSDShorts while BTC / USD jumped know that their number has declined after the soaring price of bitcoin. This means that it is unlikely that the peak will experience much effort in the event of liquidation of shorts. Although the price started to rise, he finally sold short positions along the way and scared some bears who had to close their positions.

Since no one really knows what caused this increase, there is no point in digging deeper. What is useful to deepen is the intention behind this tip. If the sudden 20% increase in Bitcoin's price (BTC) was not aimed at liquidating marginal short films, then what was the intention to do it? Well, for weeks, the majority of the cryptographic community has been predicting the end of the bear market. As we know, the majority is always wrong, but it helps a lot when the majority is the same page. This decision has once again brought the majority to the same page, which definitely helps the bears in the long run, as it allows them to tackle more bulls as long as Bitcoin (BTC) stays away from its real bottom. . The members of the cryptographic community celebrating this movement must be cautious, because the same thing happened just before the major decline that brought it below $ 6,000.

The net result of all developments in recent weeks has been a hard blow to the bearish resolution. The number of margin shorts has now decreased by more than 15% and is expected to decline further. The daily chart of BTCUSDShorts shows the number of short films marginalized on a large support. In the days that follow, we will see a trend reversal at BTCUSDShorts, which is long overdue. It is important to note that BTCUSDShorts is even more oversold on the weekly time frame. Retailers may have already given up, but professionals face unique opportunities. It's one of the best moments in history to miss Bitcoin (BTC).

The cryptocurrency market is still overbought on the weekly calendar. The stock market is in an alarming state and poses a serious threat to emerging markets should stocks fall in the coming weeks. Everything leads to the same conclusion, whether Bitcoin (BTC) has reached its low point or not, it is expected a significant decline in the near future. There are bold calls for a dip below the $ 2,000 or a low close to $ 1,000, but the fact is we have not finished. The price must further decline considerably and investors should know that it can fall in the same way as it climbed today. The fall would, however, have a better chance of being sustainable.

Source link